Basis of taxation

A company is tax resident of Cyprus if it is managed and controlled in Cyprus.

As from 2023, a Cyprus incorporated company will by default be considered a tax resident of Cyprus provided it is not tax resident in any other jurisdiction.

All Cyprus tax resident companies are taxed on their income accrued or derived from all chargeable sources in Cyprus and abroad.

With effect as from 1 January 2019 Controlled Foreign Company (CFCs) rules apply, i.e. non-distributed profits of CFCs directly or indirectly controlled by a Cyprus tax resident company, may become subject to tax in Cyprus (certain exceptions may apply).

A non- Cyprus tax resident company is taxed on income accrued or derived from a business activity which is carried out through a permanent establishment in Cyprus and on certain income arising from sources in Cyprus.

Foreign taxes paid can be credited against the Cyprus corporation tax liability.

Corporate tax rate

| Tax rate % |

|

| The corporation tax rate for all companies is | 12,5 |

Exemptions

The following are exempt from corporate tax:

| Type of income | Exemption limit |

| Profit from the sale of securities (1) | The whole amount |

| Dividends (excluding, as from 1 January 2016, dividends which are tax deductible for the paying company) | The whole amount (2) |

| Interest not arising from the ordinary activities or closely related to the ordinary activities of the company (3) | The whole amount (4) |

| Profits of a foreign permanent establishment, under certain conditions (5) | The whole amount |

| Gains relating to foreign exchange differences (forex) with the exception of forex arising from trading in foreign currencies and related derivatives. | The whole amount |

| Profits from the production of films, series and other related audiovisual programs | The lower of 35% of the eligible expenditure and 50% of the taxable income. Any restriction may be carried forward for 5 years. |

Notes:

1. For a definition of securities see (page 7).

2. Such dividend income may be subject to Special Contribution for Defence (page 30).

3. All the interest income of Collective Investment Schemes is considered to be arising from the ordinary activities or closely related to the ordinary activities of the Scheme.

4. Such interest income is subject to Special Contribution for Defence (page 30).

5. With effect as from 1 July 2016, taxpayers may elect to tax the profits earned by a foreign permanent establishment, with a tax credit for foreign taxes incurred on those foreign permanent establishment profits. Transitional rules apply in certain cases on the granting of foreign tax credits where a foreign permanent establishment was previously exempt and subsequently a taxpayer elects to be subject to tax on the profits of the foreign permanent establishment.

Corporate tax deductions for expenses

Generally expenses incurred wholly and exclusively in earning taxable income and supported by documentary evidence are deductible for corporate tax purposes, including:

| Type of expense | Deduction limit |

| Interest expense incurred for the direct or indirect acquisition of 100% of the share capital of a subsidiary company will be treated as deductible for income tax purposes provided that the 100% subsidiary company does not own (directly or indirectly) any assets that are not used in the business. If the subsidiary owns (directly or indirectly) assets not used in the business the interest expense deduction is restricted to the amount which relates to assets used in the business. This applies for such acquisitions of subsidiaries from 1 January 2012. | The whole amount of interest expense if the subsidiary does not own (directly or indirectly) any assets not used in the business. A restricted amount of interest expense is allowed to the extent the subsidiary owns (directly or indirectly) assets used in the business. Moreover as from 1 January 2019 an interest limitation rule applies in accordance with the EU Anti-tax Avoidance Directive. |

| Equity introduced to a company as from 1 January 2015 (new equity) in the form of paid-up share capital or share premium may be eligible for an annual notional interest deduction (NID). The annual NID deduction is calculated as the new equity multiplied by the NID interest rate. The relevant interest rate is the yield on 10 year government bonds (as at December 31 of the prior tax year) of the country where the funds are employed in the business of the company plus a 5% premium. A taxpayer may elect not to claim all or part of the available NID for a particular tax year. Certain anti-avoidance provisions apply. | #The NID deduction cannot exceed 80% of the taxable profit derived from the assets financed by the new equity (as calculated prior to the NID deduction). |

| Royalty income, embedded income and other qualifying income derived from qualifying intangible assets in the 'new' Cyprus intellectual property (IP) box (provision applies with effect from 1 July 2016)(1) | 80% of the net profit as calculated using the modified nexus fraction (2) |

| Royalty income, embedded income and other qualifying income derived from qualifying intangible assets in the 'old' Cyprus IP box (3 | Nil – ceased applying as from 1 July 2021 |

| Tax amortisation on any expenditure of a capital nature for the acquisition or development of IP (provision applies with effect from 1 July 2016) (4) | The whole amount allocated over the lifetime of the IP (maximum period 20 years) |

| Tax amortisation on any expenditure of capital nature for scientific research and for R&D, subject to conditions (4) | The whole amount (and for expenditure incurred in years 2022, 2023 and 2024, an additional 20%) allocated over the lifetime of the asset (maximum period 20 years) |

| Expenditure of revenue nature for scientific research and for R&D, subject to conditions | The whole amount and, for expenditure incurred in years 2022, 2023 and 2024, an additional 20% |

| Donations to approved charities (with receipts) | The whole amount |

| Employer's contributions to social insurance, General Health System (see page 71) and approved funds on employees' salaries | The whole amount |

|

Employer's contributions to:

|

1% on employee's remuneration 10% on employee's Remuneration |

| Any expenditure incurred for the maintenance of a building in respect of which there is in force a Preservation Order | Up to €700, €1.100 or €1.200 per square meter (depending on the size of the building) |

| Entertainment expenses for business Purposes | Lower of €17.086 or 1% of the gross income of the business |

| Amount invested each tax year as from 14 February 2022 in approved innovative small and medium sized enterprises either directly or indirectly, subject to conditions (applicable up to 31 December 2023). | Up to 50% of the taxable income as calculated

prior to this deduction (subject to a maximum of €150.000 per

year) (5) or 30% if the investments are financed from own funds |

| Expenditure incurred for the acquisition of shares in an innovative business (abolished as from 1 January 2017) | The whole amount |

| Eligible infrastructure and technological equipment expenditure in the audiovisual industry | 20% for small / 10% for medium enterprises |

Notes:

1. Qualifying 'intangible assets' maybe legally or economically owned and comprise patents, copyrighted software, utility models, intangible assets that grant protection to plants and genetic material, orphan drug designations, extensions of patent protection. It also comprises of other intangible assets which are non-obvious, useful and novel, that are certified as such by a designated authority, and where the taxpayer satisfies size criteria (i.e. annual IP related revenue does not exceed €7,5m for the taxpayer, and group total annual revenue does not exceed €50m, using a 5 year average for both calculations). Marketing-related intangible assets, such as trademarks, do not qualify

2. A fraction is applied to the net profit based on research and development (R&D) activity. The higher the amount of R&D undertaken by the taxpayer itself or via a taxable foreign permanent establishment or via unrelated third party outsourcing, the higher the amount of R&D fraction (modified nexus fraction).

3. The old Cyprus IP box is closed as from 30 June 2016. Under transitional/grandfathering rules, taxpayers with intangible assets that were already included in the old Cyprus IP box as at 30 June 2016 continued to apply the old Cyprus IP box provisions for a further five years i.e. until 30 June 2021 for those intangible assets. As from 1 July 2021 the grandfathering provisions do not apply.

4. A taxpayer may elect not to claim all or part of the available tax amortization for a particular tax year. Unclaimed tax amortisation capacity may be carried forward to be used in future years (spread over the remaining UEL of the asset).

5. Unused deduction can be carried forward and claimed in the following 5 years, subject to the cap of 50% of taxable income (and overall maximum of €150.000 per year).

but not including:

| Expenses of a private motor vehicle | The whole amount |

| Interest applicable to the cost of acquiring a private motor vehicle irrespective of its use and to the cost of acquiring any other asset not used in the business | The whole amount for 7 years from the date of acquisition of the asset |

Losses carried forward

The tax loss incurred during a tax year and which cannot be set off against other income, is carried forward subject to conditions and set off against the profits of the next five years.

The current year loss of one company can be set off against the profit of another, subject to conditions, provided the companies are Cyprus tax resident companies of a group(1). Group is defined as:

- One Cyprus tax resident company holding directly or indirectly at least 75% of the voting shares of another Cyprus tax resident company, or,

- Both Cyprus tax resident companies are at least 75% (voting shares) held, directly or indirectly, by a third company

As from 1 January 2015 interposition of a non- Cyprus tax resident company(ies) will not affect the eligibility for group relief as long as such company(ies) is/are tax resident of either an EU country or in a country with which Cyprus has a tax treaty or an exchange of information agreement (bilateral or multilateral).

A partnership or a sole trader transferring a business into a company can carry forward tax losses into the company for future utilisation. Losses of an exempt foreign permanent establishment can be set off with profits of the Cyprus head office. In such case, future profits of an exempt foreign permanent establishment abroad are taxable up to the amount of losses allowed.

Note:

1. As from 1 January 2015 a Cyprus tax resident company may also claim the tax losses of a group company which is tax resident in another EU country, provided such EU company firstly exhausts all possibilities available to utilise its losses in its country of residence or in the country of any intermediary EU holding company.

Reorganisations

Transfers of assets and liabilities between companies can, subject to conditions, be effected in a tax neutral manner within the framework of a qualified reorganisation, and tax losses may be carried forward by the receiving entity.

Reorganisations include:

- mergers

- demergers

- partial divisions

- transfer of assets

- exchange of shares

- transfer of registered office of a European company (SE) or a European cooperative company (SCE).

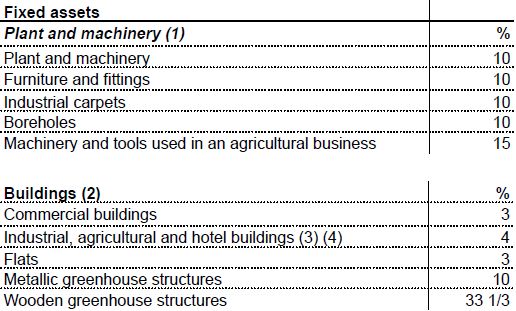

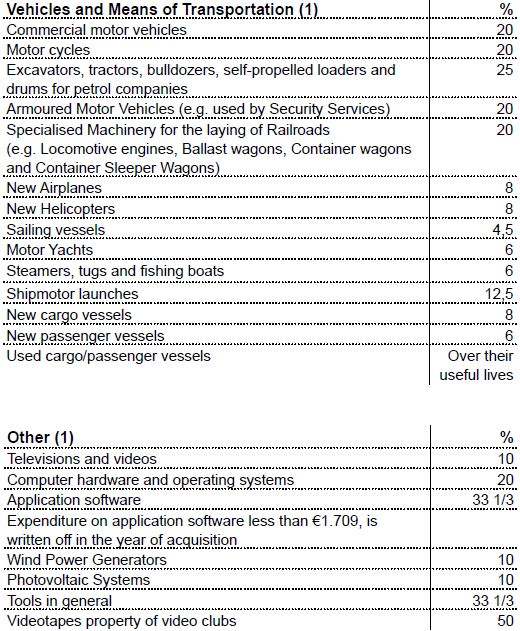

Annual wear and tear allowances on tangible fixed assets

The following allowances which are given as a percentage on the cost of acquisition are deducted from the chargeable income:

Notes

1. Plant and machinery, vehicles (excluding private motor vehicles) and other assets acquired during the tax years 2012 - 2018 (inclusive) are eligible to accelerated tax depreciation at the rate of 20% per annum (excluding such assets which are already eligible for a higher annual tax rate of tax depreciation).

2. The rates stated for buildings are for new buildings. Rates are amended in the case of second-hand buildings.

3. In the case of industrial and hotel buildings which are acquired during the tax years 2012 - 2018 (inclusive), an accelerated tax depreciation at the rate of 7% per annum applies.

4. Buildings for agricultural and livestock production acquired during the tax years 2017-2018 (inclusive) are eligible for accelerated tax depreciation at the rate of 7% per annum.

Special type of companies

Shipping companies

The Merchant Shipping Legislation fully approved by the EU (approval extended up to 31 December 2029) provides for exemption from all direct taxes and taxation under tonnage tax regime of qualifying shipowners, charterers and shipmanagers, from the operation of qualifying community ships (ships flying a flag of an EU member state or of a country in the European Economic Area) and foreign (non community) ships (under conditions), in qualifying activities.

The legislation allows non community vessels to enter the tonnage tax regime provided the fleet is composed by at least 60% community vessels. If this requirement is not met, then non community vessels can still qualify if certain criteria are met.

The legislation includes an "all or nothing" rule, meaning that if a shipowner/ charterer/ shipmanager of a group elects to be taxed under the Tonnage Tax regime, all shipowners/ charterers/ shipmanagers of the group should elect the same.

Exemption is also given in relation to the salaries of officers and crew aboard a community qualifying ship.

Shipowners

The exemption applies to:

- profits derived from the use/chartering out of the ships

- interest income relating to the working capital of the company

- profits from the disposal of qualifying ships

- dividends received from the above profits at all distribution levels

- profit from the disposal of shipowning companies and its distribution

The exemption also applies to the bareboat charterer of a vessel flying the Cyprus flag under parallel registration

Bareboat charter out agreements remain eligible for tonnage tax, with restrictions introduced for bareboat charter agreements to third parties.

The legislation provides a definition, as well as a specific list, of what are ancillary services. Moreover, it clarifies that the revenue from the ancillary services may fall under the tonnage tax regime, provided that the income therefrom does not exceed 50% of the total income generated from Maritime Transport Activities ('Core Activities').

Charterers

Exemption is given to:

- profits derived from the operation of chartered in ships

- interest income relating to the working capital of the company

- dividends received from the above profits at all distribution levels

The law grants the exemption provided that the option to register for Tonnage Tax is exercised for all vessels and provided a composition requirement is met: at least 25% (reduced to 10% under conditions) of the net tonnage of the vessels owned or bare boat chartered in.

Shipmanagers

The exemption covers:

- Profits from technical and/or crew management

- Dividends paid out of these profits at all levels of distribution

- Interest income relating to the working capital of the company

In order to qualify shipmanagers must satisfy the following additional requirements:

- Maintain a fully fledged office in Cyprus with personnel sufficient in number and qualification

- At least 51% of all onshore personnel must be community citizens

- At least 2/3 of total tonnage under management must be managed within the community (any excess of 1/3 taxed under corporation tax)

The application of the tonnage tax system is compulsory for owners of Cyprus flag ships and optional for owners of non Cyprus flag ships, charterers and shipmanagers. Those who choose to enter the Tonnage Tax regime must remain in the system for at least 10 years unless they had a valid reason to exit such as disposal of their vessels and cessation their of activities.

Insurance companies

Profits of insurance companies are liable to corporation tax similar to all other companies except in the case where the corporation tax payable on taxable profit of life insurance business is less than 1,5% of the gross premiums. In this case the difference is paid as additional corporation tax.

The Cyprus Alternative Investment Funds (AIFs) and Undertakings for Collective Investment in Transferable Securities (UCITS)

The Alternative Investment Funds Law 124(I)/2018, to the extent amended (hereinafter, the ''AIF Law'') defines alternative investment funds as any collective investment undertakings, including investment compartments thereof, which, collectively:

- raise capital from a number of investors, with a view to investing it in accordance with a defined investment policy for the benefit of those investors, and

- do not require authorisation pursuant to section 9 of Law 78(I)/2012, as amended (hereinafter, the 'UCI Law'), or pursuant to the legislation of another member state that harmonises the provisions of Article 5 of the Directive 2009/65/EC, as amended.

The AIF Law allows for three types of AIFs to be established in Cyprus which are as follows:

- Alternative Investment Funds with Limited Number of Persons (Up to 50) (AIFLNPs)

- Alternative Investment Funds with Unlimited Number of Persons (AIFs)

- Registered AIFs (RAIFs)

The various legal forms in which either type of AIFs can manifest are as follows:

AIFLNP:

- Variable Capital Investment Company (VCIC)

- Fixed Capital Investment Company (FCIC)

- Limited Partnership (LP)

AIF/RAIF:

- VCIC

- FCIC

- Common Fund (CF)

- LP

UCITS:

The UCI Law defines UCITS as undertakings the sole object of which is the collective investment in transferable securities and/or other liquid financial instruments as referred to in section 40 (1) of the UCI Law, of capital raised from the public, which operate on the principle of risk-spreading, and the units of which are, at the request of investors, redeemed or repurchased, directly or indirectly, out of these undertakings' assets.

UCITS can take the following legal forms:

- CF

- VCIC

Taxation of Funds

Funds which are opaque for tax purposes and which are managed and controlled in Cyprus are tax resident in Cyprus and are subject to the general provisions of the Cyprus tax framework.

In the case of funds which have compartments, each compartment is assessed separately for tax purposes subject to the provisions of the law. Under circumstances and depending on the legal form of the fund, some funds may be transparent for tax purposes.

Additional key provisions which are relevant to funds are set out below:

Sale of Fund Units

There is no Capital Gains Tax on the gains arising from the disposal or redemption of units in funds unless the fund owns directly or indirectly immovable property in Cyprus (subject to conditions).

However, even if it owns immovable property in Cyprus, no Capital Gains Tax arises if the Fund is listed on a recognized stock exchange.

Stamp Duty

The subscription, redemption, conversion or transfer of a fund's units should be exempt from Cyprus stamp duty.

No creation of a permanent establishment

Based on the Cyprus tax legislation no Cyprus permanent establishment will be deemed to arise:

- for non-Cyprus resident investors as a result of investment into Cyprus tax-transparent investment funds, or,

- as a consequence of the management from Cyprus of non-Cyprus investment funds.

Management services

The management fee charged for the provision of collective management services to investment funds is exempt from VAT, provided certain conditions are met.

Carried interest / performance fee for AIF and UCITS fund managers

Certain employees and executives of the following investment fund management companies or internally managed investment funds may opt for a different mode of personal taxation:

- Alternative Investment Fund Managers authorised under the Alternative Investment Fund Managers Law 56(I)/2013, as amended (hereinafter, the 'AIFM Law')

- Internally managed AIFs authorised under the AIFM Law

- UCITS Management Companies authorised under the UCI Law

- Internally managed UCITS authorised under the UCI Law

- A company to which the AIFM / UCITS Management company has delegated the portfolio management or risk management activities of the AIF/ UCITS which it manages.

Subject to conditions, their variable employment remuneration which is effectively connected to the carried interest of the fund managing entity may, through an annual election, be separately subject to Cyprus tax at the flat rate of 8%, with a minimum tax liability of €10.000 per annum. This special mode of taxation is available for a period of 10 years.

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.