In China, the invoice — or fapiao (发票) — is an essential component of the State Administration of Taxation (SAT). In accordance with the Administrative Measures of the People's Republic of China for Invoices (revised in 2010), invoices refer to the certificate of payment or receipt of money made or received in purchases and sales of goods, provisions or acceptance of services and other business activities.

In practice, a "fapiao" is evidence of payment for the sale of goods or the provision of services. Therefore, they are a part of the supporting documentation to show proof of business transactions or the claiming of business expenses.

The SAT is responsible for the administration of fapiao and individual enterprises are required to print fapiao on special paper purchased from local governmental authorities. Before being able to issue fapio, enterprises are required to have met the following conditions:

- Obtained a printing business permit and business license;

- Established equipment and technical standards able to properly print invoices; and

- Established a sound financial system and strict supervision, safety management and confidentiality system.

Equally, all fapiao are required to be printed from a "fapiao printer" that is linked online to the SAT system. In the printing process, enterprises must select the appropriate business activities registered under their business scope, such as the provision of services or sale of goods.

There are two types of fapiao: the general value-added tax (VAT) fapiao (增值税普通发票) and the special VAT fapiao (增值税专用发票).

The special VAT fapiao may be used to offset the value-added tax down the VAT chain, whilst the general VAT fapiao cannot. Therefore, it is important for all businesses working in China to understand the two different types of fapiaos.

General VAT fapiao (增值税普通发票)

General VAT fapiao are customarily issued by small scale taxpayers, enterprises with a turnover of less than 5 million RMB or enterprises who are forbidden to issue special VAT fapiao (such as general commercial taxpayers who retail cigarettes, alcohol, food, clothing, shoes and hats, makeup, and other consumer goods).

Special VAT fapiao (增值税专用发票)

Special VAT fapiao are issued by general taxpayers who are VAT registered or small scale taxpayers who may issue special VAT fapiaos through the tax authority. Special VAT fapiao can be used to claim input VAT credit and offset the VAT. From 1 May 2016, the business tax was abolished and VAT applied to all goods and provision of all services in or to China. Consequently, the Special VAT fapiao is a key element to incentivise enterprises to comply with the tax administration (for more details, see our previous posts related to VAT reforms).

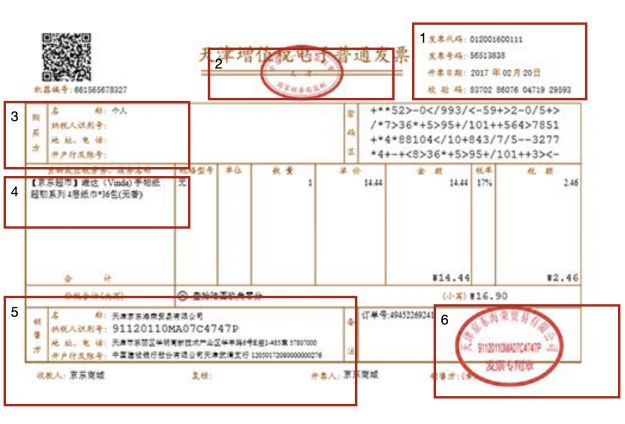

Fapiao Example

Figure 1 is an example of a fapiao. All Fapiao are required to be printed in Chinese, although the Administrative Measures stipulates, if necessary, invoices can be printed in both Chinese and a foreign language simultaneously. Below is a simple explanation of the fapiao:

- Each fapiao shall include the fapiao number and the number indicating the total number of fapiao issued by the seller to date, along with the date of insurance validity.

- Fapiaos are required to be affixed with the tax bureau seal.

- Customer details: for general VAT fapiao, only the entity name and tax number are required; for special VAT fapiao, the address, telephone and entity bank details shall be completed.

- Description of the provision of services or sale of goods. Only business activities within the enterprise's business scope may be selected for the description.

- Seller information, including company name, tax code, address and bank information.

- Fapiao shall also be affixed with the seller's invoice seal.

Entities are obliged to issue fapiaos for the provision of services or sale of goods. If a company refuses to issue a fapiao to a buyer, the buyer may report the company to the tax bureau. Equally, any forgery of a fapiao shall result in a fine of up RMB50,000 for amounts below RMB10,000. Forgeries above RMB10,000 RMB and below RMB50,000 shall result in an RMB500,000 fine.

Blank fapiao are strictly forbidden from being carried, mailed or transported in or out of China. Consequently, fapiao are an integral element in tax and accountancy compliance. It is important for businesses to educate themselves accordingly to be up to date on the laws and regulations of the SAT to maintain efficient fapiao management.

Originally published 16 January 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.