The Maples Group provides Fund Annual Return ("FAR")

completion and filing services to ensure filings are made on time

and alleviate the operational burden and cost to fund advisers.

This service includes FAR preparation, FAR filing and coordinating

regulator fee payments.

Cayman Islands domiciled closed-ended investment funds that are

registered as private funds with the Cayman Islands Monetary

Authority ("CIMA") are subject to a filing requirement

through their online portal REEFS, which includes informational

data encompassing general, operating, related fund entity and

financial information, as well as submission of annual audited

financial statements and an operator declaration.

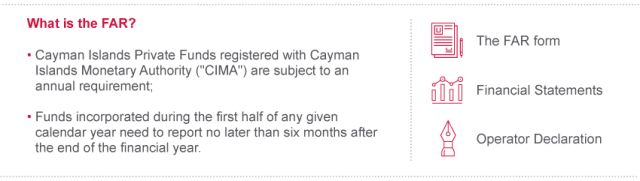

WHAT IS THE FAR?

The FAR is a Microsoft Excel-based tool through which CIMA captures general, operating and financial information relating to registered funds. It is required to be filed annually alongside the audited financial statements within six months after the financial year-end. While the local Cayman Islands auditor or other designated person must file the FAR on behalf of the fund, the fund operator, which includes the directors, trustee or general partner depending on how the fund is structured, ultimately is responsible for completing the FAR.

This filing is an annual requirement, with funds that launch operations during the first half of their fiscal year needing to report no later than six months after the end of that first part-financial year. Declarations and waivers are required for closed-ended funds not filing, whether due to a fund not yet drawing down capital from investors for investment purposes or where reporting an approved extended period (up to 18 months for first and last reporting periods).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.