All Australian Financial Services Licence (AFSL) holders and their Authorised Representatives (ARs) who provide tax (financial) advice to retail and wholesale clients are required to be either registered as a tax agent with the Tax Practitioners Board (TPB), or recognised as a qualified tax relevant provider.

A qualified tax relevant provider is an individual authorised to provide personal advice to retail clients about relevant financial products, registered with ASIC and who meets the requirements outlined in the

Note: 'Relevant financial products' are financial products other than basic banking products, general insurance products, consumer credit insurance or a combination of any of these products.

The TPB maintains a register containing details of all registered tax agents, while ASIC has developed the Financial Advisers Register listing all people or entities that provide personal financial advice to retail clients. Both registers are publicly accessible via their respective websites.

Regulators encourage consumers seeking tax (financial) advice to verify the registration and authorisation of their advisers via either the TPB register or the ASIC Financial Adviser Register to ensure that their advisers possess the necessary authorisations to provide relevant tax or financial services.

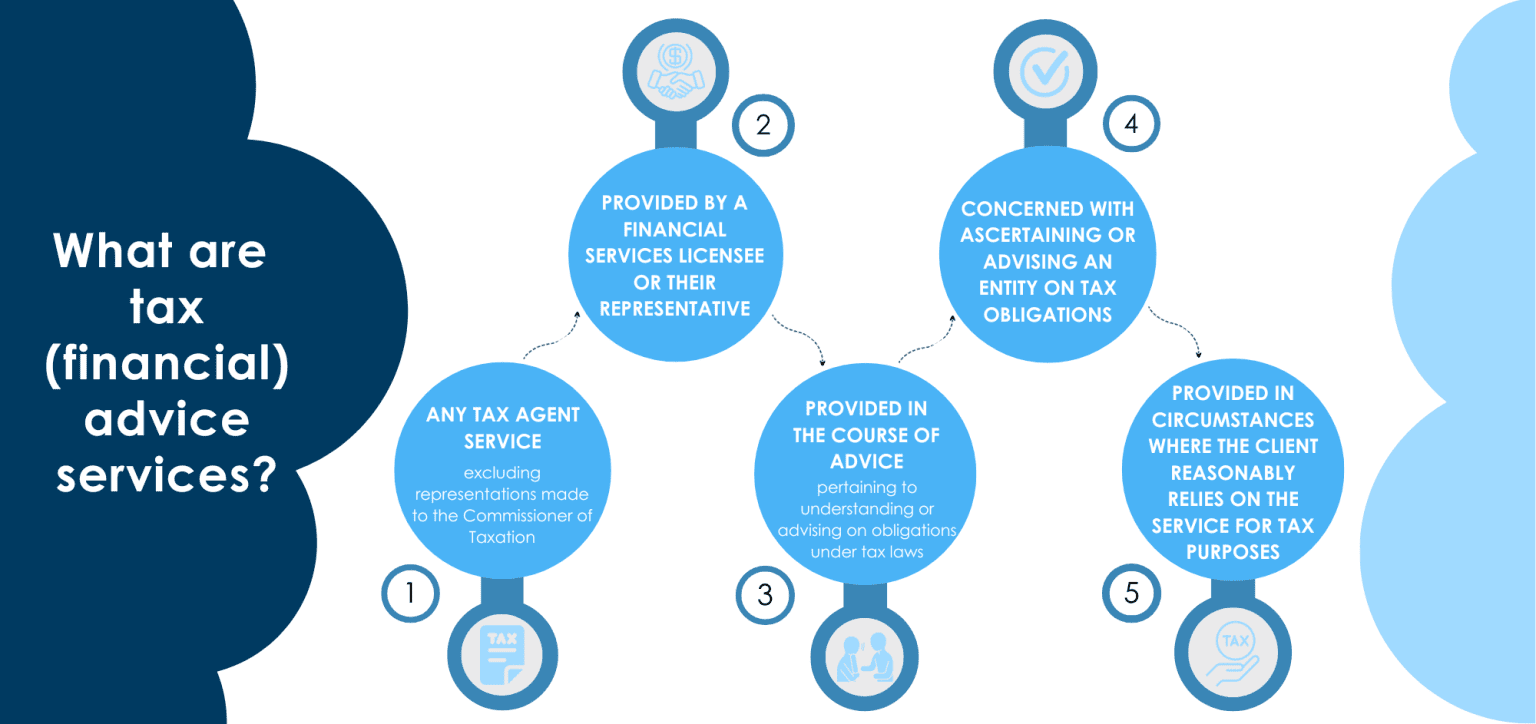

What is a tax (financial) advice service?

'Tax (financial) advice service' is defined in section 90.15 of the Tax Agent Services Act 2009 (TASA).

It includes five key elements:

- any tax agent service, excluding representations made to the Commissioner of Taxation;

- provided by a financial services licensee of their representative;

- provided in the course of advice pertaining to understanding or advising on obligations under tax laws;

- concerned with ascertaining or advising an entity on tax obligations; and

- provided in circumstances where the client reasonably relies on the service for tax purposes.

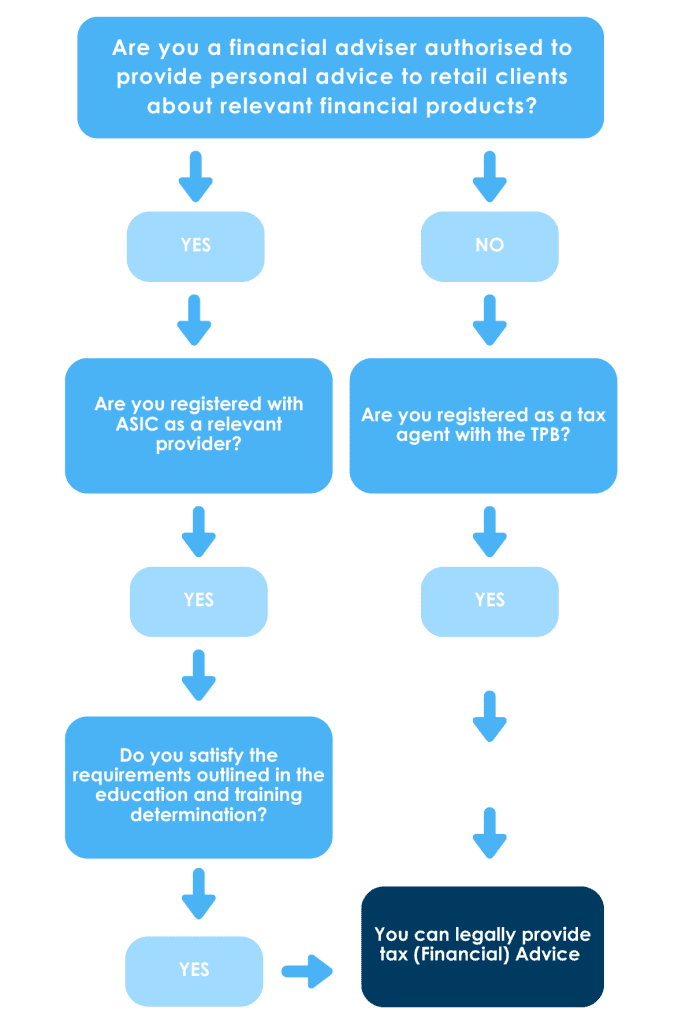

Can I legally provide tax (financial) advice?

If you intend to provide a tax (financial) advice service and are also a financial adviser authorised to provide personal advice to retail clients in relation to relevant financial products, you will need to ensure that you are registered with ASIC as a relevant provider and satisfy the requirements outlined in the Education and Training Determination to be a qualified tax (financial) advice provider.

You do not need to be registered with the TPB unless you intend to provide a wide range of tax agent services (beyond tax (financial) advice services).

If you are not a financial adviser (for example, you provide advice to wholesale clients only), you must be registered as a tax agent with the TPB to legally provide tax (financial) advice.

The registration process for individuals seeking to become tax agents solely for the purpose of providing tax (financial) advice services involves meeting specific eligibility criteria and selecting a registration pathway. There are four pathways to facilitate registration with the TPB as tax agents:

- Tertiary qualifications (Item 207);

- Diploma or higher award (Item 208);

- Work experience (Item 209); and

- Membership of a professional association (Item 210).

There are a number of requirements which must be met in order to obtain individual registration, these include:

- the individual must be over the age of 18;

- the individual is a fit and proper person;

- the individual meets the qualifications and experience requirements of the TPB; and

- the individual maintains Professional Indemnity Insurance which meets the requirements of the TPB.

How do you register with TPB as a company or partnership?

To register as a company or partnership tax agent for the purpose of providing tax (financial) advice services only, you must meet specific eligibility criteria. One such requirement is to have a sufficient number of registered individual tax agents capable of providing tax (financial) advice services and overseeing operations on behalf of the entity. It is important to note that you must determine what you deem to be a 'sufficient number' of individuals based on the individual circumstances of your business. The TPB advises that you should consider:

- the size of the business;

- the services being offered;

- the supervisory arrangements in place; and

- any potential conditions that may be imposed on your AFSL based on the qualifications and experience of its representatives.

When determining what constitutes a sufficient number, the TPB may take into account the number of qualified tax relevant providers within your company or partnership who provide tax (financial) advice services.

The individual registered tax agents that form the sufficient number may include those with a condition restricting them to providing tax (financial) advice services only.

There are a number of requirements which must be met to ensure eligibility for registration, including:

- all individual partners and directors are over the age of 18;

- each individual partner or director is a fit and proper person;

- maintaining Professional Indemnity Insurance which meets the requirements of the TPB;

- the applicant is not under external administration;

- the company or company partner has not been convicted of any serious offences within the preceding five (5) year period; and

- the company has a sufficient number of individuals registered as tax agents to maintain competency.

Registration with the TPB includes a one-off application fee for each entity and each individual representative applying for registration.

What happens if you aren't registered?

Providing tax advice without being properly registered carries hefty penalties.

Background:

The current regulatory landscape for relevant providers who provide tax (financial) advice services is stipulated in the Financial Sector Reform (Hayne Royal Commission Response—Better Advice) Act 2021 (Better Advice Act), effective from 1 January 2022.

Further reading:

Corporations (Relevant Providers—Education and Training Standards) Determination 2021 (Education and Training Determination)

Tax Practitioners Board Information Sheet TPB(I) 20/2014

Registration options to provide tax (financial) advice services

Registration options for wholesale advisers

Registering as an individual tax agent to provide tax (financial) advice services

Registering as a company or partnership tax agent.

FAQs: Relevant providers who provide tax (financial) advice services

Flowchart: Can I provide tax (financial) advice services to retail clients as a relevant provider?

Requirements for providing Personal Advice to Retail Clients

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.