AFS and Credit Licence holders ("Licensees") are required to notify ASIC within a prescribed timeframe after an entity starts to control, or stops controlling a Licensee.

What are Credit Licensees required to do?

Credit Licence holders must notify ASIC of a change in control in the form of a written letter identifying:

- the Credit Licence that is subject to the change in control,

- who, if anyone, has lost control and the date of this change; and

- who, if anyone, has gained control, and

- the date of this change.

The letter can be sent to the following address:

Credit Licensing

ASIC

PO Box 4000

Gippsland Mail Centre VIC 3841

Credit Licence holders are required to notify ASIC within 30 business days of the change.

What are AFS Licensees required to do?

AFS Licence holders must notify ASIC of a change in control via the lodgement of a Form FS20 Change of details for an Australian financial services licence through the AFS Licensee portal.

AFS Licence holders are required to notify ASIC within 30 business days after an entity starts to control, or stops controlling, the AFS licensee.

An AFS Licensee must notify ASIC if they become aware of any change in control no later than 10 business days after the change. (Regulation 7.6.04(1)(i) of the Corporations Regulations)

A change in control includes a transaction, or a series of transactions, in a 12-month period that results in a person having control of the AFS Licence (either alone or together with associates of the person).

What Lodgement Timeframe is Correct?

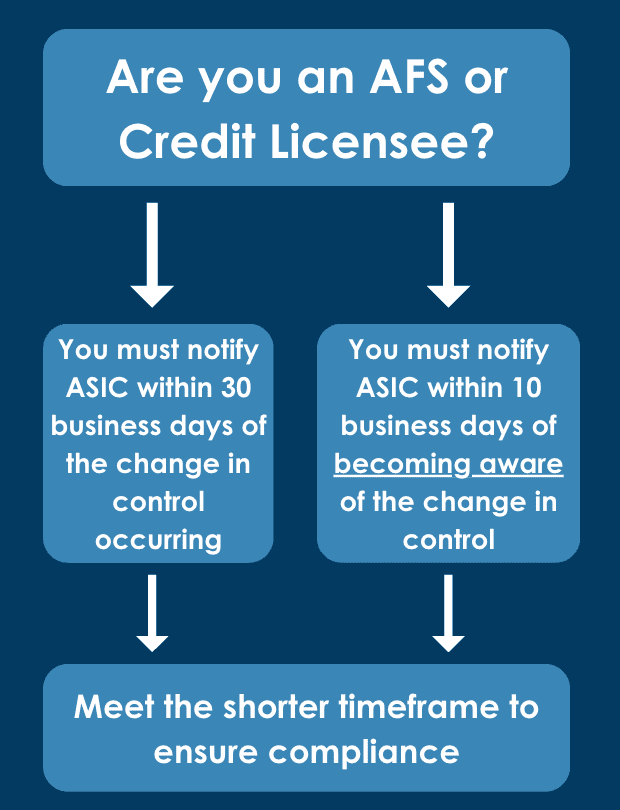

The Corporations Act and NCCP Act along with the and the Corporations Regulations and NCCP Regulations impose two different change of control notification requirements on Licensees which makes it difficult for Licensees to ensure they make the required lodgement notification within the prescribed timeframes.

So, which timeframe should Licensees adhere to?

Given that both the Corporations Regulations and NCCP Regulations impose a licence condition on all Licensees requiring them to notify ASIC within 10 business days of becoming aware of a change of control, Licensees should ensure they comply with the shorter lodgement timeframe to avoid any potential breaches of their Licence and/or disciplinary action from ASIC.

What is Control?

Control of a body corporate means:

- having the capacity to cast, or control the casting of, more than one-half of the maximum number of votes that might be cast at a general meeting;

- directly or indirectly holding more than one half of the issued share capital of the licensee (not including any part of the issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital);

- having the capacity to control the composition of the body corporate's board or governing body; or

- having the capacity to determine the outcome of decisions about

the body corporate's financial and operating policies, taking

into account:

- the practical influence that can be exerted; and

- any practice or pattern of behaviour affecting the body corporate's financial or operating policies.

(See section 910B(1) of the Corporations Act & section 16A of the NCCP Act))

Further Reading

- For AFS Licence holders:

- Section 912DA of the Corporations Act

- Change in control of AFS licensee

- For Credit Licence holders: Section 53A of the NCCP Act

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.