The Federal Court has clarified some issues regarding conflicted remuneration. These clarifying comments from the Court are important for licensees that provide retail financial product advice to consider.

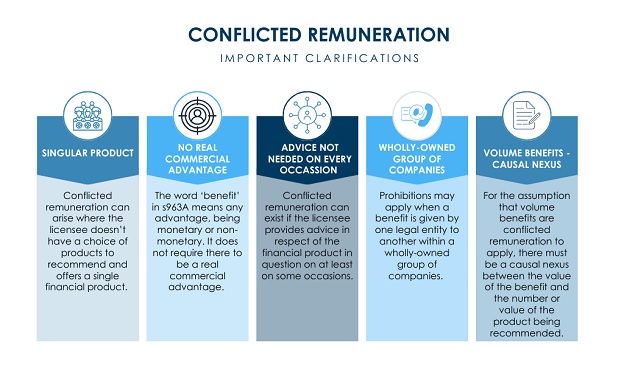

- No Real commercial advantage required – The Court reiterated the purpose of the conflicted remuneration regime is to prohibit benefits of any kind if (and only if) the benefits could reasonably be expected to influence the choice of financial product recommended or the advice provided by a licensee or its representatives. Thus, the benefit does not require the existence of a real commercial advantage after an assessment of any net benefits that may arise.

- Single Financial product – The Court noted the possibility of conflicted remuneration within the meaning of s 963A is not confined to circumstances where the licensee receiving the benefit is confronted with a choice of financial product to recommend or a choice of financial product advice to give. It can also arise when a licensee offers a single financial product (or a single financial product of a particular kind) or has chosen to offer financial product advice having a singular content (for example, to invest in a particular financial product).

- Related Entities – The prohibition on conflicted remuneration can apply when a benefit is given by one legal entity to another within a wholly-owned group of companies. The fact that a benefit is given by one entity to another within a group of companies is a relevant circumstance in assessing whether the benefit could reasonably be expected to influence the choice of financial product recommended or the financial product advice given.

- Advice not required on every occasion – The definition in s 963A does not require proof that a licensee provides financial product advice on every occasion on which it distributes the relevant financial product. A benefit given to a licensee can constitute conflicted remuneration if the licensee provides financial product advice to retail clients in respect of the financial product in question, at least on some occasions.

- Volume-based benefits – The application of the assumption that volume-based benefits are conflicted remuneration is not dependent merely on the fact that a benefit is given; it depends upon whether the benefit is wholly or partly dependent on the total value of, or number of financial products recommended to retail clients or acquired by retail clients to which the licensee has provided financial product advice. A causal nexus between the value of the relevant benefit and the number or value of relevant financial products recommended to or acquired by retail clients is required.

What is Conflicted Rumeneration?

Conflicted remuneration is:

- Any monetary or non-monetary benefit;

- which is given to a licensee or its representatives who provide financial product advice to retail clients; and

- where the benefit could reasonably be expected to influence

the:

- choice of financial product recommended to retail clients; or

- financial product advice given to retail clients.

What Next?

Any licensees receiving or paying benefits to other licensees or representatives should review and potentially revise the structures around these benefits with a focus on the following key questions:

- review whether any benefits, paid or received, could be

reasonably expected to influence the:

- choice of financial product recommended to retail clients; or

- financial product advice given to retail clients.

- are the benefits volume based? If so, is the value of the

benefit wholly or partly dependent on:

- the total value of financial products recommended or acquired by retail clients?

- the number of financial products recommended or acquired by retail clients?

- where benefits are paid, is the licensee or representative providing financial product advice to the retail client on at least some occasions?

- do benefits given to related entities meet the requirements of the Act in relation to conflicted remuneration?

- For licensees that advise on only one financial product – do any benefits paid or received meet the requirements of the Act in relation to conflicted remuneration?

Background

The conflicted remuneration provisions were originally introduced in June 2012 as part of the Future of Financial Advice reforms, as a response by the Australian Government to the 2009 Inquiry into Financial Products and Services in Australia. This inquiry, conducted by the Parliamentary Joint Committee on Corporations and Financial Services, considered various issues associated with corporate Collapses, including St0rm Financial Services Pty Ltd and Opes Prime Group Ltd.

In June 2020, ASIC initiated proceedings against the Commonwealth Bank of Australia (CBA) and its subsidiary, Colonial First State Investments Limited (CFSIL). ASIC alleged that when CFSIL issued, and CBA distributed, the "Essential Super" superannuation product CFSIL gave, and CBA accepted benefits which were conflicted remuneration contrary to prohibitions contained in the Corporations Act 2001 (Cth) ("Act"). The trial judge dismissed ASIC's case.

On 17 August 2023, the Federal Court upheld the trial judgement that the benefits given by CFSIL and accepted by the CBA were not conflicted remuneration within the meaning of section 963A of the Corporations Act.

On 29 September 2022, the trial judge in the case against CBA and CSFIL dismissed the proceedings for the following principal reasons:

- The benefits did not constitute prohibited "benefits" within meaning of s 963A of the Act.

- The benefits could not reasonably be expected to influence the choice of financial product recommended, or the financial product advice given by CBA .

- ASIC failed to establish that the CBA gave financial product advice to retail clients who opened an account in the Essential Super Fund.

- Even if the benefits constituted conflicted remuneration under the provisions of the Act, those benefits were exempted by operation of transitional provisions in the Act and the relevant regulations.

On 26 October 2022, ASIC appealed the Federal Court's decision. The grounds of appeal were largely concerned with the proper construction of the provisions of the Act and its application to the facts as found.

Further Reading

Sophie Grace Website: Conflicted Remuneration

Australian Securities and Investments Commission v Commonwealth Bank of Australia [2022] FCA 1149

Regulatory Guide 246 Conflicted and Other Banned Remuneration