1. General news

1.1 Consultation on the simplification of regulatory penalties

HMRC has issued a further consultation document following an initial consultation conducted earlier this year.

Since 2005, the Review of Powers has been undertaking a programme to review, align and modernise HMRC's legislative powers and safeguards. This programme includes new cross-tax penalty frameworks for inaccuracies in documents, failures to notify and failures to file a return or pay on time. Penalties for failure to comply with information requests from HMRC have also largely been modernised and this work is proposed to be completed by the reforms to data gathering powers which form part of the Finance Bill currently before Parliament.

Once this work has been completed, the UK tax regime will be supported by a modernised and aligned administrative framework with common design principles. The treatment of the same non-compliance for different taxes and duties will no longer attract differing sanctions under the law, except in those rare occasions where it makes sense to do otherwise.

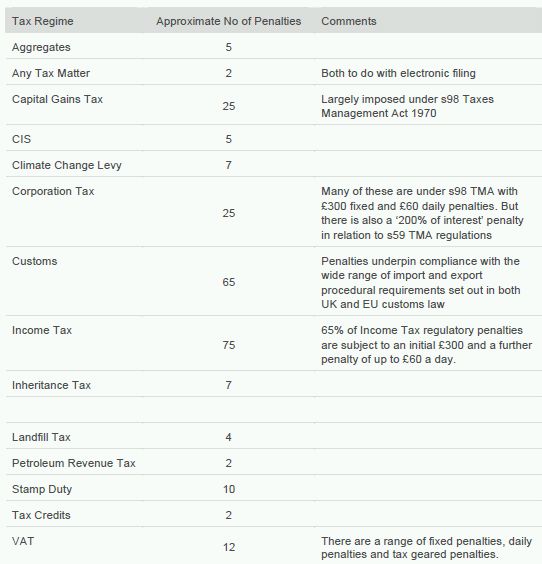

There remain over 300 civil penalties (see summary below) which have not yet been considered by the Review of Powers. These penalties – called "regulatory penalties" for the purposes of this consultation – underpin the tax system in a variety of ways.

The consultation asks respondents to consider how a new model, or models, should work, specifically in relation to how different types of penalties should be treated, and whether it is necessary to consider the different roles of the penalties when designing a new model.

1.2 General Anti-Avoidance Rule (GAAR) - Progress Summary

In December 2010 the Government asked Graham Aaronson QC to lead a study programme into a General Anti-Avoidance Rule (GAAR). The group will complete its study by 31 October 2011.

This study will consider whether a GAAR could deter and counter tax avoidance, whilst providing certainty, retaining a tax regime that is attractive to businesses, and minimising costs for businesses and HMRC. The Government is committed to predictability and stability for the UK tax system, and would not introduce a GAAR without further formal public consultation.

As the study passes its midway point, the study group has written a progress summary as follows:

"Dear Mr Gauke

GAAR Study - Progress Summary

As the GAAR Study passes its halfway point I thought you may wish to have a brief update on its progress. The Study Group has worked very thoroughly and cohesively, with two plenary sessions to evaluate the substantial work done prior to each meeting. We have also benefited from outstanding secretarial and research support provided by Jonathan Bremner of Pump Court Tax Chambers and Zoe Leung-Hubbard of HMRC.

Work to date

The Study Group has considered, and reached consensus, on the strength and weaknesses of the current judicial approach to the interpretation of tax statutes and to the application of those statutes to tax avoidance schemes.

It has considered the experience of GAARs in a number of other common law jurisdictions; and it has also considered the responses made last year to HMRC's informal consultation process on a potential GAAR for the UK. In addition, it has considered academic and professional material dealing with actual GAARs in other jurisdictions and a potential GAAR for the UK.

Current stage

Following evaluation of these matters the Study Group has reached consensus on what would be the potential advantages of a GAAR for the UK, and what concerns such a GAAR would need to address and allay.

In the light of the above, the Study Group has developed a conceptual framework of principles which would need to be embodied in a GAAR for it to be suitable to enact in the UK, and which would meet the criteria set out in your letter of appointment.

Future work

Over the coming weeks the Study Group will consider whether it will be possible to develop the conceptual framework into draft legislation, the operation of which would be sufficiently effective, clear and certain to merit its enactment. In doing so it will take into account any new points or concerns raised in consultations.

I should emphasise that we do not yet know whether it will be feasible to develop the conceptual framework into a set of statutory rules fit for enactment.

Consultation

Apart from considering material produced in the context of the informal consultation process which HMRC conducted last year, we have recently had very useful meetings with representatives of the Chartered Institute of Taxation and of the Institute of Chartered Accountants in England and Wales. Meetings have been scheduled with the CBI and the Institute of Chartered Accountants of Scotland, and are being scheduled with the Law Society, the Revenue Bar Association and the Institute of Directors. We will be contacting other representative bodies with a view to arranging discussions, and would be grateful to hear the views of any professional body, or indeed individuals, who wish to get in touch with us.

Conclusion

Finally, the study remains on course to let you have our conclusions by the end of October.

Kind regards.

Graham Aaronson QC

9 June 2011"

2. Private Clients

2.1 Number of non-domiciled taxpayers paying the remittance basis charge

In a House of Commons Written Answer Mr Gauke estimated the number of non-domiciled individuals paying the remittances basis charge (RBC) as follows:

|

2011/12 |

2012/13 |

|

|

£30,000 |

7,400 |

5,900 |

|

£50,000 |

3,700 |

|

|

7,400 |

9,600 |

The actual number of taxpayers who paid the RBC in 2008/9, the first year, was 5,400 and no reasons are given for the significant increases in the estimates. However payment of the RBC is dependent on the nondomiciled individual having been in UK for at least seven out of the previous nine years and so there will be a number of taxpayers who meet this test for the first time in the years in question.

3. Business tax

3.1 Single Compliance Process

HMRC has issued a briefing paper for tax agents on the single compliance process.

www.hmrc.gov.uk/news/scp-trial.pdf

It is aimed at improving the enquiry process for 'local compliance' and 'SME' taxpayers.

The introduction of this pilot was trailed at item 3.4 in Informal of 23 May 2011. The trial will occur from June to December 2011 over the following 12 HMRC locations:

|

Belfast |

Newcastle |

|

Cardiff |

Reading/Slough |

|

Edinburgh/Dundee |

Southampton |

|

Euston Tower, London |

Warrington |

|

Exeter |

York |

The trial aims to cover around 1,200 cases. HMRC intends to roll out the new process nationally from January 2012, subject to the results of the trials.

HMRC envisage the SCP as a single framework within which the majority of future SME business enquiry work will be undertaken. The SCP will cater for both single tax and cross-tax enquiries. Their approach uses five process stages (Planning, Contact, Process, Resolve, Close) which are common to most enquiries. Using this design framework HMRC has proposed four different levels of intensity, with varying amounts of time spent on each case.

- The first level will be to carry out an enquiry where there is no need for a face to face meeting, for example by correspondence, and with minimum inconvenience.

- The second level will adopt a simplified and faster route for those cases where a lower intensity face to face intervention approach is required.

- The third level will address cases requiring a greater amount of time because the depth and breadth of the enquiry is more involved.

- The fourth level will tackle the most demanding cases such as those indicating tax evasion characteristics or those which are highly complex in nature.

All levels can apply to all taxes and types of cases and can be moved between levels.

ICAEW has commented that:

"One aspect of the SCP is worth noting: in many cases HMRC is likely to attach quite a lot of importance to meeting the taxpayer and looking at records at their business premises. Agents should bear in mind that while a meeting may well be a good idea in some enquiry cases, HMRC does not have the power to insist on one or to insist on meeting the taxpayer, though it does have the power to inspect business premises. We will cover this and other aspects of the SCP when we publish more detailed guidance. In the meantime, if your SME clients are in the pilot areas, it may be worth alerting them to the possibility of HMRC contacting them as part of the SCP pilot."

3.2 DOTAS

HMRC is currently undertaking an informal consultation on updating DOTAS, with a request for comments by 31 August 2011. It sets out notes on proposed new Hallmarks as follows:

- Employment income schemes. HMRC has already received notification of arrangements seeking to sidestep the disguised remuneration legislation using loans and assets. It is also concerned that the disguised remuneration legislation will lead to an increased use of 'growth' share schemes (which in HMRC's view involve a class of shares, not available to ordinary investors, whose rights are such that they have low value at issue, or acquisition, but the potential for significant appreciation if the company grows in value).

- A territorial based offshore hallmark. HMRC remain concerned about avoidance schemes which rely for their effect on less than transparent arrangements in offshore territories, particularly in view of the coming changes to CFC rules. They are therefore exploring the possibility of a territorial based offshore hallmark.

- Income tax avoidance schemes using loss arrangements. HMRC continue to be concerned at the marketing of loss schemes and two other consultations have implications for loss schemes (High Risk Tax Avoidance Schemes published 31 May and an imminent consultation on high risk areas of the tax code such as the use of income tax losses). However HMRC are keen to explore a refinement to Hallmark 6 (Loss schemes) so that the 'main benefits test' is altered to be 'the or a main benefit' if the arrangements are an unregulated collective investment scheme (as defined in the Financial Services and Markets Act 2000) and the fees charged by the promoter exceed a certain percentage of the gross investment.

- Hallmark 8 on pensions would be removed as it ceased to apply from 6 April 2011. They would keep the need for a replacement hallmark under review.

There is also a draft consolidated statutory instrument covering Tax Avoidance Schemes Information Regulations, making what HMRC consider some minor changes.

3.3 EU Financial Activities Tax

In a letter to the European Council dated 17 June 2011, President Jose Manuel Barroso commented on financial sector taxation indicating that legislative proposals would be put forward after the summer. He commented that there were strong grounds on deciding for a financial sector tax in the EU as a first step:

- to avoid fragmentation in the financial sector arising from uncoordinated tax measures across the EU;

- to ensure the sector makes an appropriate contribution to recouping the costs of the current crisis and to address concerns about excessive profits;

- to create disincentives for overly risky or purely speculative transactions.

In addition to the above the Commission would continue to work for global agreement on a financial transaction tax.

3.4 Finance Bill 2011 Lords Report

A main theme of this year's Lords Report on Finance Bill 2011 is how far, in its first year, the Government has stuck to its own new approach, including full consultation at each stage in the process. The witnesses thought that on the whole the Government had done so, and that the outcome would be better tax legislation.

However there was disappointment with the announcement of an increased supplementary charge on oil and gas production and new provisions against tax avoidance through disguised remuneration; the latter has mushroomed to over 60 pages of new legislation. The view of the witnesses was that consultation from the time the measure was announced, in accordance with the new approach, would have led to better legislation. The Lords share these concerns: if the Government does not abide by its own rules for tax policy making, it risks eroding the credibility of its commitment both to the new approach and to a stable and predictable tax system for the UK.

www.publications.parliament.uk/pa/ld201012/ldselect/ldeconaf/158/158.pdf

3.5 Tax under consideration on all large business enquiries

HMRC has released information under the freedom of information rule regarding the measure of tax under enquiry by the Large Business Service. The snapshot as at 31 March 2011 is as follows (with cases going back to 1990):

- tax under consideration on all LBS enquiries was £25.5 billion;

- tax under consideration on LBS CFC enquiries was £3.75 billion;

- the number of issues under enquiry by LBS was 2,721, of which 134 involved CFCs.

www.hmrc.gov.uk/freedom/tax-lbs-enq.htm

4. VAT

4.1 VAT and single use carrier bags in Wales

The Welsh Assembly Government is to introduce a compulsory charge (initially set at a minimum of 5p) on 'single-use' carrier bags which retailers must charge to customers in Wales, with effect from 1 October 2011. Retailers outside Wales who deliver goods to customers in Wales using single-use carrier bags will also have to make the charge. This will be regarded as consideration for VAT purposes so a VAT registered business will charge 4.17p plus VAT.

A HMRC Brief gives further information.

www.hmrc.gov.uk/briefs/vat/brief2311.htm

5. Tax Publications

Business Record Checks

HMRC is introducing a programme of business record checks to review the adequacy and accuracy of SME records.

Pensions: reduction to the lifetime allowance

The lifetime allowance upper limit on the amount of pension and for lump sum from pension schemes that benefit from tax relief is being reduced from 6 April 2012, subject to a 'fixed protection' election.

Reduction to LTA and Fixed Protection – Restricted release

Technical background to the Lifetime Allowance reduction from 6 April 2012 for pension savings and the'fixed protection' election.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.