Concerning the 2024-25 tax year, High Income Child Benefits will now be charged at an increased threshold of £60,000, an increase of £10,000 from the previous threshold of £50,000. Announced in the Spring Budget, and with consultation on wider reforms to follow, we take a look at how the changes to HICBC may affect you and further discuss the reforms impacts and progression.

What is HICBC?

The High Income Child Benefit Charge (HICBC) ensures that Child Benefits are reclaimed from families where the highest earner has an income above a set threshold that is deemed to be reasonable.

Before 6 April 2024, the income threshold whereby HICBC was revoked was £50,000 and the tax charge was equal to 1% of the total Child Benefit's received for every £100 earned over £50,000. This meant that Child Benefit payments were effectively withdrawn completely when the highest earner earned £60,000.

Now, a full clawback of Child Benefits is not expected until a relevant parent earns £80,000 and the clawback is calculated at 1% of every £200 over the £60,000 threshold. This comes as a welcome revision for many as the thresholds were deemed to be outdated having remained at £50,000 to £60,000 since the policy was first introduced in 2013.

Gov.UK legislation

Gov.UK has released details of the changes announced in the Spring Finance Bill as follows:

'Legislation will be introduced in Spring Finance Bill 2024 to amend section 681B to increase the HICBC starting threshold to £60,000. It will also amend section 681C to extend the HICBC taper to between £60,000 and £80,000, by amending the calculation of the appropriate percentage so that 'L' will be set at £60,000 and 'X' at £200.

New claims to Child Benefit are automatically backdated by three months, or to the child's date of birth (whichever is later). For Child Benefit claims made after 6 April 2024, backdated payments will be treated for HICBC purposes as if the entitlement fell in the 2024 to 2025 tax year if the backdating would otherwise create a HICBC liability in the 2023 to 2024 tax year.'

Data Insight

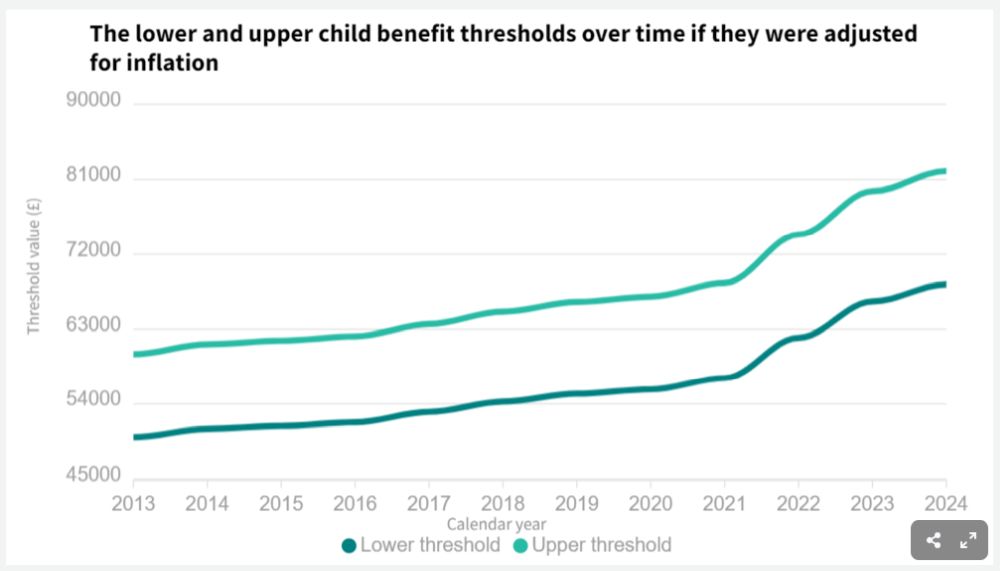

Figure 1: Calculation using data from the Office for National Statistics.

Using data published by the Office for National Statistics (ONS), inflation since 2013 (2013-2024) amounts to 36.714% revealing the extent to which the HICBC threshold has been in need of review. Gov.UK have acknowledged that increasing the HICBC threshold will have a positive impact for around 485,000 families. This includes around 305,000 individuals currently paying the HICBC who will have this reduced, including 170,000 individuals who will no longer be liable for HICBC. The remaining 180,000 are the families currently not claiming Child Benefit or opting out of getting Child Benefit payments that are now eligible to receive payments for Child Benefit.

It is evident that the threshold should have been increased considerably sooner to provide the necessary relief to those affected. Considering current high inflation levels and high wages, many parents have been reaching the HICBC threshold in recent years.

For families navigating the HICBC, understanding its implications on household finances is crucial. The charge is calculated based on adjusted net income, encompassing total taxable income before any allowances, such as interest from savings and dividends. If the household income exceeds £60,000, the higher earner is responsible for paying the tax charge. If you are unsure how you are affected by the changes to HICBC it is best to seek expert advice.

How is HICBC calculated?

HICBC is calculated using your 'adjusted net income'. This being your total taxable income before any allowances. This includes interest from any savings and dividends. Should your net income fall over the £60,000 threshold, whoever has the higher income in the household (you or your partner) will be responsible for paying the tax charge.

We urge you to seek appropriate advice if you are unsure of your eligibility for HICBC. For example, HICBC may be applicable to your household even if the child living with you is not your child. Details of the charges intricacies can be found on Gov.UK, alternatively our team of experts can assist with any clarification.

How do I pay HICBC?

If you are affected by HICBC, you must declare it on a self-assessment tax return. Either you can choose to not receive Child benefits at all, or you can pay the charge through self-assessment at the end of each tax year.

Should you choose to opt out of receiving payments for Child Benefits, you should still fill in the Child Benefit claim form and state that you do not want to receive the payments.

Necessary developments concerning HICBC in the future

Despite the revisions to HICBC that were introduced on 6 April 2024, there are still inequalities in the policy that must be considered further. For example, a single parent earning £80,000 would have to repay all Child Benefits received, whereas a dual-parent household where both parents earn £60,000 each (totalling £120,000 income) would not incur the charge. A consultation is set to take place to address this disparity, and by April 2026, HICBC is expected to be administered on a household basis rather than an individual one, aiming to rectify these inequalities.

The recent changes to the thresholds signify a step towards addressing concerns of fairness and impact. For many, a change in how HICBC Is calculated is necessary and further revisions should be expected. The threshold change is seemingly a token gesture when considering the issue in its fullness.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.