On April 15, 2020, OECD released the report titled "Tax and Fiscal Policy in Response to the Coronavirus Crisis: Strengthening Confidence and Resilience" (the "COVID-19 Response"). The COVID-19 Response discussed the decisive action many governments have taken to contain and mitigate the spread of the virus and to limit the adverse impacts on their citizens and their economies, and outlined various tax policy options as available tools. Included in the tax policy discussion is the commitment to stay the course in response to the tax challenges of the digitalisation of the economy and ensuring that MNEs pay a minimum level of tax. (p.6) In the COVID-19 environment, the new impetus to efforts to reach agreement on Pillar One issues internationally can now stem not only from "[t]he increased use of digital services" but also from "the need to collect more revenues" which can be achieved, in part, by "strengthening the taxation of economic rents" (p.6) particularly of the companies which perform relatively well during the crisis.

The intent to focus the "taxation of economic rents" on better-performing enterprises has been reinforced in the OECD's "Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalisation of the Economy" published on July 1, 2021 which proposes that in-scope companies be defined as the MNEs with global turnover above 20 billion euros and profitability above 10%. While the profit margin cut-off may seem reasonable, the one-size-fits-all approach is disheartening.

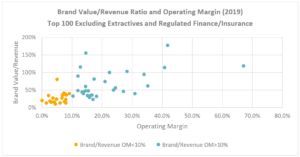

A quick review of the top 100 brands valued by BrandFinance1 illustrates the point: while for the companies with operating margins under 10% the ratios of brand value to revenue cluster between about 15% and 40%, for companies with operating margins in excess of 10% - which companies would be in-scope as proposed by the Statement - the ratios of brand value to revenue are spread widely between 20% and over 100%. Thus, if the 10% profitability were to be accepted as a simple mechanical threshold, the residual profits that would be subject to allocation as Amount A could include, in part, the return on the MNE's brands. One can question whether this is OECD's intention.

Footnote

1 brandirectory.com/global Brand Finance Global 500 January 2020

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.