The Internal Revenue Service (IRS) recently announced 2012 cost-of-living adjustments to the applicable dollar limits for various employer-sponsored retirement and welfare plans. Plan sponsors should update payroll and plan administration systems accordingly and should incorporate the new limits in relevant participant communications. Because 2012 marks the first year the IRS has increased employee benefit plan limits since 2009, plan sponsors also may want to consider updating plan documents to include the new cost-of-living adjustments, to the extent such adjustments are not automatically incorporated by cross-reference.

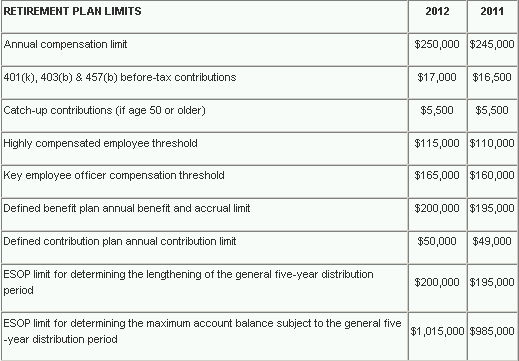

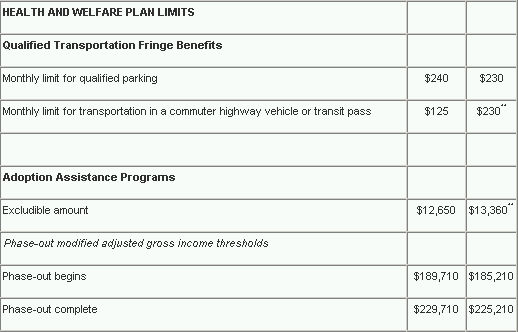

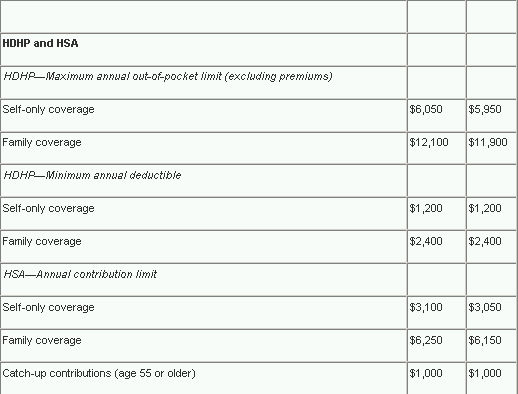

The Internal Revenue Service (IRS) recently announced the cost-of-living adjustments to the applicable dollar limits on various employer-sponsored retirement and welfare plans for 2012.> Although many dollar limits currently in effect for 2011 will change, some limits will remain unchanged for 2012. Earlier this year, the IRS announced new limits for 2012 relating to high deductible health plans (HDHPs) and health savings accounts (HSAs). The table below compares the applicable dollar limits for 2011 and 2012 for certain employee benefit programs.*

Plan sponsors should update payroll and plan administration systems for the new 2012 cost-of-living adjustments and should incorporate the new limits in relevant participant communications, like open enrollment materials and summary plan descriptions. Also, because 2012 marks the first year the IRS has increased employee benefit plan limits since 2009, plan sponsors may want to consider updating plan documents to include the new cost-of-living adjustments, to the extent such adjustments are not automatically incorporated by cross-reference.

For further information about applying the new IRS employee benefit plan limits for 2012, contact any of our employee benefits lawyers, or an author.

*Dollar limits are generally applied on a calendar year basis; however, certain dollar limits are applied on a plan year, tax year or limitation year basis.

**The temporary increase in the income exclusion for this benefit is currently scheduled to expire on December 31, 2011.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.