The term "ESG" was coined by a group of asset managers for the United Nations Environment Programme Finance Initiative (UNEP FI) and Freshfields Bruckhaus Deringer, one of the world's leading international law firms, in their October 2005 game-changing report, A Legal Framework for the Integration of Environmental, Social and Governance Issues into Institutional Investment, better known as the "Freshfields Report." Prior to the Freshfields Report's release, it was commonly accepted that corporate and asset managers' sole duty to shareholders and investors was to maximize profits. The Freshfields Report pivoted from this view, asserting, "[i]ndeed, many people wonder what good an extra percent or three of patrimony are worth if the society in which they are to enjoy retirement and in which their descendants will live deteriorates. Quality of life and quality of the environment are worth something, even if not, or particularly because, they are not reducible to financial percentages." The four years following the Freshfields Report brought more ESG innovation and integration than ever before.

According to sustainability pioneer Paul Clements-Hunt, who helped lead the work underlying the Freshfields Report, the initial thought was to promote ESG as "GES" based on the view that Governance (G) was the most vital area; followed by Environmental (E); and finally Social (S). It was later decided that GES was insufficiently catchy, so Environmental (E) was shifted to the front; Social (S) was placed in the middle as it was most likely to be "flicked off the end by Milton Friedmanesque lobbyists"; and Governmental (G) was moved to the other end. This resulted in the acronym we know today as ESG.

Environmental criteria relevant to ESG include an organization's energy and natural resource consumption, commitment to reducing carbon emissions and other forms of waste, position on climate change, and the effects of an organization's activities on humans and wildlife. Social criteria relevant to ESG include an organization's community and social impact; level of civic engagement; workforce health and quality of life; and diversity, equity and inclusion efforts. Governance criteria relevant to ESG include an organization's policies and procedures for business and board operations; executive accountability; legal and regulatory compliance; supply chain diversity; and other external stakeholder relationships.

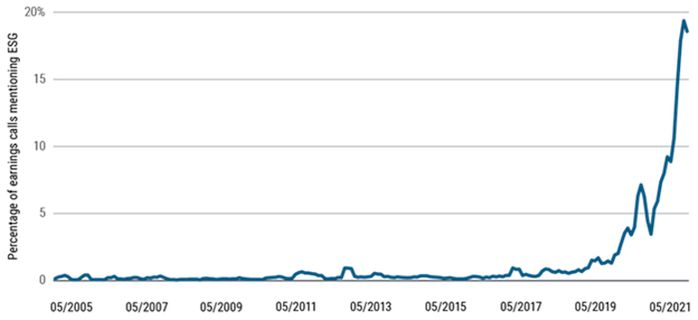

Notably, the COVID-19 pandemic and intensified awareness of social issues have worked to fast-track and solidify the importance of corporate attention to ESG. Pimco, an investment management firm that oversees over $2.2 trillion in assets, reported that, based on its analysis of earnings call transcripts of roughly 10,000 global companies, from May 2005 to May 2021, ESG mentions went from 0-1% to 19%. In 2019, just before the pandemic, mentions were only at 5%.

Source: Pimco Asset Allocation Outlook, Mid-Cycle Investing: Time to Get Selective (July 14, 2021).

BlackRock, the world's largest investment manager, announced in its 2021 expectations that it would increase the number of companies for which it assesses climate change policy from 440 to over 1,000, calling on them to "disclose a business plan aligned with the goal of limiting global warming to well below 2 degrees Celsius, consistent with achieving net-zero [greenhouse gas emissions] by 2050." Vanguard, a Pennsylvania-based investment advisor managing over $7 trillion in global assets, noted in a June 2020 publication that where climate concerns are material to a company's operations, it expects the company to stock its board with "climate-competent" directors who can "foster healthy debate on climate topics, challenge management assumptions and make thoughtful and informed decisions regarding these risks."

BlackRock, State Street and Vanguard are three of the largest shareholders of many public companies. Each has called on boards of directors to share their approach to board diversity and has indicated that it may vote against board directors it considers to be insufficiently delivering in this area. Legal & General Investment Management, one of Europe's largest asset managers, promises to vote against S&P 500 company board nominating committee chairs in 2022 if their boards contain no racially or ethnically diverse directors. Institutional Shareholder Services (ISS), the world's largest shareholder advisory firm, has a similar general policy plan for 2022; and has a current policy to vote against or withhold votes from the nominating committee chairs of S&P 1500 or Russell 3000 company boards who have no female members. ISS plans to expand this policy to include companies beyond these two indices in 2023.

Both ISS and Glass Lewis, the world's largest independent provider of sustainable governance and engagement support services to institutional investors and public companies, have expressed plans to recommend against board chairs who fail to disclose information related to board-level oversight of ESG issues beginning in 2022. RBC Global Asset Management (RBG GAM), an Ontario-based asset management services provider for high-net-worth investors, integrates "all relevant ESG factors" into its investment process based on its view that when organizations are transparent about their ESG strategies and practices, investors gain better insight into what a company is truly made of and values.

The global acceptance of ESG as a legitimate way to value an organization is a glaring sign that markets and mindsets are changing. A strong corporate ESG strategy can increase sales and boost recruitment and retention efforts in a commercial climate where people are seeking jobs and products from companies that align with their personal priorities. A robust ESG program positively impacts an organization's bottom line by opening up access to large pools of capital, expanding customer base and cultivating loyalty. Stakeholders, including clients, customers, employees and investors, are putting their time, talent and treasure where their hearts lie. When asked by a prospective investor or other stakeholder for an ESG report, an organization should be prepared to deliver. Corporate leaders and decision-makers should take heed and take action to equip their organizations to profess more than profit to remain sustainable, competitive and distinctive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.