As previously reported, the U.S. markets have experienced a 35% year-over-year increase in volume, with 111 IPOs completed in the first nine months of 2017, raising $26.5 billion. A recent PwC report noted that the pharma and life sciences sectors accounted for 31% of the IPOs conducted in 2017's third quarter with 11 IPOs raising $1.1 billion.

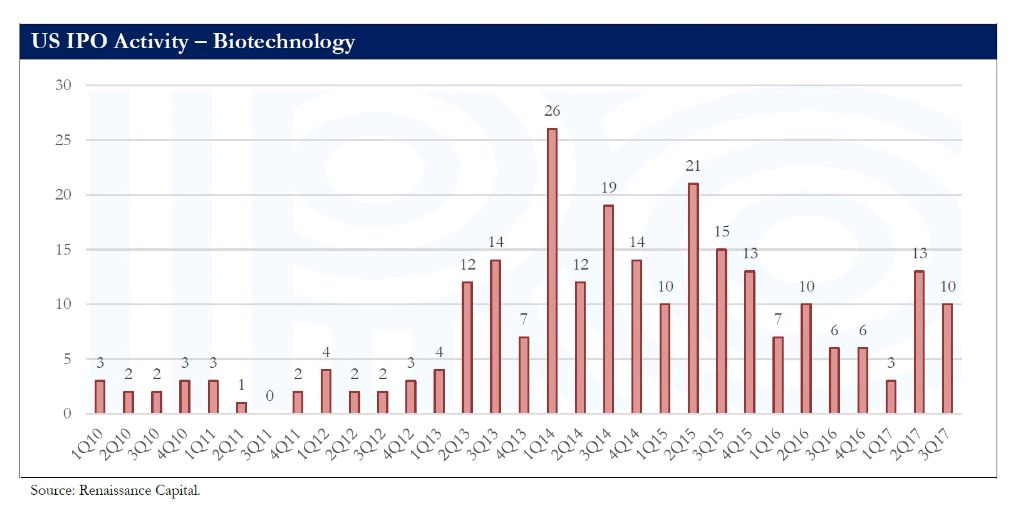

In Renaissance Capital's Quarterly Report on the U.S. IPO Market, biotech IPOs are in the spotlight once again. Renaissance reported 10 biotech IPOs conducted this past quarter. This continues a substantial increase from the first quarter of 2017, which hit a four year-low with only three biotech IPOs completed.

Private equity-backed IPOs have fallen to their lowest volume since the first quarter of 2016. PE-backed IPOs accounted for seven IPOs, which raised $1.4 billion across a variety of sectors. Venture capital-backed IPOs remained steady with 13 IPOs raising $1.7 billion. Tech companies only accounted for two of the 13 VC-backed IPOs raising $330 million, a five quarter low.

Renaissance also reports that the third quarter of 2017 saw 49 new IPO filings, a 23% increase from 2017's second quarter. There are now 77 companies in the IPO pipeline with 47 having filed in the past 90 days. We will continue to monitor the IPO market on this blog.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved