The US Securities and Exchange Commission ("SEC") and the Commodity Futures Trading Commission ("CFTC") have overhauled Form PF and private fund managers have until March 12, 2025, to begin reporting on the new Form. The changes to the reporting requirements mandated by the amendments to the Form ("Form PF Amendments") will require substantial preparation by many managers.1

The Form PF Amendments are designed to enhance both the SEC's and the Financial Stability Oversight Council's ("FSOC") monitoring of systemic risk, and strengthen the regulatory oversight of private funds and investor protection efforts.2 The Form PF Amendments were jointly adopted by the SEC and CFTC on Feb. 8, 2024, with the Chairman of the SEC, Gary Gensler, noting "since Form PF first was adopted [12 years ago], the SEC, CFTC, and FSOC have identified gaps in the information . . . from private fund advisers . . . and amendments . . . will enhance the [SEC's, the CFTC's,] and [the] FSOC's understanding of the private fund industry as well the potential systemic risk posed by the industry and its individual participants. In addition, the adoption also furthers investor protection efforts."

Form PF is the reporting form used by certain SEC-registered investment advisers to private funds, including those that also are registered with the CFTC as a commodity pool operator or commodity trading adviser. The Form PF Amendments change how large hedge fund advisers report the following, among other changes:

- Investment exposures;

- Borrowing and counterparty exposure;

- Market factor effects;

- Currency exposure;

- Turnover;

- Country and industry exposure;

- Central clearing counterparty reporting;

- Risk metrics;

- Investment performance by strategy;

- Portfolio liquidity; and

- Financing and investor liquidity.

In addition, the Form PF Amendments require additional basic information about advisers and the private funds that they advise, including identifying information, assets under management, withdrawal and redemption rights, gross asset value and net asset value, inflows and outflows, base currency, borrowings and types of creditors, fair value hierarchy, beneficial ownership, and fund performance.

The Form PF Amendments come just two months after the Dec. 11, 2023 effective date for the majority of the requirements under the Form PF event-based reporting amendments finalized by the SEC in May 2023.3

This Alert outlines certain key changes to Form PF reporting requirements under the Form PF Amendments, as well as the potential burden on private funds to revise their reporting processes to comply with the Form PF Amendments.

Amendments to General Instructions – Impact on all Filers

The Form PF Amendments include significant changes to the Form PF General Instructions, which apply to all Form PF filers and are intended to improve data quality and comparability and to enhance systemic risk assessment. The amendments to the General Instructions include:

1. Separate Reporting for each Component Fund of a Master-Feeder and Parallel Fund Structure: The Form PF Amendments' most substantial change is the new requirement to separately report each component fund of a master-feeder arrangement or parallel fund structure, other than a feeder fund that invests all of its assets in a single master fund, US treasury bills, and/or cash and cash equivalents (defined as a "disregarded feeder fund").

Currently, Form PF allows for advisers to respond to questions regarding master-feeder arrangements and parallel fund structures either in the aggregate or separately, as long as they do so consistently throughout the Form.4 The SEC was reluctant to prescribe such an approach in 2011 when Form PF was originally adopted, citing the potential burden on advisers as part of the reporting framework. In the adopting release for the Form PF Amendments ("Adopting Release"), the SEC explained that given the disparities in approaches between Form PF filers, certain risk profiles with respect to asset size, counterparty exposures and/or investor liquidity have been obscured, and separate reporting will improve data quality and comparability and enhance systemic risk assessment.5

While advisers will now be required to report separately each component fund of a master-feeder arrangement and parallel fund structure, advisers will continue to aggregate these structures for purposes of determining whether the adviser meets a reporting threshold (e.g., in determining if the adviser is a large hedge fund adviser).6 In explaining how disaggregated reporting will improve the identification of risk exposures, the SEC provided an example where a feeder fund may have counterparty exposure, rather than the entire fund in the aggregate, as fewer assets held at the feeder fund level would be available as collateral and the counterparty may have greater risk.7

As noted above, there is a carve out from the separate reporting requirement for a "disregarded feeder fund", which is a feeder fund that invests all of its assets in (i) a single master fund, (ii) US treasury bills, and/or (iii) cash and cash equivalents.8 Advisers will identify a disregarded feeder fund and look through to any disregarded feeder fund's investors in responding to certain questions regarding the master fund's investors (e.g., beneficial ownership).9 The SEC views a disregarded feeder fund as not meaningful for data analysis as the master fund is the conduit through which investment is made, and such master fund's activity is captured via the Form.10

Advisers will continue to aggregate master feeder arrangements and parallel fund structures for purposes of determining whether the adviser meets a reporting threshold (e.g., in determining if the adviser is a large hedge fund adviser). However, the SEC adopted instructions stating that advisers should disregard the holdings of feeder funds in their respective master fund's equity for the purposes of determining whether the master-feeder arrangement compromises a qualifying hedge fund, as this will avoid potential double counting.11

Unchanged from the current Form PF, dependent parallel managed accounts must be aggregated with the largest private fund to which it relates. Advisers will continue to be required to report the total value of all parallel managed accounts related to each reporting fund.

In justifying this change to require separate reporting, the SEC explained that such reporting would not be overly burdensome since advisers already assemble aggregated data for determining Form PF reporting categories, and any additional burdens are justified to increase transparency and systemic risk monitoring.

2. Investments in other private funds ("fund of funds"): Currently, advisers include the value of their private funds' investments in other private funds when determining whether the adviser meets the threshold to file Form PF. Currently, Form PF also generally allows an adviser to disregard the value of equity investments in other private funds for purposes of both the Form's reporting category thresholds (e.g., whether it qualifies as a large hedge fund adviser) and responding to certain questions on Form PF, as long as the reporting is done consistently throughout the Form subject to certain exceptions.12

The Adopting Release retains this flexibility to allow advisers to continue to include or exclude the value of such investments. However, the SEC opted to amend Instruction 7 of the Form PF General Instructions to include with more explicit language that requires advisers to include the value of their investments in private funds – whether internal or external – in determining whether the adviser is required to file Form PF; whether it meets the thresholds for reporting as a large hedge fund adviser, large liquidity fund adviser, or large private equity fund adviser; and whether a hedge fund is a qualifying hedge fund.13

In explaining these changes, the SEC noted that the current flexible standard provides unclear and inconsistent reporting and data on the scale of a reporting fund's exposures. Disagreeing with a number of commentors regarding the increased burden of reporting such information, the SEC remarked that advisers are currently required to include investments in other private funds to determine whether they meet the Form PF filing threshold and fund-of-funds structures present risks because they are engaged in direct investments.

The SEC retained elements of the instruction allowing for funds that invest substantially all of their assets in other private funds (and only holds cash and cash equivalents and instruments acquired for the purpose of hedging currency exposure) to only complete Section 1b of the Form, and not Section 1c. While the SEC generally retained this exclusion, it modified the instructions to change the language from "substantially all" to "80% or more of its assets."14

Currently, advisers are not required to, but nonetheless have the option to, "look through" a reporting fund's investments in any other entity (including other private funds), which the SEC commented has led to inconsistent data and comparisons. As a result, Instruction 7 of the Form PF General Instructions was amended further to require advisers to "look through" a reporting fund's investments in internal or external private funds (other than a trading vehicle), unless the question instructs the adviser to report exposure obtained indirectly through positions in such funds or other entities. The instructions were modified to require advisers that cannot avoid "looking through" to the reporting fund's investments in internal private funds or external private funds to include an explanation in response to Question 4.15

3. Trading Vehicles: Currently, Form PF does not require advisers to report separate legal entities wholly or partially owned by private funds that hold assets, incur leverage, or conduct trading or other activities as part of the private fund's investment activities, but do not operate a business (a "trading vehicle"). Given the fact that trading vehicles aren't currently identified, there is a blind spot for the SEC, with the Adopting Release stating "Form PF does not provide a clear window into the existence or use of trading vehicles and the risks they may present."

The Form PF Amendments require advisers to identify and report information on any trading vehicles of the reporting fund, regardless of whether the trading vehicle is wholly owned or partially-owned. The types of information that advisers will be required to report include how the reporting fund uses the trading vehicle, position sizes, and counterparty exposures of the reporting fund that are attributable to the trading vehicle. The Form PF General Instructions were also amended to explain how advisers will report information if the reporting fund uses a trading vehicle – specifically, if the adviser uses a trading vehicle, it will be required to be identified in Section 1b and report answers for it and the fund on an aggregated basis.16

While reporting will be done on an aggregated basis, the Form PF Amendments add specific questions to Form PF that are designed to assist the SEC in understanding the use of such trading vehicles and identify risk exposures. This approach, the Adopting Release stated, will help differentiate this level of reporting from that of the reporting fund and emphasized the importance of this information to provide more complete and accurate visibility into asset class exposures, position sizes, counterparty exposures relied on by trading vehicles, and systemic risk monitoring generally.

4. Report Timing: To harmonize reporting information, large hedge fund advisers and large liquidity fund advisers will be required to update Form PF within a certain number of days after the end of each calendar quarter, rather than each fiscal quarter. All other advisers will continue to make annual filings within the prescribed timeframe following the end of their fiscal year. Additionally, all advisers will use fiscal quarters and years, when relevant, to determine whether they are meeting filings thresholds.17

The SEC cited disparities in the timing of reporting across this category of advisers and the potential delays in seeing comprehensive data across similarly situated funds. Analyzing Form ADV data as of December 2022, the SEC noted that 0.4 percent of large hedge fund advisers and large liquidity fund advisers do not file on a calendar quarter basis, equating to about 224 private funds. Based on the SEC's own data, only a de minimis segment of advisers will be impacted by this change. Nonetheless, the SEC noted that discrepancies in reporting time creates gaps in completeness of information they receive at a particular time, thus degrading their data analysis and comparison capabilities. In its first reference to the CFTC in the Adopting Release, the SEC also noted that calendar reporting aligns with the CFTC's CPO-PQR reporting, allowing easier integration of data sets.

The Form PF Amendments do not impact private equity fund advisers who will continue to file any required quarterly private equity Section 6 event-based reports (adviser-led secondaries, removal of adviser as GP, etc.) on a fiscal quarter basis.

Amendments to Section 1

Advisers required to file Form PF must complete some or all of Section 1 with respect to the private funds it advises. Section 1 of Form PF includes certain identifying and demographic information. The Adopting Release states that the amendments to Section 1 are designed to (i) provide greater insight into private funds' operations and strategies, (ii) assist in identifying trends, (iii) improve comparability across advisers, (iv) improve data quality, and (v) reduce reporting errors. A number of amendments have been made to Section 1, and we have highlighted the notable amendments below:

- Withdrawal or Redemption Rights (Section 1b)

Currently, Form PF requires that only large hedge fund advisers report whether their qualifying hedge fund(s) provide investors with withdrawal or redemption rights "in the ordinary course."18 The Form PF Amendments require all advisers to respond to Question 10(a) or 10(b), which require the adviser to disclose whether the reporting fund is an "open-end private fund" in Question 10(a) or a "closed-end private fund" in Question 10(b). The SEC adopted newly defined terms for "open-end private fund" and "closed-end private fund" related to Question 10.19

If the reporting fund is an open-end private fund, the adviser will be required to disclose (i) how often withdrawals or redemptions are permitted by selecting a response from a list of categories (in Question 10(c)) and (ii) what percentage of the reporting fund's net asset value may be, or is, subject to a suspension of, or material restrictions on, investor withdrawals/redemptions by an adviser or fund-governing body pursuant to Question 10(d).

Advisers that disclose in Question 10 that the reporting fund is neither an open-end private fund nor a closed-end private fund are required to provide a "detailed explanation" in their response to Question 4. These amendments are intended to improve data quality by more precisely classifying how an adviser should report on funds that offer limited withdrawal or redemption rights. The SEC notes, in a carryover from the May 2023 amendments to Form PF, that information on redemption rights will allow for SEC and FSOC to analyze stress or potential strategies that may be exacerbated by or result in fund failure based on investor redemptions.

2. Gross Asset Value and Net Asset Value (Section 1b)

Large hedge fund advisers and large liquidity fund advisers will be required to report their monthly net asset value and gross asset value. However, to address comments regarding the potential burden of monthly gross and net asset value calculations, advisers may use the reporting fund aggregate calculated value ("RFACV") and newly defined gross reporting fund aggregate calculated value ("GRFACV"), or the newly defined "gross reporting fund aggregate calculated value" ("GRFACV"), if the adviser does not calculate GAV or NAV on a monthly basis. This additional information will be reported as of the end of each month of the reporting period in the quarterly filings, rather than only reporting the information as of the end of the reporting period, as Form PF currently requires.20

Advisers should note the carryover of the RFACV framework from the May 2023 event-based reporting amendments. Importantly, GRFACV (and RFACV) may be calculated using the adviser's or its service provider's methodologies, provided they are consistent with information reported internally. Advisers will need to indicate the methodology used to report in Questions 11 and 12.

The Form PF Amendments added new Question 13, which requires advisers to separately report the value of unfunded commitments included in the net and gross asset values reported in Questions 11 and 12. The asset value calculations in Questions 11 and 12 should include unfunded commitments, so that Form PF data is comparable to Form ADV data.

3. Inflows and Outflows (Section 1b)

Currently, large hedge fund advisers only report changes in inflows or outflows on an annual basis, which, the Adopting Release notes, causes this data to be stale and less effective than more frequently reported data for monitoring systemic risk. The SEC also stated that they're currently unable to differentiate between changes in value resulting from performance and changes in value resulting from inflows and outflows.

In response, the newly added Question 14 now requires large hedge fund advisers and large liquidity fund advisers to report information concerning the reporting fund's inflow and outflow activity, including contributions to the reporting fund, as well as withdrawals and redemptions, or other distributions of any kind to investors for each month of the reporting period. Advisers must include all new contributions from investors and exclude contributions of committed capital that they have already included in gross asset value calculated in accordance with Form ADV instructions. Here again, these amendments entail the SEC obtaining additional data throughout the reporting period by requiring this monthly data.

4. Fund Performance (Section 1b)

The Form PF Amendments redesignate current Question 17 as new Question 23, which requires all advisers to provide gross and net fund performance "as reported to current and prospective investors, counterparties, or otherwise" for specified fiscal periods using the table provided in Form PF. Advisers must report performance as a money-weighted internal rate of return (instead of a time-weighted return), if the reporting fund's performance is reported to investors, counterparties or otherwise as an internal rate of return since inception. Whether the adviser uses a time-weighted or money-weighted rate of return, the methodology used should be consistent over time.

If the adviser does not provide net performance or gross performance information to investors, counterparties, or otherwise, then they will be required to provide the most representative set of performance information (if the adviser reports different fund performance results to different groups), with an explanation of its selection to be provided in Question 4.

The SEC acknowledged the potential inconsistencies between this new requirement for reporting fund performance on Form PF and certain other performance reporting rules. First, the SEC noted that quarterly performance reporting is required under the Private Fund Adviser Rule ("PFAR"), but did not address how PFAR reporting should or would be reflected in Form PF. For example, it is conceivable that an adviser's quarterly performance reporting pursuant to PFAR could use an alternate methodology from that of Form PF. The SEC also acknowledged that calculations of net and gross performance for Form PF may treat fees and expenses differently than the calculation of net and gross performance under the Marketing Rule, but notes that different audiences are receiving this reporting.

5. Investment Strategies (Section 1c)

The Form PF Amendments to the investment strategies disclosed in Section 1c require the disclosure of more granular strategies for both equity and credit (e.g., private credit and associated sub-strategies, such as direct lending) to both account for the SEC's evolved understanding of hedge fund strategies and to improve data quality and comparability.

The adviser must choose the investment strategies that best describe the reporting fund's investment strategies, as of the last day of the reporting period, to account for intra-quarter changes to strategy. If the adviser selects "other" they'll need to describe their strategy and why none of the available categories are sufficient.21 The strategy disclosed in Section 1c should be consistent from one reporting period to the next.

Notably, the SEC included both "digital assets" and "litigation finance" as reportable investment strategies in Section 1c, serving as an acknowledgment by the SEC that investment strategies are not static and that they may evolve based on technological changes and industry trends. With respect to "digital assets," the SEC stopped short of defining the term for Form PF reporting purposes, but did acknowledge the prevalence of funds employing such strategies and its status as an asset class. With regard to the addition of "litigation finance" as a reportable investment strategy, the SEC noted that its addition to Section 1c, as well as other more granular categories for credit strategies, are meant to allow the SEC and FSOC to "conduct more targeted analysis and improve comparability among advisers and hedge funds, which the [SEC] and FSOC can use to identify and address systemic risk and investor protection issues in times of stress more accurately."22

6. Counterparty Exposure (Section 1c)

Counterparty exposures is one of the key areas of focus for the SEC and FSOC for purposes of systemic risk monitoring. These Form PF Amendments are fairly extensive and include a new Question 26, which requires advisers (other than qualifying hedge funds) to complete a consolidated counterparty exposure table regarding exposures the adviser has to creditors/counterparties, and the exposures that creditors/counterparties have to the adviser.

Advisers will be required to report the dollar value of borrowing and collateral received and lending and posted collateral. The Form PF Amendments introduce newly defined terms, "borrowing and collateral received (B/CR)" and "lending and posted collateral (L/PC)", with the SEC stating that these definitions are based on their understanding of borrowing and lending and helps ensure data quality and comparability. Current Questions 22 and 23 have been redesignated as Questions 27 and 28, and now provide more detailed instructions for advisers to use when identifying the individual counterparties, as well as the entity that has the reported exposure. Question 27 requires advisers to identify each creditor or other counterparty (including central clearing counterparties) that owes an amount (before posted collateral) equal to or greater than either (1) five percent of NAV as of the data reporting date or (2) $1 billion. Question 28 requires advisers to provide information for counterparties where the fund has net mark-to-market counterparty credit exposure which is equal to or greater than either (1) five percent of NAV or (2) $1 billion, after taking into account collateral received or posted by the reporting fund.

Qualifying hedge funds will complete similar counterparty exposure questions in Section 2. Together, the questions in Section 1c and similar questions at Section 2 will allow the SEC and FSOC to consolidate information relating to hedge funds' and qualifying hedge funds' arrangements with creditors and other counterparties.

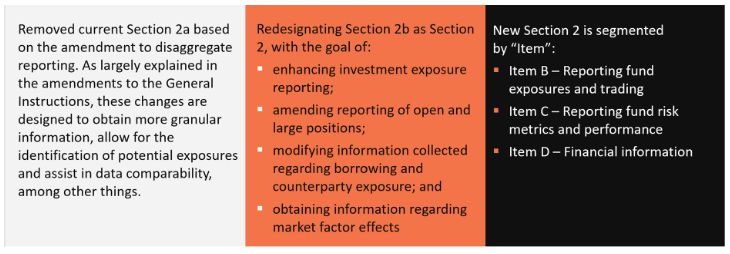

Amendments to Section 2

The SEC rearchitected Section 2, which applies to large hedge fund advisers, as indicated in the chart below:

The additional information large hedge fund advisers will be required to disclose in amended Section 2 is intended to, among other things, provide further insight into the operations and strategies of qualifying hedge funds and their advisers. Below are some of the notable amendments captured in Section 2:

- Separate Reporting for Positions Held Physically, Synthetically or Through Derivatives & Indirect Exposure

The Form PF's current instructions (and the associated definitions) require advisers to combine exposures held physically, synthetically, or through derivatives when reporting certain fixed income and other sub-asset classes. The current Form PF reporting requirements, which allow advisers to aggregate their physical and synthetically held positions, as well as long and short exposures, obscures the SEC's understanding of the fund's overall exposure because of the risk differences between such holdings, which reduces the SEC's and FSOC's ability to effectively assess systemic risk.

Advisers will now be required to report the dollar value of a qualifying hedge fund's long and short positions in certain sub-asset classes by "instrument type" for each month of the reporting period. These amendments introduce more granular information as advisers will separately report long and short positions in these sub-asset classes held physically, synthetically or through derivatives, and indirectly through certain entities.

2. Adjusted Exposure Reporting

Currently, advisers report "gross" long and short exposure (i.e., the dollar value of a qualifying hedge fund's long positions and short positions for various sub-asset classes). While retaining this reporting, the amendments require advisers to also report the "adjusted" exposure of long and short positions for each sub-asset class in which a fund has a reportable position. The inclusion of adjusted exposure reporting is intended to provide an additional datapoint and view into underlying risk exposures, the SEC noting that gross exposure could lead to potential false indicators of long/short exposure not representative of the actual economic exposure and market risk of a reporting fund's portfolio.

3. Open and Large Positions

Open and large positions were called out by Chair Gensler in his statement on the adoption of the Form PF Amendments, noting that "the final rules will expand reporting requirements about a large hedge fund's open positions and certain large positions. These requirements will provide insight into the extent of a fund's portfolio concentration and large exposures to any specific assets. Such concentration or exposure may increase the risk of amplified losses for investors. Gathering additional data on concentration and exposure will help to protect investors and assess systemic risk."

Advisers to qualifying hedge funds will be required to report their top five long and short netted positions and the top ten netted long and short positions. Additionally, advisers will provide more information regarding the total number of reference assets for the fund's long and short netted exposure, and relative percentages of NAV based on these long and short netted exposures.

Advisers will also be required to provide certain information on a fund's reference asset to which the fund has gross exposure equal to or exceeding certain thresholds (e.g., 1 percent of NAV). These amendments are intended to provide a more holistic view of the reporting fund's portfolio concentration.

4. Counterparty Exposure and Significant Counterparty Reporting

The Form PF Amendments will require qualifying hedge funds to report counterparty exposures using a new consolidated counterparty exposure table (similar to the new consolidated counterparty exposure table adopted in Section 1c), which will capture all cash, securities, and synthetic long and short positions by a reporting fund, a fund's credit exposure to counterparties, and amounts of collateral posted and received.

This consolidated counterparty exposure table replaces the information currently required by Questions 43, 44, 45, and 47 of the current Form PF, and requires, among other things, that advisers report the qualifying hedge fund's borrowings and other transactions with creditors and other counterparties by type of borrowing or transaction (e.g., unsecured, secured borrowing and lending under a prime brokerage agreement, etc.) and the collateral posted or received by a reporting fund in connection with each type of borrowing or other transaction.

The new consolidated counterparty exposure table is designed to capture information on all non-portfolio credit exposure that a qualifying hedge fund has to its counterparties (including CCPs) and the exposure that creditors and other counterparties have to the fund.

For each qualifying hedge fund, advisers will also be required to identify all creditors and counterparties (including CCPs) where the amount a fund has borrowed (including any synthetic long positions) before posted collateral is equal to or greater than certain thresholds. For the top five creditors and other counterparties from which the fund has borrowed the most, advisers will be required to identify the counterparty (by name, LEI, and financial institutional affiliation) and provide information detailing a fund's transactions and the associated collateral.

Questions 42 and Question 43 will require the disclosure of information about a reporting fund's key individual counterparties (including CCPs) to which the fund has net mark-to-market counterparty credit exposure, as well as counterparties to which the reporting fund has net mark-to-market exposure above certain thresholds.

5. Additional Exposure Reporting

- Currency Exposure Reporting – The Form PF Amendments create new Question 33, requiring large hedge fund advisers to disclose (1) the net long value and short value of a fund's currency exposure arising from FX derivatives and all other assets and liabilities and (2) each currency to which the fund has long or short dollar value exposure equal to or exceeding certain thresholds.

- Turnover – The Form PF Amendments will require disclosure on a per-fund basis of the value of turnover in certain asset classes (rather than on an aggregate basis as currently required). The amendments include new categories for turnover reporting that disaggregate combined categories and better capture turnover of potentially relevant securities (such as various types of derivatives).

- Country and Industry Exposure – The Form PF Amendments will require advisers to provide information about each country or industry to which a reporting fund has exposure equal to or exceeding certain thresholds.

Effective and Compliance Dates

The effective date and compliance date of the Form PF Amendments is March 12, 2025. The SEC noted that the one-year implementation timeline would "provide time for advisers to prepare to comply with the amendments, including reviewing the requirements, building the appropriate internal reporting and tracking systems, and collecting the required information, as well as to simplify the compliance process and reduce potential confusion . . ."23

While advisers may well be fatigued by the abbreviated six-month timeline to implement the Form PF event-based reporting amendments, advisers should consider discussing implementation plans, including creating internal working groups across the various departments/functions (e.g., legal, compliance, operations, finance, etc.), as well as early outreach and coordination with service providers.

Given the SEC's prodigious rulemaking and other rule implementations to balance, private fund advisers should not view the one-year timeframe as a means to delay, as these amendments will result in a marked change from current Form PF reporting requirements.

Footnotes

1 Form PF; Reporting Requirements for All Filers and Large Hedge Fund Advisers, 89 FR 17984 (March 12, 2024).

2 See Securities and Exchange Commission, Final Rules, Form PF; Reporting Requirements for All Filers and Large Hedge Fund Advisers, Release No. IA-6546; (Feb. 8, 2024) (hereinafter, Final Rules).

3 See Form PF; Event Reporting for Large Hedge Fund Advisers and Private Equity Fund Advisers; Requirements for Large Private Equity Fund Adviser Reporting, Release No. IA-6297; (May 3, 2023); Schulte Roth & Zabel, Alert: SEC Form PF Reporting Changes Effective Dec. 11, 2023, and June 11, 2024 (June 21, 2023), available here.

4 See Final Rules at 12.

5 See id.

6 See id.

7 See id. at 13.

8 The current definition of "cash and cash equivalents includes "government securities" and Form PF defines "government securities" as (1) U.S. Treasury securities, (2) agency securities, and (3) any certificate of deposit for any of the foregoing. The Form PF Amendments revise the definition of "cash and cash equivalents" by removing "government securities" from the definition of "cash and cash equivalents." The Form PF Amendments present "government securities" as its own line item in the Form PF Glossary of Terms. Further, the SEC adopted an amendment that directs advisers to exclude digital assets when reporting "cash and cash equivalents."

9 In the case of a disregarded feeder fund in Question 6 of amended Form PF, advisers instead will identify the disregarded feeder fund and look through to any disregarded feeder fund's investors in responding to certain questions regarding fund investors on behalf of the applicable master fund.

10 See Final Rules at 13.

11 See Instruction 6 of the amended Form PF General Instructions.

12 See Final Rules at 19-20.

13 See id. at 20.

14 See id. at 24.

15 See id. at 24-25.

16 See id. at 26-27 (Specifically, the Form PF Amendments revise Instruction 7 and 8 to require advisers to include information pertaining to their trading vehicles when completing Form PF.)

17 See id. at 31.

18 See Form PF; Event Reporting for Large Hedge Fund Advisers and Private Equity Fund Advisers; Requirements for Large Private Equity Fund Adviser Reporting, Release IA-6297; (May 3, 2023), at Section 2b, Question 49.

19 See Final Rules at 69; 83.

20 See id. at 51-52.

21 The SEC cited that the amount of hedge fund exposure that advisers attribute to the "other" category has grown by 30 percent from the second quarter 2021 through the first quarter 2023, according to analysis of Private Fund Statistics. This increase has degraded the SEC's data analysis capabilities

22 See Final Rules at 76-77.

23 See Final Rules at 170.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.