On Aug. 23, 2023, the U.S. Securities and Exchange Commission (SEC), in a 3-2 vote, adopted new rules under the Investment Advisers Act of 1940 (Advisers Act) that will have a sweeping impact on investment advisers of private funds. This alert summarizes the adopted rules and highlights some key observations and issues for investment advisers to consider.

Key observations

- The SEC dropped the proposed general prohibition on hedge clauses (i.e., waiver or indemnification provisions) but clarified that an adviser seeking reimbursement, indemnification or exculpation for breaching its federal fiduciary duty would violate the antifraud provisions of the Advisers Act.

- The SEC also dropped the proposed prohibition on charging a portfolio investment for certain fees and will permit other activity that was proposed to be prohibited subject to certain disclosure or consent.

- The SEC added an exception to the definition of "private fund" for "securitized asset funds," which generally include collateralized loan obligations (CLOs). Thus, advisers do not have to comply with the quarterly statement, audit, preferential treatment and restricted activity rules (as described below) with respect to securitized asset funds.

- On Sept. 1, 2023, industry trade groups filed a challenge to the rules in the United States Court of Appeals for the Fifth Circuit.

Registered Private Fund Advisers

Quarterly Statements Rule

New Rule 211(h)(1)-2 under the Advisers Act (Quarterly Statements Rule) requires an investment adviser that is registered or required to be registered with the SEC to prepare a quarterly statement for any private fund (other than a securitized asset fund) that it advises, directly or indirectly, that has at least two full fiscal quarters of operating results. The Quarterly Statements Rule requires registered private fund advisers to distribute a quarterly statement to private fund investors that discloses fund-level information regarding performance, the cost of investing in the private fund, and fees and expenses paid by the private fund, as well as certain compensation and other amounts paid to the adviser.

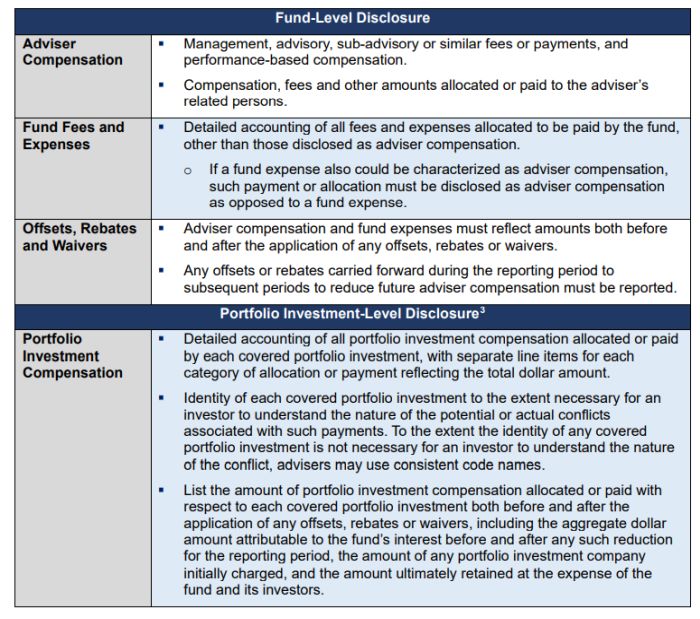

Fee and Expense Disclosure – The following table summarizes the fund-level and portfolio investment-level fee and expense reporting requirements.

Performance Disclosure – The Quarterly Statements Rule requires advisers to include standardized fund performance information in each quarterly statement provided to fund investors, which differs based on whether the disclosure relates to a "liquid" or "illiquid" private fund.4

Liquid fund advisers must disclose the following performance measures in the quarterly statement:

- Annual net total returns since inception or for each fiscal year over the 10 years prior to the quarterly statement, whichever is shorter.

- Each liquid fund's average annual net total returns over the one-, five- and 10-year periods.

- The liquid fund's cumulative net total return for the current fiscal year as of the end of the most recent fiscal quarter covered by the quarterly statement.

Illiquid fund advisers must disclose the following performance measures in the quarterly statement, shown since the inception of the illiquid fund and computed with and without the impact of any fund-level subscription facilities:

- Gross internal rate of return and gross multiple of invested capital for the illiquid fund.

- Net internal rate of return and net multiple of invested capital for the illiquid fund.

- Gross internal rate of return and gross multiple of invested capital for the realized and unrealized portions of the illiquid fund's portfolio, with the realized and unrealized performance shown separately.

Illiquid fund advisers must also provide investors with a statement of contributions and distributions for the fund, reflecting the aggregate cash inflows from investors and the aggregate cash outflows from the fund to investors, along with the fund's net asset value. Further, the Quarterly Statements Rule requires illiquid fund advisers to display the different categories of required performance information with equal prominence.

Preparation and Distribution of Quarterly Statements – The Quarterly Statements Rule requires statements to be distributed to investors within the following timelines:

- For funds that are not fund of funds, quarterly statements must be distributed within 45 days after the end of each of the first three quarters of each fiscal year and within 90 days after the end of the fiscal year.

- For funds that are fund of funds, quarterly statements must be distributed within 75 days after the end of the first three quarters and within 120 days after the end of the fiscal year.

- Newly formed funds are required to prepare and distribute a quarterly statement beginning after the fund's second full quarter of generating operating results.

Audit Rule

New Rule 206(4)-10 under the Advisers Act (Audit Rule) requires a registered investment adviser providing investment advice, directly or indirectly, to a private fund to cause that fund to undergo a financial statement audit that meets various requirements set forth in Rule 206(4)- 2 (i.e., the Custody Rule). As a result, each of the following is required under the Audit Rule:

- The audit must be performed by an independent public accountant that meets the standards of independence set out in Regulation S-X and is registered with, and subject to regular inspection as of the commencement of the professional engagement period as of each calendar year-end, by the Public Company Accounting Oversight Board in accordance with its rules.

- The audit must meet the definition of audit in Regulation S-X.

- Audited financial statements must be prepared in accordance with generally accepted accounting principles.

- Annually, within 120 days of the fund's fiscal year-end and promptly upon liquidation, the fund's audited financial statements (consisting of the applicable financial statements, related schedules and accompanying footnotes and the audit report) are to be delivered to investors in the fund.

Adviser-Led Secondaries Rule

New Rule 211(h)(2)-2 under the Advisers Act (Adviser-Led Secondaries Rule) requires SEC registered advisers to satisfy certain requirements if they initiate a transaction that offers the fund's investors the choice between selling all or a portion of their interests in the fund and converting or exchanging all or a portion of their interests in the fund for interests in another vehicle advised by the adviser or any of its related persons (i.e., an adviser-led secondary transaction). To complete an adviser-led secondary transaction, advisers must either obtain a written opinion stating that the price being offered to the fund for any assets being sold as part of an adviser-led secondary transaction is fair (Fairness Opinion), or obtain a written opinion stating the value (as a single amount or a range) of any assets being sold (Valuation Opinion).

Each Fairness Opinion and Valuation Opinion must be provided by an independent opinion adviser – a person who provides fairness opinions or valuation opinions in the ordinary course of its business and is not a related person of the adviser. 5

All Private Fund Advisers

Restricted Activities Rule

New Rule 211(h)(2)-1 under the Advisers Act (Restricted Activities Rule) restricts all advisers to a private fund, regardless of their SEC registration status, from engaging in certain activities. The following chart describes those restrictions and any applicable exceptions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.