We are pleased to present our year-end update on financial reporting and issuer disclosure enforcement activity. This White Paper primarily focuses on the U.S. Securities and Exchange Commission's ("SEC") enforcement activity through the end of 2021 and discusses recent trends in SEC enforcement activity, as set out in the SEC Enforcement Division's Results for FY 2021.

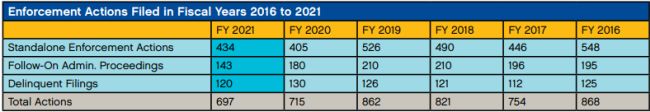

While the total number of enforcement actions brought by the SEC's Enforcement Division was the lowest it has been within the past five fiscal years,1 and its 434 stand-alone enforcement actions initiated by Enforcement were lower in sum than the total number of such actions in any of FY 2016-FY 2020,2 nothing can be read into these numbers, as the new chairman was not on board until April 2021, and the new director of Enforcement arrived at the end of July, two months before the end of the fiscal year.

Far more telling of the direction of the Enforcement program are the pronouncements of the new chairman and director in speeches and testimony before Congress, and the Enforcement Division's Annual Report. In that report, the Enforcement Division articulated "Financial Fraud and Issuer Disclosure" as an ongoing priority, and we do not anticipate that the decrease in enforcement activity (both total and in the areas of general financial reporting and disclosure) in FY 2021 signals otherwise. Also of note, in all these pronouncements, the emphasis on conduct by individuals, and especially gatekeepers-which includes lawyers, auditors, and boards of directors-has been highlighted. Sanctions likely will be used to highlight the commission's focus on this conduct.

In the areas of financial reporting and disclosure, the SEC filed a total 70 enforcement actions that it primarily classified as "Issuer Reporting/Audit and Accounting," representing roughly 10% of enforcement activity for FY 2021.3 This marks a roughly five percentage point decrease from FY 2020, in which Issuer Reporting/Audit and Accounting cases constituted 15% of enforcement activity.4 Again, these numbers should not be read as directional.

Also as noted in its Enforcement Results Press Release for FY 2021, the Enforcement Division dedicated its resources and attention to several noteworthy initiatives and groundbreaking matters that the SEC described as "first-of-their-kind."5 For example, the SEC touted its achievements in bringing enforcement actions in cases involving DeFi technology and "against emerging threats in the crypto and SPAC spaces."6

The balance of this White Paper recaps several notable enforcement actions in the areas of financial reporting and public disclosure since the end of summer 2021.

FINANCIAL REPORTING CASES

On August 24, 2021, the SEC announced settled proceedings against a hospital service provider, its CFO, and its controller for accounting and disclosure violations that resulted in the company's reporting of inflated earnings per share. Specifically, the company did not report probable or reasonably estimable losses related to lawsuits, even when the company intended to settle the cases and had made estimates of the potential settlement costs. According to the SEC, the company's accountants erroneously determined that these loss contingencies did not have to be reported until the settlements were approved by a judge. Had the company reported accurately, it allegedly would have missed estimates and reported negative earnings per share. The SEC thus alleged that the company violated Sections 17(a)(2) and 17(a)(3) of the Securities Act of 1933 ("Securities Act") and Sections 13(a), 13(a)(b)(2)(A), and 13(b)(2)(B) of the Securities Exchange Act of 1934 ("Exchange Act"); the former CFO violated Sections 17(a) (2) and (17)(a)(3) of the Securities Act and Exchange Act Rule 13b2-1 and caused the company's aforementioned alleged violations; and the Controller caused the company's aforementioned violations of the Exchange Act. Without admitting or denying fault, the company agreed to cease and desist from further violations and to pay $6 million in civil penalties. The company's CFO agreed to a ban prohibiting him from practicing and appearing before the SEC as an accountant for two years, and to pay $50,000 in civil penalties. The company's controller agreed to cease and desist from further violations and to pay $10,000 in civil penalties.7 This action was the third action resulting from the Enforcement Division's ongoing Earnings Per Share Initiative, which uses risk-based data analytics to uncover alleged accounting and disclosure violations.

On August 25, 2021, the SEC initiated proceedings against the former CEO of a technology company, alleging that he made false statements with respect to the company's growth in terms of customer acquisition and financial performance. According to the SEC, the former CEO engaged in a fraudulent scheme by which he more than tripled the company's valuation by doctoring the company's financials and sales metrics. Specifically, the former CEO prematurely recognized revenue from contemplated customer deals before they were executed and by falsifying or fabricating supporting invoices. The SEC thus alleged that the former CEO violated Section 17(a) of the Securities Act and Section 10(b) of the Exchange Act and Rule 10b-5 thereunder. The SEC is seeking injunctive relief, a civil penalty, and an officer-and-director bar against the former CEO. Additionally, the U.S. Attorney's Office for the Northern District of California has announced parallel criminal charges against the former CEO.8

On September 2, 2021, the SEC announced settled proceedings against a telecommunications company arising from alleged accounting and disclosure fraud that materially overstated revenues over a two-year period. Specifically, the SEC alleged the company and its executives ordered recognition of revenue based on nonbinding purchase orders prior to product shipment, in violation of GAAP. According to the SEC, the company should have met all of its performance obligations under each purchase order before recognizing revenue, and the company had inadequate internal accounting controls to determine whether the obligations had been met. The SEC further alleged that former company executives knowingly or recklessly authorized or accepted decisions to improperly recognize revenue and directed employees to encourage customers to sign audit confirmations through false statements about the confirmations' purposes. Finally, the SEC alleged the company allegedly improperly recognized millions in revenue from an unsigned, mid-negotiation purchase order. Thus, the SEC alleged that the company violated Section 17(a) of the Securities Act, Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, as well as various reporting, books and records, and internal accounting control provisions of the Exchange Act and rules thereunder. To settle the charges, the company agreed to cease and desist from further violations of the charged provisions and to pay a $500,000 penalty. The SEC's order specifically acknowledged the company's cooperation in the investigation and the remedial measures it took in response, including restatement of its financial results for 2018 and the first half of 2019.9

On September 3, 2021, the SEC announced settled proceedings against a food and beverage manufacturing company for engaging in an expense management scheme that resulted in the restatement of several years of financial reporting, as well as the company's former COO and CPO for misconduct related to the accounting scheme. Specifically, the SEC alleged that the company negotiated and maintained false and misleading supplier contracts in order to prematurely recognize cost savings. In sum, the company allegedly recognized unearned discounts from suppliers and then touted this practice to investors as "cost savings." The SEC further alleged that the company's former COO and CPO received warning signs of the company's misconduct. Rather than addressing these signs, the COO allegedly pressured procurement to deliver unrealistic savings targets and improperly approved financial statements. Moreover, the CPO allegedly approved several improper supplier contracts and certified financial statements when the misconduct allegedly occurred. According to the SEC, the company's procurement division lacked adequate internal controls, and the former COO should have known that his failure to properly address warning signs caused the company's internal accounting control failures.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.