Annual Update of Form ADV

The Securities and Exchange Commission (the "SEC") requires SEC-registered investment advisers and Exempt Reporting Advisers1 to annually update the information on their Form ADVs. Form ADV is filed electronically on the Investment Adviser Registration Depository ("IARD") system. As in past years, the annual update filing must be made within 90 days of an adviser's fiscal year-end and should update responses to all items answered on Form ADV ("Annual Updating Amendment").2

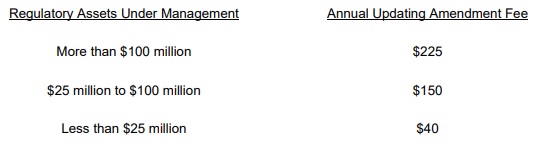

SEC-registered investment advisers pay a fee determined by the amount of the particular adviser's regulatory assets under management3 for filing Annual Updating Amendments.

Exempt Reporting Advisers will pay $150 for filing Annual Updating Amendments. Advisers that register as advisers or file as Exempt Reporting Advisers with one or more states and not with the SEC will not be charged a processing fee this year to file an Annual Updating Amendment.

Fees must be credited to the adviser firm's Flex-Funding Account on the IARD system before filings may be submitted.4 No fee is charged for filing an electronic amendment to Form ADV unless it is an Annual Updating Amendment.

Annual Confirmation of Investors' Status Under the "New Issue" Rules

Financial Industry Regulatory Authority, Inc. ("FINRA") Rule 5130 precludes broker-dealers from selling New Issue securities (generally equity IPO securities) to accounts the beneficial owners of which are Restricted Persons as defined in that Rule. In addition, FINRA Rule 5131 restricts broker-dealers from selling New Issues to accounts that are beneficially owned by persons that are executive officers or directors of public companies and certain covered nonpublic companies having specified relationships with the broker-dealer, and persons materially supported by such persons ("Covered Persons").5 Rule 5131 permits allocations of New Issues to an account in which the collective beneficial interests of Covered Persons associated with any one particular public company or covered nonpublic company represent 25% or less of the value of the account.

Because Rules 5130 and 5131 look to the beneficial owners of an account, managers of private investment funds that purchase New Issue securities for their funds are required to ask about the Restricted and Covered Person status of investors in their funds. 6

Rule 5130 requires that a manager annually reconfirm that an investor is not a Restricted Person and is thus able to participate in the profits and losses from New Issue securities.7 Rule 5131 requires a manager to check the status of its funds' investors as Covered Persons every twelve months, and if they are, with which public companies or covered nonpublic companies. Both Rules allow the annual confirmation of status to be in the form of a negative consent once an initial written confirmation has been obtained.

Thus, managers wishing to purchase New Issue securities should communicate with each of their investors sometime before the anniversary date of the responses received last year, advising them, based on the investor's answers from last year, whether the manager has treated the investor as a Covered Person and/or a Restricted Person and asking the investor to inform the manager of any changes in such investor's status. The manager may also state in the mailing that if it does not receive a reply by a certain date, it will assume that there has been no change in the investor's status.

Footnotes

1 Exempt Reporting Advisers ("ERAs"), (i) advisers managing only venture capital funds and (ii) advisers managing only private funds with less than $150 million in the aggregate of regulatory assets under management managed from a place of business in the United States, are exempt from registration under the Investment Advisers Act of 1940, but are required to file a notice or "report" with the SEC. The reports are made using Form ADV, but with only certain sections completed. ERAs are only required to complete Items 1, 2, 3, 6, 7, 10, and 11 of Part 1A of Form ADV and any corresponding schedules.

2 In addition to this requirement to update all responses on Form ADV once a year, the instructions for Form ADV require that registered advisers promptly report by amendment the addition or deletion of a Relying Adviser as part of an Umbrella Registration, and changes to Items 1 (except 1.O. and Section 1.F. of Schedule D), 3, 9 (except 9.A.(2), 9.B.(2), 9.E., and 9.F.), and 11 of Part 1A, Sections 1 or 3 of Schedule R, and, if applicable, Items 1, 2.A. through 2.F., and 2.I. of Part 1B, and material changes to Items 4, 8, and 10 of Part 1A, Section 10 of Schedule R and the Part 2A Brochure, and, if applicable, material changes to Item 2.G. of Part 1B. Part 3 of Form ADV (Form CRS relationship summary) which is required of SEC-registered advisers with retail investors, must be amended within 30 days whenever any information in it becomes materially inaccurate, by filing with the SEC an other-than-annual amendment and must include an exhibit highlighting the most recent changes. Advisers may include the form CRS relationship summary as part of an annual updating amendment. ERAs are also required to update all responses to the Items in Form ADV completed by ERAs in their Annual Updating Amendment. Additionally, any changes to Items 1 (except 1.O. and Section 1.F. of Schedule D), 3, and 11, and material changes to Item 10, must be amended promptly by ERAs.

3 As calculated for Item 5.F. of Form ADV.

4 Every adviser authorized to use the IARD system to make electronic filings of Form ADV has a financial account with the IARD. Firms may submit payments by check, wire transfer or electronic payment via Web CRD/IARD E-Bill. Instructions and relevant addresses are available here. Investment advisers registered with or applying for registration with the SEC will continue to be subject to any applicable state notice filing fees.

5 Please see our Firm's client memorandum, FINRA Anti-Spinning Rule's Impact on Private Funds, March 8, 2011, here.

6 Last year, effective January 1, 2020, FINRA amended Rules 5130 and 5131 to change which persons are considered Restricted or Covered Persons under the Rules. Please see our firm's client alert, SEC Approves Amendments to the FINRA New Issue Rules, November 25, 2019, here.

7 Some managers also annually ask investors classified as Restricted Persons if their status has changed

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.