On July 21, 2023, the United States Bureau of Ocean Energy Management (BOEM) issued a final sale notice (FSN) announcing the first-ever offshore wind lease sale in the Gulf of Mexico. BOEM set the auction date for August 29, 2023 and will be offering three leases totaling 301,746 acres on the outer continental shelf (OCS) in the Gulf of Mexico – one lease area (102,480 acres) off Lake Charles, Louisiana and two lease areas (102,480 and 96,786 acres) off Galveston, Texas. The lease areas combined have the potential to produce over 3.6GW of offshore wind energy and provide power for almost 1.3 million homes.

Lease Area Details

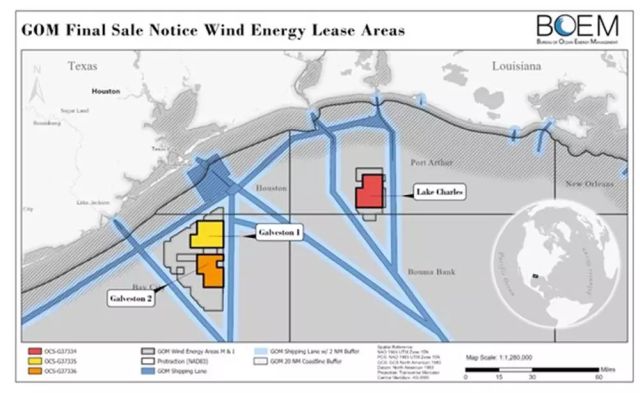

The three lease areas included in the FSN are the same size and orientation described in the Proposed Sale Notice and are depicted as follows:

Qualified Bidders

The FSN identifies 15 entities that are qualified to bid in the auction. The qualified bidders are:

- 547 Energy LLC

- Avangrid Renewables, LLC

- Coastal Offshore Renewable Energy LLC

- energyRe Offshore Wind Holdings, LLC

- Equinor Wind US LLC

- Gulf Coast Offshore Wind LLC

- Gulf Wind Offshore LLC

- Hanwha Offshore North America LLC

- Hanwha Q CELLS USA Corp.

- Hecate Energy LLC

- Invenergy GOM Offshore US Gulf, LLC

- RWE Offshore US Gulf, LLC

- Shell New Energies US LLC

- TotalEnergies Renewables USA, LLC

- US Mainstream Renewable Power, Inc.

Prior to the auction, each entity is required to submit a Bidder's Financial Form (BFF) that, among other things, lists eligible bidders with whom they are "affiliated," as such term is defined in the FSN. Affiliated entities cannot compete against each other in the auction.

Based on past BOEM auctions, it is likely that not all qualified bidders will participate in the Gulf of Mexico auction. For the New York Bight auction, 25 entities were qualified and only 14 ended up competing in the auction. For the North Carolina auction, 16 entities were qualified and only 5 ended up competing in the auction. For the California auction, 43 entities were qualified and only 7 ended up competing in the auction.

Multi-Factor Auction Format

Similar to the auctions held for lease areas off California and North Carolina, BOEM will use a multi-factor auction format that combines a monetary bid amount and a non-monetary factor. A bidder can receive a credit of 20 percent of its cash bid in exchange for financial commitments to support workforce training programs for the offshore wind industry, develop a domestic supply chain for the offshore wind industry, or a combination of both. A bidder can also receive 10 percent of its cash bid in exchange for financial commitments to establish and contribute to a fisheries compensatory mitigation fund or contribute to an existing fund to mitigate potential negative impacts to commercial and for-hire recreational fisheries caused by offshore wind development in the Gulf of Mexico. If a bidder qualifies for both bidding credits, the credits are additive for a total credit of 30 percent of the cash bid and would constitute 23.1 percent of the total bid price. Unlike past auctions, both bidding credits require a commitment to make qualifying monetary contributions in the same amount as the bidding credit received.

Each bidder is required to identify whether it is making the commitments to earn the bidding credits in the BFF, which is due on August 6, 2023. Each bidder is also required to submit a conceptual strategy that describes objective, quantifiable, and verifiable actions that will be taken to qualify for the credits, which is due with the BFF. BOEM will appoint a panel to review the conceptual strategies and determine eligibility for the bidding credits.

In addition to submitting the BFF, qualified bidders are required to submit a bid deposit of $2 million no later than August 13, 2023. If a bidder is unsuccessful in the auction, its bid deposit will be returned. If a bidder wins a lease in the auction, the bid deposit will be contributed towards its winning bid price.

Auction Mechanics

All three lease areas will be offered in a single online auction. For this auction, BOEM is only permitting bidders to bid on one of the offered lease areas at a time, and bidders may only win one of the lease areas.

The auction will proceed in a series of rounds with incremental price increases until no more than one active bidder remains for each of the three lease areas. The bid made by a bidder in each round will represent the sum of the monetary amount (cash) and the non-monetary factor (bidding credits). To continue to participate in the auction, a bidder must submit a bid for one of the lease areas in each round. A bidder may move between the three lease areas throughout the auction.

The first round will last 30 minutes, and subsequent rounds are expected to last approximately 10-20 minutes with a short 10-minute recess in between. BOEM anticipates that the auction will last one to two business days. BOEM has set a minimum bid of $50 per acre for each lease area, which is lower than the minimum bids set for the California and New York Bight auctions (i.e., $100 per acre). At the end of the auction, BOEM will announce the provisional winners of each of the three lease areas. BOEM is holding a mock auction for qualified bidders on August 28, 2023.

What to Expect After the Auction

After BOEM has announced the provisional winner of each of the three lease areas, the U.S. Department of Justice will have 30 days to conduct an antitrust review of the auction. If there are no issues identified, BOEM will send each provisional winner a copy of the lease and they will have 10 business days to post financial assurance, pay any outstanding balance of their winning cash bid, and sign and return the lease. Once BOEM receives the signed lease and verifies all other obligations have been fulfilled, it will execute the lease. The rent for the first year is due 45 calendar days after the lessee receives the lease copies for execution.

The leases to be awarded would have an operations term of 33 years and include a number of stipulations, including the following:

- provide semi-annual progress reporting;

- coordinate and provide regular communication with affected stakeholders;

- establish a statement of goals in relation contribution to the offshore wind industry supply chain and provide regular progress updates;

- make every reasonable effort to enter into Project Labor Agreements (PLAs) during the construction stage of the project;

- comply with environmental protocols associated with mitigation, monitoring and reporting conditions; and

- to the extent that it is technically and economically practical or feasible, consider the use of cable corridors, regional transmission systems, meshed systems, or other mechanisms for transmission facilities proposed in a construction and operations plan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.