The chances of success greatly improve when you start with a clear goal, set measurable standards, and execute on the plan. So it's fair to say New York City has taken a big step toward a more sustainable future by finally moving forward with commercial Property Assessed Clean Energy (C-PACE) financing for energy efficient improvements and renewable energy systems in existing buildings in New York City.

Below is what building owners need to know to be part of the solution and the magnitude of the opportunity for lenders.

The Goal

In 2019, New York City passed the Climate Mobilization Act (CMA) which, among other things, put into place greenhouse gas emission standards for residential and commercial properties. Now projects to achieve these goals can be financed using C-PACE. With the milestones under the CMA fast approaching, buildings must reduce their emissions (relative to 2005 emissions) 40% by 2030 and 80% by 2050. To make sure they can meet these goals, major environmental retrofits may be required and C-PACE financing makes that possible.

The Guidelines

The New York City Mayor's Office of Sustainability and the New York City Energy Efficiency Corporation (NYCEEC) have put out guidelines which detail the process from intake to application to approval for C-PACE.

Called the NYC Accelerator PACE Financing Program, it is administered by the NYCEEC and allows for funds to be borrowed for certain kinds of building improvements which will be repaid through a charge on the property's tax bill. If the PACE financing is not paid when due, a lien will be created that encumbers that property.

How to Execute

Here are some key issues to be aware of when considering using the NYC Accelerator PACE Financing Program:

- You must be a fee owner of the property with no civil penalties, taxes or debts owed to the city.

- You must use an approved, pre-qualified lender. There are currently 11 lenders available.

- The subject property must be an "Eligible Site" which means it must be an existing building located in the five boroughs (and it cannot be a 1-2 unit residential building).

- The C-PACE loan must fund "Energy Efficiency Improvements" which reduce energy consumption or "Renewable Energy Systems" which generate electric or thermal energy. These improvements must be backed by a recent energy audit or a recent feasibility study respectively under NYSERDA Guidance by NYSERDA approved entities.

- The project to be funded must have a Savings-to-Investment Ratio (SIR) of 1.0 or greater.

- The C-PACE loan term must be less than or equal to the weighted average useful life of the measures financed.

- There may be restrictions on the amount permitted to be borrowed.

- Fees for participating in the program may be capitalized into the loan.

The Challenges

A major consideration is that all holders of mortgages or deeds of trust on the subject property must provide consent to the C-PACE loan and the terms thereof. The reason for this is that, per the City Rules, the C-PACE lien will take "priority over all other liens and encumbrances on the subject property except for the lien of City Charges." City Charges are defined to include things like "taxes, assessments, sewer rents, sewer surcharges and water rents."

Because these loans have only just begun in New York City, we've yet to see how the lien priority enforcement may play out in practice should a C-PACE lender need to enforce a PACE lien through a tax sale (only available in New York City if there are also unpaid real property taxes) or need to foreclose on the loan through an Article 13 procedure.

While many mortgage holders see there is a value and benefit to these kinds of energy-efficient property improvements, there may be some who do not want to give up their lien position. Owners should be ready to reach out to their mortgage holders in anticipation of this priority requirement.

The Opportunity

As the lender is responsible for submitting the online application, owners should plan to work closely with the C-PACE lender on collecting relevant supporting materials needed.

We talked to Gunes Kulaligil co-founder of Methodical Management about the scale of the C-PACE needs and he pointed to the city's aging skyline to demonstrate the magnitude of the opportunity.

"NYC real estate is old, with an average age of over 70 years. Almost half of these building were built pre-WWII, some dating to 1800s — before central air conditioning was invented or at least commonly used in residential or commercial buildings. A majority of these buildings still use oil burning furnaces for heat and hot water, accounting for over 40% of the city's carbon emissions, so retrofitting efficient heating elements would be a great starting point to achieve reduction goals, but HVAC upgrades are not cheap."

This is where C-PACE can come in.

"Add to that upgrades for lighting, insulation, roofing and plumbing fixture and your tab could run 10% of your property value — all of which could potentially be financed via C-PACE," Kulaligil said.

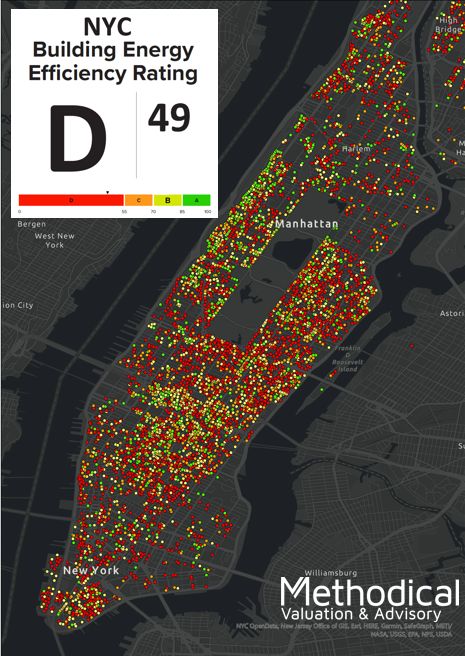

From his research, there are over 24,000 "Covered Buildings" in NYC, (i.e., large buildings that are required to report an Energy Efficiency Report). And based on those who reported their energy efficiency to the city, there's a lot of work to be done. Based on this map of Manhattan alone, you can see the scale of the C and D rated buildings.

Looking Ahead

The origination opportunity should have lenders seeing a different kind of green. As Kulaligil calculated, "back of the envelope math puts the C-PACE origination opportunity north of $100 billion: Let's say A or B rated buildings are fine and no improvements required. That still leaves us with about 1.5 billion square footage in buildings rated C, D or F. Using a ballpark figure of $1,000/sqf — property value for these buildings is $1.5 trillion. Assuming 10% assessment, origination opportunity is $150 billion."

Fines for failing to meet the CMA emission thresholds start to apply in 2024, so time is of the essence to achieve these goals and finance the projects necessary to reach them.

Nicole Serratore, an attorney in the Insolvency + Finance group, contributed to this post.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.