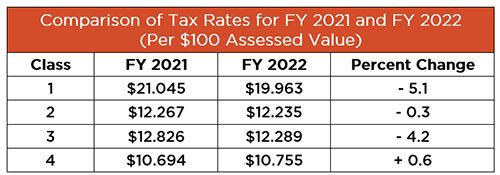

On June 30, the New York City Council and the Mayor's Office enacted the New York City 2021/22 property tax rates. There was a net decrease year-over-year on residential tax classes 1 and 2. Utility tax class 3 also saw a sharp decline while class 4 commercial properties modestly rose. Please refer to the chart below.

Tax payments for the first quarter or half (depending upon property type), were due on July 1, 2021. Tax bills were preprinted utilizing the 2020/21 tax rate. There will be an adjustment for the tax rate on bills generated later in the year to account for the tax rate change.

The announced 2021/22 tax rates do come somewhat as a surprise as many industry professionals were projecting an increase as a countermeasure to the large net decrease in property tax assessments. Tax assessments for 2021/22 declined by their largest margin in over twenty-five years due to the impacts of COVID-19 (i.e. loss of income). There was an overall market value decline of 5.2%.

You may review the assessed value of your property or pay your tax bill online at Property Taxes (nyc.gov) .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.