One of the areas where Cadwalader has seen a significant pickup in activity levels in 2013 and early 2014 is royalty and patent stream monetizations. In 2013, we helped clients complete 10 royalty and patent monetization deals in the pharmaceutical and technology spaces. The most important motivators for clients entering into these deals include:

- allowing sellers to monetize existing long-term revenue streams sitting on their balance sheets without raising on-balance sheet debt; and

- allowing buyers to gain exposure to otherwise unavailable asset classes.

These deals covered a wide variety of participants and structures—including one 144A offering, two §4(2) private placements, two acquisitions by royalty funds, and two strategic transactions—and allowed sellers to:

- look to their balance sheets for sources of financing, particularly when raising on-balance sheet debt or equity is less commercially or operationally appealing;

- move the underlying receivables off their balance sheets;

- reduce their exposure to counterparty credit risk; and

- establish a value for undervalued assets.

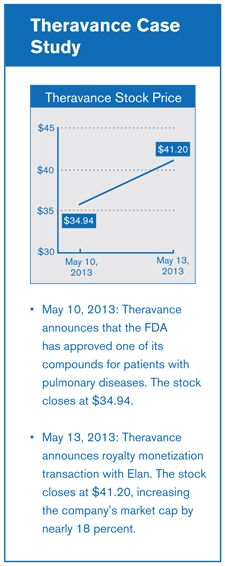

These deals are structured by isolating multi-year revenue streams (royalty payments, patent license payments, etc.) and selling them for one-time cash payments. Like traditional securitizations, they are implemented through bankruptcy-remote structures that reduce the risks for buyers and improve pricing for sellers. There are important distinctions between the servicing and management mechanics of the receivables of pharmaceutical royalties, which often relate to a handful of underlying molecule or compound patents, and technology royalties, which are more often related to portfolios comprising thousands of patents.

Based on current activity levels in this area, we expect to continue seeing strong activity for these types of deals through the remainder of 2014.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.