[This post is part of our Hydrogen Blog Series. Read the rest of the series here.]

The Department of Energy ("DOE") held a webinar on Friday, August 18, 2023 on the U.S. government's national hydrogen strategy. The main announcement was the formation of the Hydrogen Interagency Taskforce, or "HIT," but the webinar was otherwise light on details regarding the status of key federal hydrogen programs, such as the Inflation Reduction Act's ("IRA") hydrogen production tax credit, the Hydrogen Hubs program, and the demand-side hydrogen program DOE is currently developing. Here are a few takeaways.

The HIT will be directed by Sunita Satyapal (Director, Hydrogen and Fuel Cell Technologies Office, DOE) and will involve more than ten other federal agencies. (See hydrogen.gov, the HIT's new website, for the complete list.) The HIT will consist of three working groups, (1) Supply and Demand at Scale; (2) Infrastructure, Siting, and Permitting; and (3) Analysis and Global Competitiveness. Stay tuned for updates on ways stakeholders can get involved in the consideration of these important topics once the HIT's work gets underway.

Speakers from DOE and other federal agencies set out in clear terms the Administration's three-part strategy for clean hydrogen development: (1) deploying clean hydrogen projects; (2) reducing the costs associated with clean hydrogen; and (3) developing regional networks for hydrogen production, distribution, and use via the Hydrogen Hubs. This isn't news per se. But it is a helpful reminder regarding how the government is conceptualizing the major hurdles clean hydrogen faces. The two flagship programs meant to address those hurdles are the IRA tax credit, which is aimed at reducing costs, and the Hydrogen Hubs program, which will fund the development of regional networks of clean hydrogen producers, distributors, and end users. Both programs, as well as DOE's demand-side program, will contribute to the capstone of the three-part strategy—deployment.

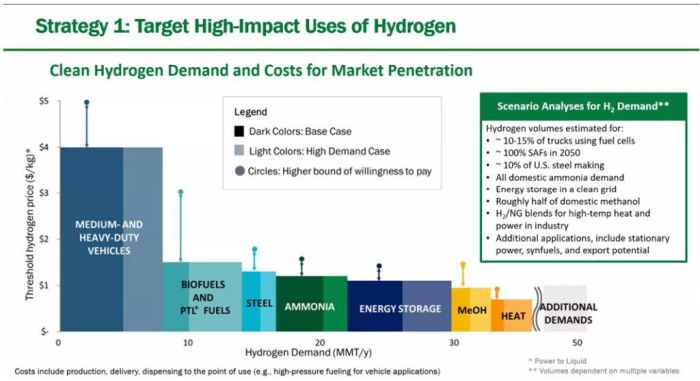

DOE was also clear about where it sees the usefulness of clean hydrogen—in heavy industry (chemicals manufacturing, steel, etc.), heavy-duty transportation, and long-duration energy storage. Again, this isn't news. But it's a good reminder that, although the IRA and BIL include major incentives for clean hydrogen, the administration sees clean hydrogen mainly as a decarbonization gap-filler that will be important in addressing certain hard-to-decarbonize sectors. DOE displayed the chart below, which shows the sectors where DOE sees clean hydrogen as a viable decarbonization solution and the reductions in costs needed to make clean hydrogen economical:

Fourth, the webinar underscored the federal government's efforts to coordinate around clean hydrogen development. An EPA representative highlighted two proposed rules that hinge in part on clean hydrogen, the proposed emission standards for heavy-duty vehicles, which identifies hydrogen fuel cells as a potential emissions reduction technology for certain classes of heavy-duty vehicles, and the proposed power plant rule, which includes a compliance pathway for certain new and existing (primarily) natural-gas-fired plants that would require co-firing "low GHG" hydrogen. The Department of Transportation speaker, from the Pipeline and Hazardous Materials Safety Administration, addressed two other rules—one finalized, and the other proposed—that deal with ruptured or leaking pipelines, which now carry natural gas, but could one day be repurposed for hydrogen or hydrogen blends.

I'll end on what was missing from the discussion. There was no mention of recent reporting that the Department of Treasury has delayed issuing guidance on the IRA hydrogen tax credit until October and possibly until December. That guidance will potentially resolve several outstanding issues regarding how the IRA hydrogen credit will be implemented. This includes the methods for calculating hydrogen's lifecycle emissions, which will be critical given that hydrogen must meet specific emissions thresholds to be considered "clean" and thus creditable. There was also little information given about the status of Hydrogen Hub funding. Hub applications are currently pending. A DOE speaker mentioned that a decision was coming "soon" but didn't elaborate further.

Both the hydrogen tax credit guidance and the Hub funding will be key to the future of clean hydrogen in the United States. They may also be a lynchpin for other climate rules and policies, including EPA's proposed rules for heavy-duty vehicles and power plants, as well as the administration's overarching climate goals. Mary Frances Repko, the White House's Deputy National Climate Advisor to the President, who was the webinar's lead-off speaker, was clear—clean hydrogen is necessary to reach 100 percent clean energy in the United States. Let's hope we hear more soon regarding the administration's plans to implement these important hydrogen programs.

To view Foley Hoag's Law and the Environment Blog please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.