Private investment funds distribute returns to investors and sponsors according to a predetermined plan, known as a "distribution waterfall," that is included in the fund's governing documents. Sponsors and managers typically do not participate in returns until investors receive an amount that is equal to their original investment plus a minimum return, known as the "preferred return" or "hurdle rate." Where funds set the hurdle rate affects when sponsors and managers get paid and can also impact how much they make overall.

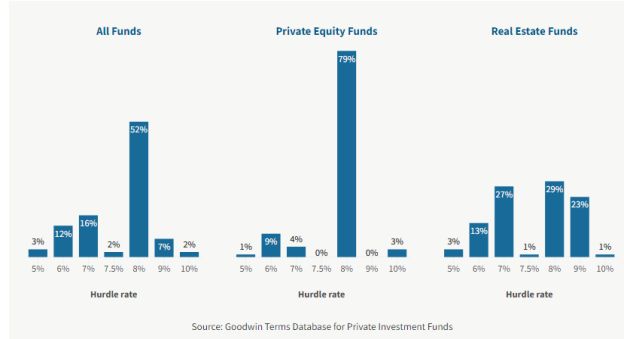

According to the Goodwin Terms Database for Private Investment Funds, more than 50% of funds have a hurdle rate of 8%. The second-most-common hurdle rate, used by 16% of funds, is 7%. However, the picture can be quite different when you look at specific asset classes (as opposed to all funds considered in aggregate). For example, nearly 80% of private equity funds have a hurdle rate of 8%, but only 29% of real estate funds do (hurdle rates of 7% and 9% are almost as common in real estate). About half of infrastructure funds have a hurdle rate of 8%, with 7% and 7.5% being second and third most common. Credit funds typically set hurdle rates below 8%, with the majority being between 5% and 7%. The majority of US venture funds do not have a hurdle rate, but they are much more common outside the US.

Inflation could change the picture

Hurdle rates remained consistent during the recent period of historically low interest rates, although some managers have been able to get more favorable terms by setting hurdle rates lower or by switching to a fixed return of capital approach that requires managers to return 120% to 130% of invested capital to investors before they begin to receive carried interest. It remains to be seen whether hurdle rates will be consistent during the current period of higher inflation and interest rates.

Other factors

Hurdle rates should always be considered in the context of the distribution waterfall as a whole. Details related to carried interest and catch-up provisions, for example, can have a significant effect on profit sharing, and these factors may also vary by asset class and strategy. Private equity and venture funds usually have a 100% catch-up after payment of the preferred return, real estate funds are more likely to have a 50/50 catch-up, and infrastructure funds have catch-ups ranging from 50% to 100%.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.