With the possibility of significant penalties for improperly reported transactions, it is important to understand how certain changes necessitate specific reporting.

Is your organization considering a stock transfer, a merger, a change in control, building a new practice location or updating its board of directors? If these kinds of changes are afoot, it is critical to "turn and face the strain," making sure that you properly notify the Centers for Medicare & Medicaid Services (CMS) to meet the requirements outlined in the Medicare provider agreement.

There are a variety of transactions that healthcare facilities and practitioners may enter into that could result in either a change of ownership (CHOW) or a change of information (CHOI) to their existing Medicare enrollment information. Because a transaction may start as a CHOI but CMS may ultimately consider it a CHOW, it is important to understand how CMS defines CHOW, CHOI and other changes that require notification to maintain an accurate Medicare enrollment record.

Generally, CMS regulations define a transaction as a CHOW when it involves the removal, addition or substitution of a partner in a partnership; the merger of a provider corporation into another corporation; or the consolidation of two or more corporations that results in the creation of a new corporation. Otherwise, the change is likely a CHOI. Regardless, with many changes to an organization's structure, there is an obligation to notify CMS to ensure compliance with the provider agreement.

Likewise, similar changes must also be reported to state Medicaid programs. Medicaid programs, in many cases, have shorter timelines. For example, the failure to report changes in ownership to state Medicaid programs can result in the denial of reimbursement and even recoupment of amounts previously paid.

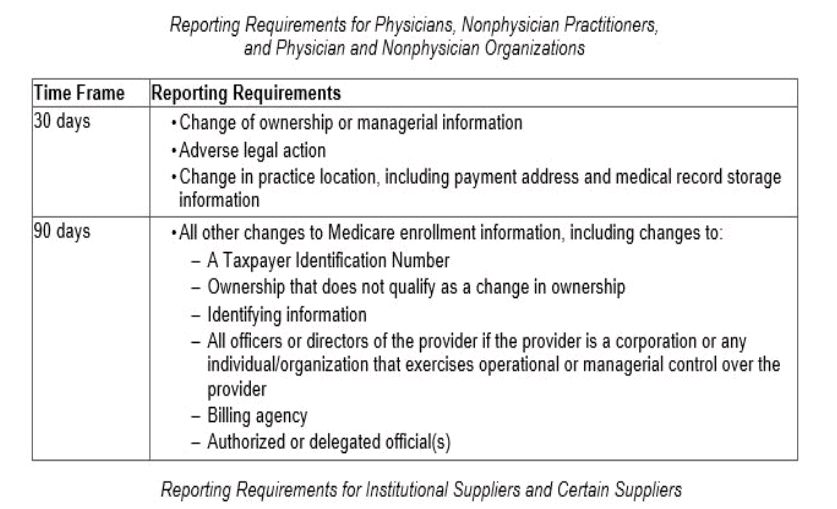

With the possibility of significant penalties for improperly reported transactions, it is important to understand how certain changes necessitate specific reporting. For physicians, nonphysician practitioners, physician organizations and nonphysicians organizations, any change in ownership, adverse legal action or change in practice location must be reported to CMS within 30 days. All other changes to Medicare enrollment must be reported within 90 days. For hospitals and most other suppliers, any change in ownership, change in managerial control, or change in authorized or delegated officials must be reported within 30 days, with all other changes requiring a report within 90 days.

CMS encourages providers to utilize the Provider Enrollment, Chain, and Ownership System (PECOS) to report changes. The two tables below provide a high-level overview of CMS notification expectations outlined in the regulations:

CMS has been under heightened scrutiny by the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG) to reinforce the importance of reporting changes of information and changes of ownership. A 2016 OIG report that focused on the vulnerabilities in provider enrollment and ownership in Medicare found that the effective date of many provider changes of ownership fell outside the required 30-day notice to CMS. The HHS Departmental Appeals Board has also upheld enforcement penalties against providers for failure to notify CMS, with punishments ranging from enrollment suspension to fines or termination from the Medicare program for a certain period.

Could these changes impact provider reimbursement? The answer is yes, although it may depend on the nature of the change. In fact, recent CMS guidance clarifies how providers should expect to be reimbursed following a transaction that results in a CHOW. Specifically, new language in the CMS Program Integrity Manual, Chapter 15, states that where the new owner/buyer accepts the old owner/seller's provider agreement, CMS will continue to pay the old owner/seller until the CMS Regional Office processes the CHOW application. However, after the CHOW application is processed, Medicare Administrative Contractors will only pay the new owner/buyer under the CMS Certification Number. CMS states that it is "the responsibility of the old and new owners to work out between themselves any payment arrangements for claims for services furnished during the CHOW processing period." If the new owner/buyer chooses to reject the provider agreement, "Medicare will never pay the applicant [buyer] for services" rendered before the new application is approved by CMS.

Change may be difficult, but it happens. Providers must continue to meet the CMS participation agreement requirements to ensure compliance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.