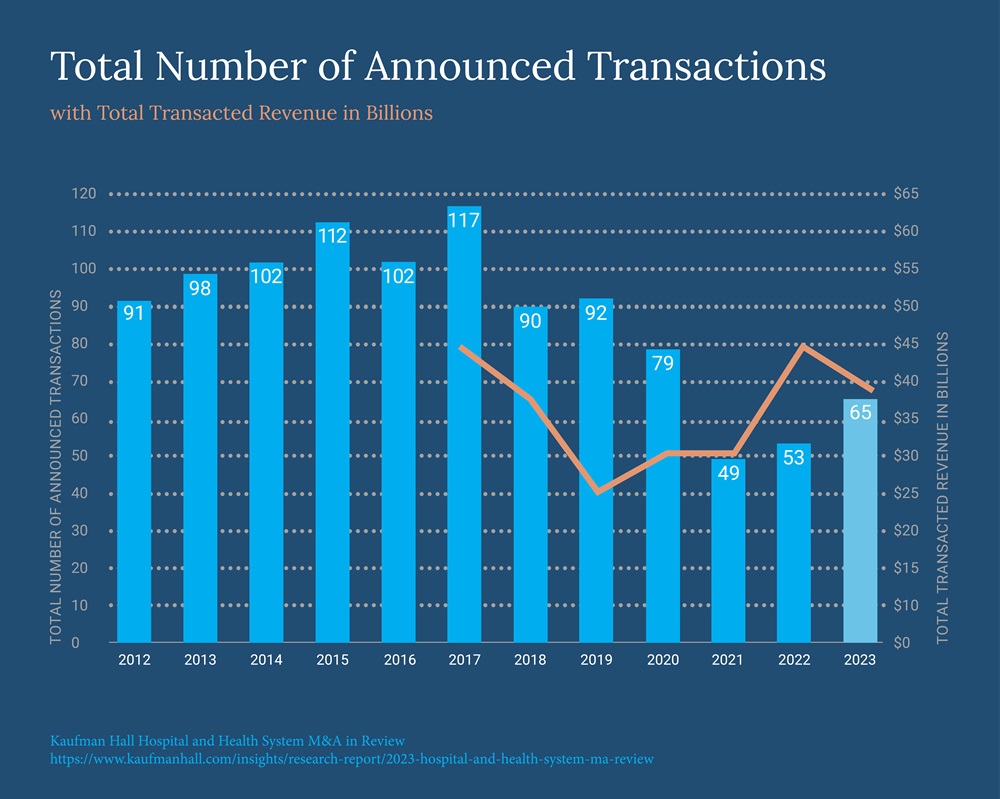

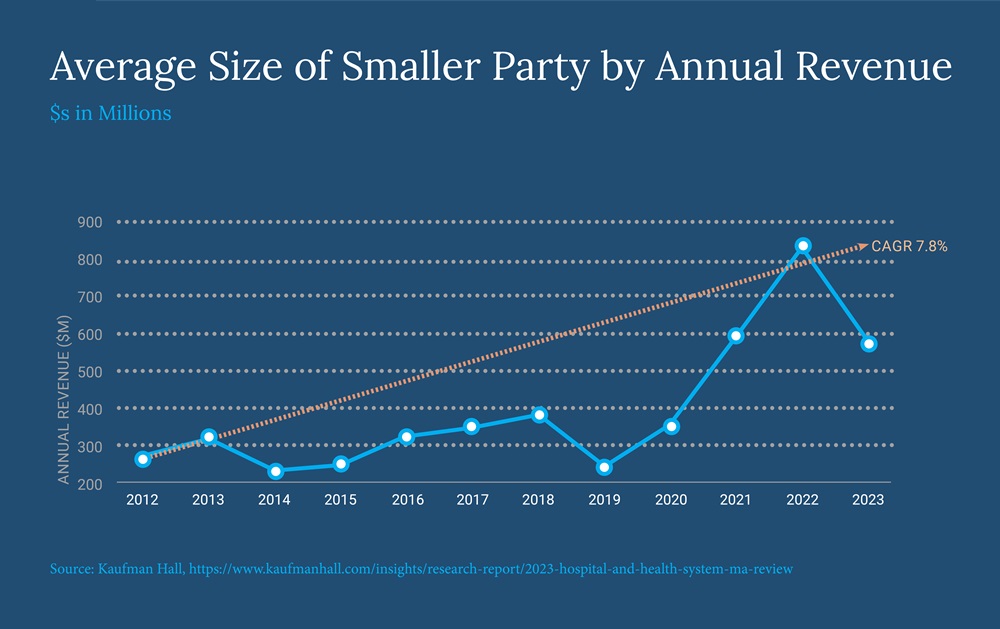

Lately, we have read about mega-scale hospital mergers and acquisitions (M&A) nearly every week. With M&A activity at the highest level since 2020 and average seller size continuing to trend upward, systems are growing market share and increasing revenue at an unprecedented magnitude. For example, in December, Jefferson Health announced that it intends to merge with Lehigh Valley Health Network to create a 30-hospital system with 700+ sites of care and 62,000 employees, becoming the largest employer in Philadelphia.

One of the stated goals of the Jefferson merger is to generate "sustainable cash flow and improved financial stability." This is becoming the hallmark of an industry that is shifting focus from sheer size to true scale. We are calling this new phase of M&A "Significant Scaling."

As scaling has advanced, we have also seen increasing pushback from regulators challenging large-scale healthcare transactions, but the pushback is not limited to just health systems. In May, the U.S. Justice Department announced that it developed a new task force to review and address antitrust concerns spanning "issues regarding payer-provider consolidation, serial acquisitions, labor and quality of care, medical billing, healthcare IT services and access to and misuse of healthcare data. For many reasons, not all healthcare organizations will join mega-systems – but we think all providers can learn and benefit from the rationale behind these mergers.

Where Are You on the "Significant Scaling" Continuum?

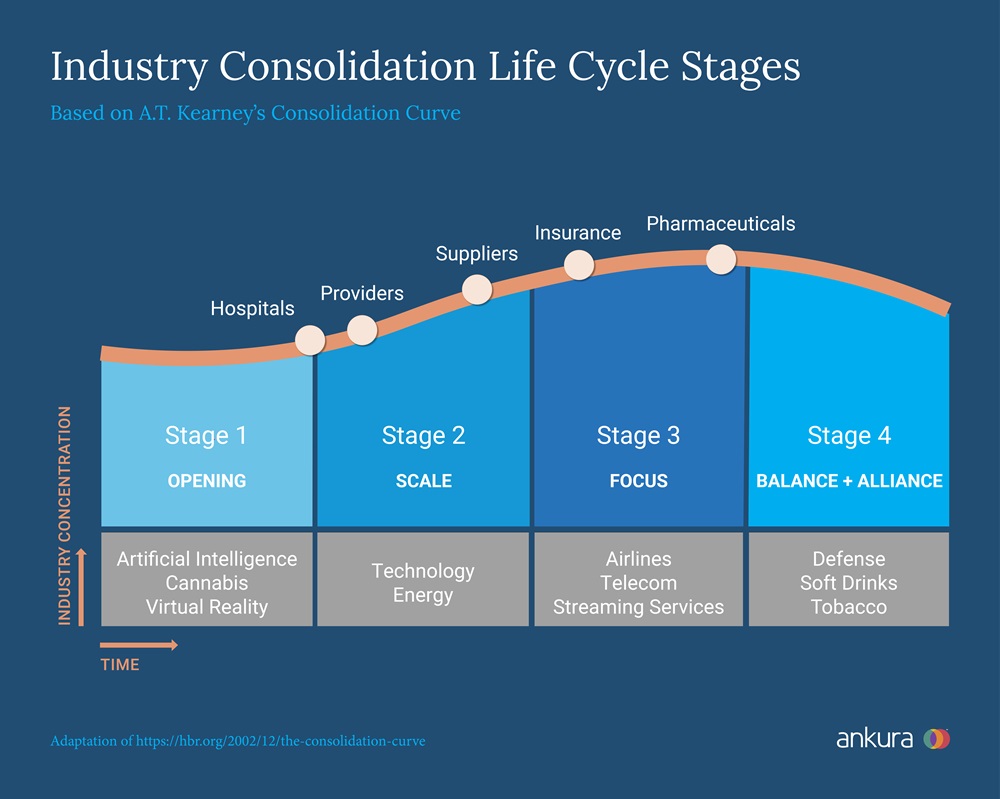

A 2002 article in Harvard Business Review described "The Consolidation Curve," depicting the life cycle of an industry in stages based on the degree of consolidation. Over the past 20 years, the healthcare industry has seen steady growth in M&A activity, shifting major players toward stages 2 and 3 on the Curve.

| Stage | Market Share of Top 3 Companies | Organizational Priorities |

|---|---|---|

|

1 |

10-30% |

Growing market share and revenue |

|

2 |

15-45% |

Merger integration ("Significant Scaling") |

|

3 |

15-70% |

Core capabilities, profitability, and strengthening or eliminating weaker components of their business |

|

4 |

70- 90% |

Defend position and create new, spin-off growth |

We surmise that hospitals and health systems are at the earliest stage of the Consolidation Curve among their healthcare industry peers. They have been slower to advance economies of scale because of ongoing regulatory pressures and the necessity of prioritizing the day-to-day challenges stemming from the pandemic. But now that organizations are stabilizing, we urge our health system partners to take a fresh look at the execution of "Significant Scaling" to become more nimble, secure, and innovative. Administering replicable, high-quality, efficient care across a broad network of sites requires a mindset shift for health system leadership.

What Are the Key Focus Areas To Achieve Economies of Scale in Stage 2?

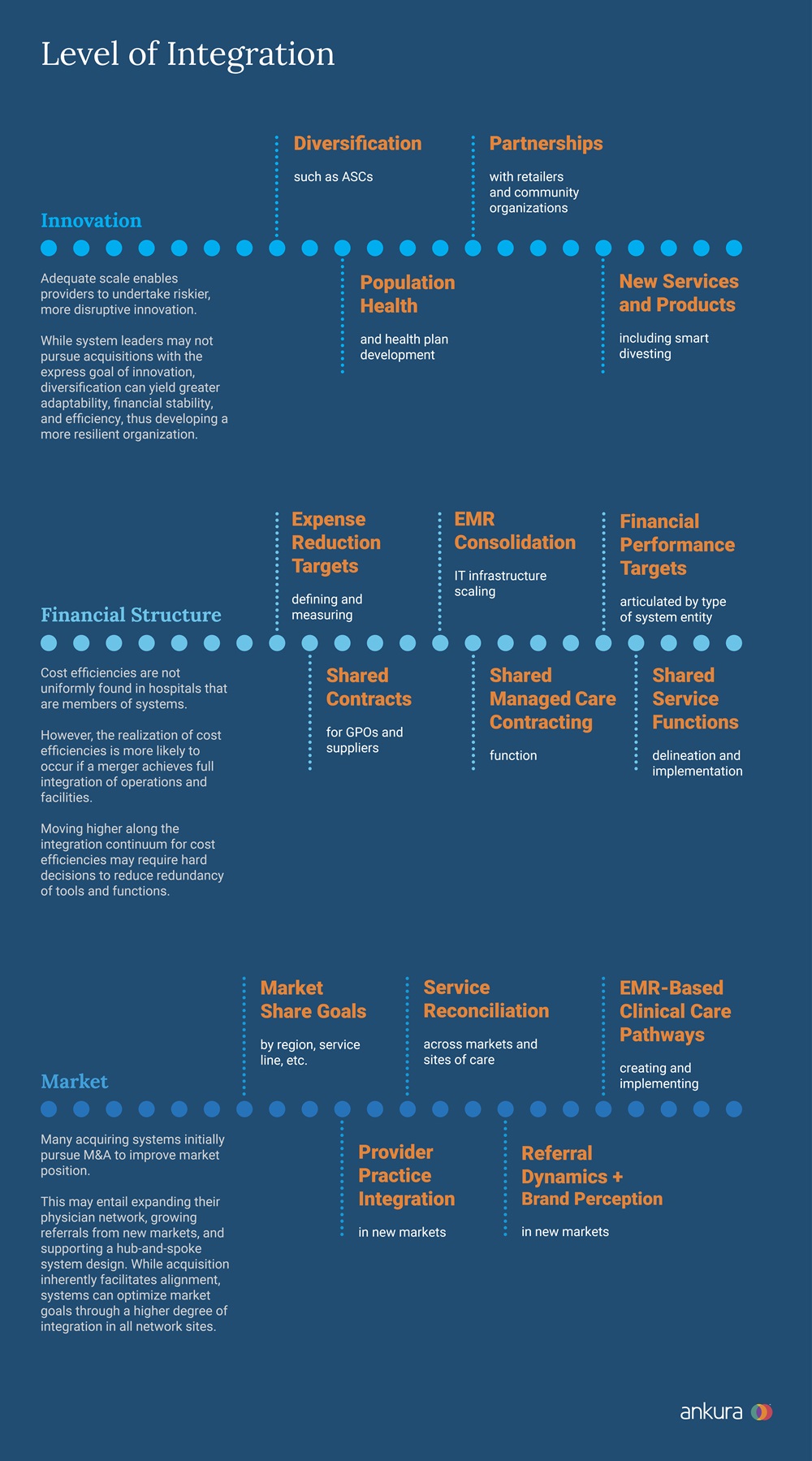

In Stage 2, an organization shifts its focus away from market share and revenue targets towards standardization and integration of assets. It aims to strengthen its capital position and pursue industry dominance.

While there are many ways to generate economies of scale, three offer enhanced financial viability and downside protection.

1. Standardization

In a 2019 JAMA article, the authors estimate that 30% of healthcare spending is wasteful. That adds up to more than $1.2 trillion each year (about $3,700 per U.S. resident) from administrative and operational waste, harm and safety events, overtreatment, ER visits, and high-cost medications. Even at only one location, standardization in each of these areas would significantly reduce costs and increase care outcomes. But over hundreds of sites of care and billions of processes, imagine the cost savings! For example, Intermountain Health is employing standardization across its 400 clinics and 33 hospitals by consolidating its electronic health records (EHRs) into a single platform to help them achieve significant cost savings. Now that is significant scaling with most of the savings directly to the bottom line.

2. Incremental Scalable Cost Infrastructure

The term "scalable infrastructure" refers to a health system's ability to accommodate increasing demand and workloads without compromising performance, efficiency, or cost. Scalable infrastructure is not driven by a 1:1 demand ratio and absorbs additional patient volume without a corresponding increase in costly resources such as the facility footprint, equipment, or staff. Costs are not compromised with incremental variable demand but scaled to improve margins per asset.

We observe this phenomenon when helping providers develop a shared service operating model. Examples include system-based centralized distribution centers, joint call and IT centers, and administrative leadership in functions such as strategy, marketing, contracts, and legal.

One key attribute of leveraging scalable infrastructure is the ability to offer new services without building a new location. For example, operating an urgent care in the evenings out of an existing primary care office allows you to leverage everything except for staff and increase the utilization of existing assets.

3. Negotiating Power

Increased negotiating power is one of the primary reasons for today's trend of Significant Scaling. While acquiring small or medium-sized systems is still advantageous, mega deals give the acquirer instant and impactful negotiating power with payors, politicians, unions, and vendors. As the largest employer in Philadelphia, Jefferson Health can leverage its size, geography, and influence to reduce contract pricing and enhance reimbursement negotiation positioning. More broadly, at this size and scale, the organization can influence state policies with implications for growth, reimbursement, and competition.

How Can Hospital Providers Realize the Benefits of System Integration Without M&A?

Increasing scrutiny of M&A activity in the healthcare space may limit opportunities for providers to achieve scale through formalized system expansion. However, independent providers or smaller systems can still draw upon the goals of provider M&A activity to achieve economies of scale, on a smaller scale.

What Can Systems Do To Make Their Scale Meaningful?

Keep goals in focus and evaluate them regularly. In a 2017 study of hospital M&A conducted by HFMA and Deloitte, 30% of executives involved in M&A transactions reported "I don't know" if the transaction achieved its projected cost efficiencies (source). In a rapid evolution of scale, goals are dynamic and must be regularly evaluated and measured to ensure the organization is on track.

Treat scaling as a marathon, not a sprint. Truly realizing economies of scale is a long-term process with many potential stakeholders. Realistic expectations around time and resource demands will ensure that a team is not frustrated by slow progress.

Lead with culture and communication. Due diligence should be the start of an effective culture and communication merger. Considerations should include an assessment of both organizations' approaches to staffing practices, key programs/services at the acquired facility, provider relationships, brand perception among staff and patients, preferred communication styles at the organization, and more.

Take a thoughtful approach to all service offerings. Leverage analytics and strategy to evaluate all service offerings based on measures of consumer perception, financial performance, cannibalization, and more.

Systemization Is Here to Stay

Moving beyond the "system on paper only" stage allows

health systems to begin tackling healthcare's Triple Aim of improving population health,

care experience, and per capita cost. These touted but

less-realized benefits of health system M&A will require focus,

continual assessment, and difficult choices. We believe that a keen

focus on merger integration capabilities will position strong

health systems to significantly scale their way to financial

security, market relevance, and longevity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.