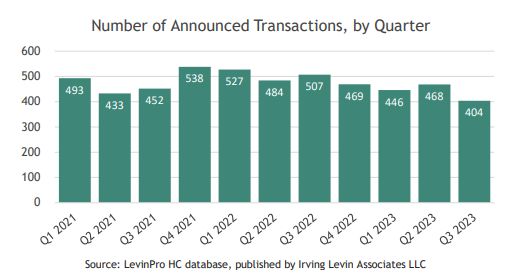

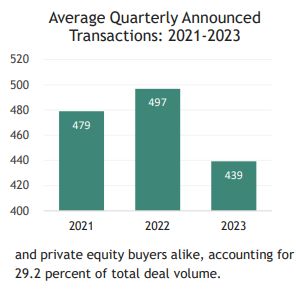

Ankura is pleased to present an overview of healthcare transactions announced or closed during Q3 2023 in the United States. Total transactions decreased by 13.7 percent in the third quarter of 2023 after increasing by 4.9 percent in the second quarter. Excluding the Life Sciences and Medical Office Buildings sectors, the total number of transactions in the United States decreased by 16.4 percent.

Notable Transactions Announced or Closed in Q3:

- Thoma Bravo, L.P., via its managed funds Thoma Bravo Discover Fund IV, L.P. has agreed to acquire NextGen Healthcare, Inc. for approximately $1.6 billion. Thoma Bravo, L.P will pay $23.95 per share in cash to acquire NextGen Healthcare, Inc., implying a 2.5x revenue multiple and a 14.4x EBITDA multiple. NextGen Healthcare, Inc. provides healthcare technology solutions in the United States.

- Strata Decision Technology, L.L.C. acquired Syntellis Performance Solutions, LLC from Madison Dearborn Partners, LLC and Thoma Bravo, L.P. for an enterprise value of $1.4 billion on August 8, 2023. Syntellis Performance Solutions, LLC develops enterprise performance management software for healthcare, higher education, and financial institutions.

- Boston Scientific Corporation (NYSE:BSX) entered into a definitive agreement to acquire Relievant Medsystems, Inc. on September 19, 2023. The transaction includes an upfront cash payment of $850 million and undisclosed additional contingent payments based on sales performance over the next three years. The transaction is expected to close in the first half of 2024.

- TPG Inc. has acquired Nextech Systems, LLC from Thomas H. Lee Partners, L.P. Nextech Systems, LLC designs and develops healthcare technology solutions for specialty providers. TPG Inc. paid $1.4 billion on September 7, 2023 to acquire Nextech Systems, LLC from Thomas H. Lee Partners, L.P.

Key Observations:

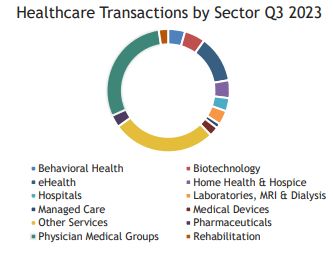

In Q3 2023, announced transaction activity was significantly lower than the previous quarter. Additionally, transaction prices were noticeably lower with few transactions exceeding $1 billion. Behavioral Health, eHealth, and Rehabilitation were the only sectors that experienced an increase in transaction activity. Despite growth in these specific sectors during the latest quarter, overall transaction volumes remain subdued due to continued interest rate increases and staffing challenges in the healthcare industry.

As shown in the figures below, recent healthcare acquisitions have been dominated by three sectors: Physician Medical Groups, Other Services1 , and eHealth. Despite declines in transaction activity in Q3, the Physician Medical Group sector remained the most active sector in terms of total transactions as a result of interest from health system

In the coming years, healthcare transactions are poised to face heightened scrutiny due to proposed changes announced by the Federal Trade Commission in July of this year. These guidelines are expected to bring about more rigorous oversight and regulation within the healthcare sector, potentially impacting merger and acquisition activities, partnerships, and other transactions. Organizations involved in healthcare transactions will need to stay informed and closely monitor developments in response to these proposed guidelines as they shape the future of healthcare transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.