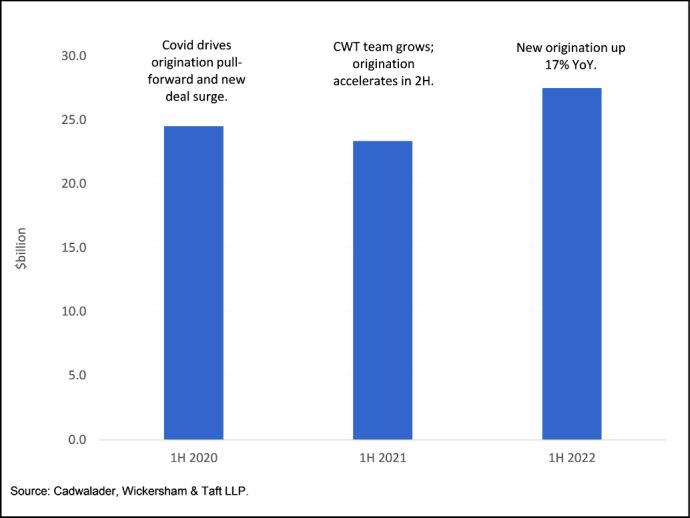

Cadwalader representations on new fund finance facilities in the U.S. rose 17% in the first half to total more than $27.0 billion. (The final tally may rise as we complete our dataset for June closings.) Growth in fund finance origination comes as overall credit markets have decelerated meaningfully. Corporate bond issuance declined by 26% in the first half and non-mortgage structured products issuance came in 70% below 1H 2021.

Exhibit 1: Fund Finance First Half Origination Volume (New Deals, U.S.)

We attribute the continued growth in fund finance to three factors. First, credit fundamentals in our market are less directly linked to the economy than in most other credit products, and, therefore, the outlook for loan performance was unchanged despite the downward revisions to the economic outlook. Second, fund finance doesn't have a direct link to capital markets pricing. While this is a constraint to the sources of available capital, it insulates the product from market volatility that has challenged other credit products. Third, asset demand at banks remains strong while the menu of loan and security products that are attractive to add to the balance sheet in the current environment has become smaller.

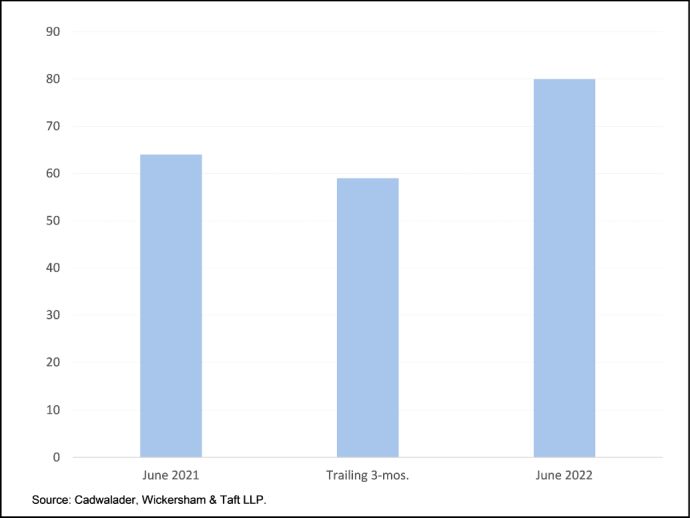

Second quarter bank earnings were a mixed bag, but a couple of things worked consistently across most institutions. Loan growth continued at a solid pace, and higher rates translated into net interest income, exceeding expectations. C&I lending led the charge, with growth coming from both higher utilization and new origination. We think lenders are likely to continue to do what works in the second half: to continue to make balance sheet available to fund finance, which should support the continued momentum in origination. This would be consistent with our internal data: Our new matter openings and prospective deals in the pipeline ticked up meaningfully in both the U.S. and UK in June.

Exhibit 2: Fund Finance New Matters Accelerated in June (U.S.)

While origination volume has been robust, new subscription facility pricing widened by about 6 bps in the first half from the 2021 average. The pricing range also tightened, with the minimum margin on deals moving meaningfully higher. The market has been split on the approach to spread adjustment, with about a third of deals using the ISDA standard. While the credit spread adjustment approach may not reach a consensus soon, all-in pricing could move wider in the second half, consistent with the trends in the loan and structured products markets.

Conclusion

The main drivers behind the growth in fund finance origination remain in place and point to a strong second half. For the outlook beyond 2022, we're watching private market internals. Buyout deal and exit values are materially lower year-to-date, which suggests the return of capital to LPs is decelerating and the time it takes to reach the LPA deployment hurdles that are prerequisite to raising the next sequential fund is stretching longer. Slowing capital velocity in private markets could weigh on fundraising in 2023 and fund finance origination with that. That said, fund finance will operate with a significant lag and, in the meantime, it's also possible that either capital deployment or capital returns to LPs may break out of the first-half lows.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.