Despite recent regulatory "encouragement" to adopt SOFR as "preferred" by the Alternative Reference Rates Committee (ARRC),1 we continue to observe credit agreements in the US loan markets that use a credit-sensitive alternative rate (CSR) to SOFR.2

In fact, a recent check of public filings showed eight reported credit agreements that used a CSR, specifically the Bloomberg Short-Term Bank Yield Index (BSBY). This represented a significant increase over the two non-SOFR transactions we had reported previously. Of the eight public agreements, three use BSBY as the sole interest rate, four provide for either BSBY loans or Base Rate loans (with BSBY as a component of "Base Rate"), and one uses BSBY as the second step in a benchmark replacement waterfall between Term SOFR and Daily Simple SOFR.

We found no public filings based on Ameribor. The IBA ICE Bank Yield Index and IHS Markit CRITR still are in a test phase only, and AXI is still under development by SOFR Academy, so we would not have expected to find examples of their use.

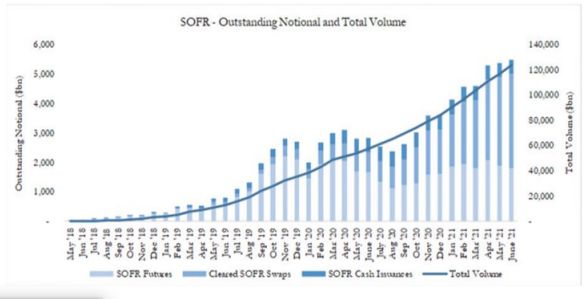

Of course, SOFR cash issuance (that includes, or even is mostly, bonds rather than loans) remains modest and has not significantly increased since March 2020, as shown in the SOFR Term Rates Factsheet:

Now that the ARRC has formally recommended the CME Group's published term SOFR, we will be keeping a close eye on the market's preference for SOFR versus CSRs.

Footnotes

1. See, for example, the ARRC factsheet-ARRC Formally Recommends a Forward-Looking SOFR Term Rate (the "SOFR Term Rates Factsheet")-published on 29 July 2021 summarizing, among other things, SOFR's strengths, and prepared remarks of SEC Chair Gary Gensler before the Financial Stability Oversight Council on 11 June 2021.

2. We discussed the credit sensitive rates announced to date, and what we knew about them so far, in our prior blog post, Eeny, Meeny, Miny, Muse: Which LIBOR Alternative Shall I Choose?

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.