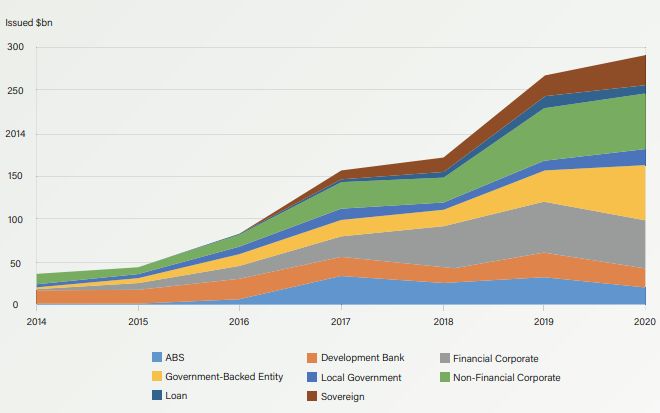

Green bond issuance is growing dramatically, and so are the challenges resulting from a lack of standardisation among green bond offerings. Global green bond issuance topped $290 billion in 2020. Despite slowing in the first half due to COVID-19, issuance saw a 9% increase over 2019. Projected green bond issuance for 2021 could reach $400 billion - $450 billion.

Green bond issuance

Although green bond issuance has grown rapidly, sustained long-term growth of the green bond market will require solutions that foster standardisation. The following standardisation issues must be addressed:

- There is a notable lack of common disclosure frameworks for each asset class of green bonds, compounded by the technical nature of 'green' disclosure data points. However, private-sector driven solutions are helping trade associations and industry groups address this challenge head on.

- Many jurisdictions lack a clear legal definition of what qualifies as a 'green bond'. The EU moved first toward adopting a standard classification system for what constitutes a green bond, and the United States Securities and Exchange Commission (the SEC) or other financial regulators may adopt a standard classification system for what constitutes a green bond and may require nonfinancial disclosures about green bonds.

- Issuers should, as standard practice, include robust risk factor disclosures in green bond offerings to mitigate securities law liability concerns relating to lack of uniformity regarding green bond classification, as well as suitability for investor purposes.

Source: Climate Bonds Initiative

Lack of common disclosure framework

Issuers and investors suffer from a lack of consensus about what green data should be provided to investors in connection with green bond offerings. This lack of a common disclosure framework will require a customised solution for each asset class of green bonds, which will likely require answering a number of questions:

- What type of information is needed, and will this vary based on the asset class and the type of investor? Not all investors want the same information. Investors in non-financial corporate green bonds, for example, may focus on supply-chain environmental impacts, while investors in green assetbacked securities (ABS) may look closely at the carbon footprint of the underlying income-producing assets.

- What data points do investors in a given asset class want, specifically? Some investors are primarily interested in data points regarding climate resilience and/or climate risk scenario analysis, while other investors focus on data points that speak to the achievement of climate change prevention goals such as reducing carbon footprint or water usage. On which data should issuers focus their primary attention?

- Is the data that investors want reasonably obtainable? Answering this question may require answers to other questions: Will a consultant need to be hired to obtain the data? Will contractual provisions need to be added to contracts in order to obtain data (e.g. leases with tenants, loan agreements with borrowers, or contracts with suppliers)? Is the data solid enough for an issuer to stand behind the disclosure statements made in the offering materials? Is the data able to be comforted by accountants or third party verifiers? Ideally, an issuer will identify a list of discrete, objective and codable data points that lend themselves to collection, verification, communication via the offering materials, and ultimately manipulation and analysis by investors.

- To what extent will investors desire asset-level data regarding electricity usage? Will they care about whether the electricity is generated at a renewable source or from fossil fuels? In the case of green ABS backed by incomeproducing real estate, is the data needed only for landlordcontrolled areas in a building? Or is it needed for tenant-controlled areas too, even if they are separately metered?Is it just historical data they need, or is ongoing reporting required too? What about water usage data?

- To what extent will the issuer be required to make information available on an ongoing (post-closing) basis? Is it feasible to do so? Issuers cannot provide certain data points without cooperation from third parties. In the commercial mortgage-backed securities context, for example, an issuer must obtain cooperation from borrowers and tenants in order to obtain periodic utility usage data.

- At what level of granularity should the data be presented (e.g. company-wide, pool-wide, or on each individual asset)?

- Is it permissible to make assumptions about an issuer's assets when preparing disclosures about whether an asset pool is green (e.g. sampling or estimations)? Unfortunately, the technical nature of certain 'green' data points can lead to further uncertainty. For example, the bewildering array of green building certifications leads to confusion.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.