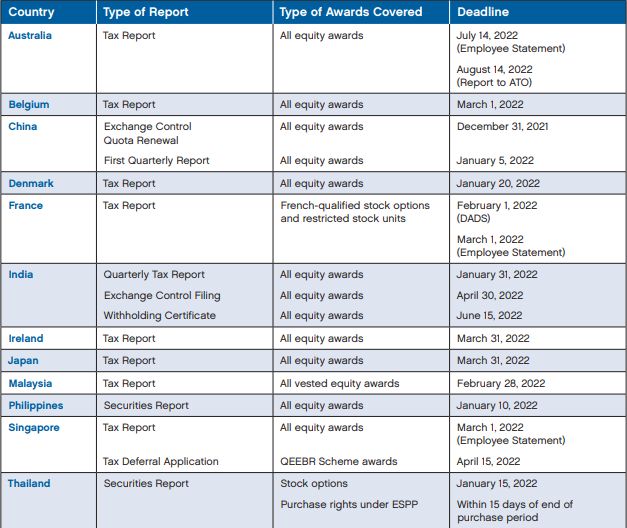

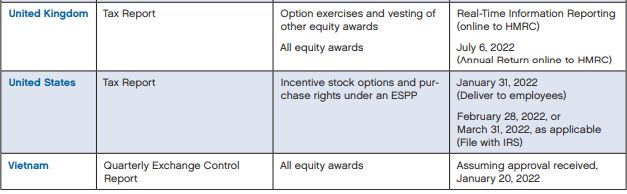

This White Paper highlights some of the principal annual or quarterly reporting requirements for employee stock plans that multinational companies most commonly encounter when offering these programs to their employees in selected jurisdictions worldwide. A chart summarizing these items appears at the end of this White Paper. Please note that this White Paper does not address routine, year-end tax reporting obligations nor does it cover filings that are required for purposes of relying on a securities law-related exemption tied to the grant of an equity award.

AUSTRALIA

Tax Reporting for Equity Awards

Employers are subject to annual reporting requirements

with respect to all equity grants made to Australian employees. By

July 14, 2022, Australian employers must issue an Employee Share

Scheme Statement to each employee who was granted an equity award

that vested or was exercised in the prior tax year (i.e., before

June 30, 2022), and by August 14, 2022, the employer must file an

Employee Share Scheme Annual Report with the Australian Taxation

Office ("ATO") using the requisite software program.

BELGIUM

Compensation Tax Reporting

Compensation paid by an affiliated foreign entity to a

person providing services to, or benefiting, a Belgian subsidiary,

which includes income earned from equity awards, must be reported

to the Belgian tax authorities by March 1 of each year following

the calendar year in which the compensation was paid or granted.

Reports (fiches 281) must be filed with respect to

compensation earned in the 2021 calendar year by March 1, 2022. For

tax-qualifying stock options, the grant is deemed to take place on

the 60th day following the offer to the employee (if the

employee expressly accepted the offer in writing within the 60-day

period).

CHINA

Exchange Control Reports for Stock Options/Restricted

Stock Units/Purchase Rights

For companies that have obtained the State Administration

of Foreign Exchange ("SAFE") registration for their

equity plans in China, quarterly reports must be filed with the

local SAFE officials detailing the company's equity plan

activity (e.g., grants, exercises, share sales, and the balance of

the designated foreign exchange account) during the previous

quarter. The next report is due by January 5, 2022 (which is the

third business day of the first quarter of the calendar year), for

activity that occurred during the fourth quarter of 2021.

In addition, for those companies that have obtained SAFE approval for their equity plans (and the plans have not since been terminated) and grant stock options or purchase rights, they must renew their foreign exchange quota for the 2022 calendar year. This renewal request should be made annually by the Chinese affiliate that is authorized by its parent company outside of China to act as its local agent with respect to SAFE-related matters. As a best practice, this renewal request should be filed by December 31, 2021 (although under current SAFE practice, a renewal request which is complete by March 31, 2022 is acceptable). Please note that, based on our consultation with SAFE branches in certain key cities, including Beijing, Shanghai, Shenzhen, and Tianjin, and in Guangdong and Jiangsu provinces, quota renewals are not required for companies that only grant awards that do not require the transfer of funds across borders (i.e., full value awards such as restricted stock or restricted stock units).

DENMARK

Annual Equity Award Tax Reporting

Annual tax reporting is required for stock option

exercises and the vesting of restricted stock unit

("RSUs"). The tax reports are due by January 20 of the

year following the year in which the shares are acquired pursuant

to a stock option exercise or RSU vesting.

FRANCE

Tax Reporting for French-Qualified Awards

French affiliates of companies that grant stock options

and/or RSUs to their employees in France that are tax-qualified

under the French Commercial Code must fulfill certain tax reporting

requirements to (i) the social security office

("URSSAF"), (ii) the beneficiary, and (iii) the French

tax authorities.

At the time of grant of the French tax-qualified stock options and/or RSUs, the French affiliate must report to URSSAF the name and address of each beneficiary and the number and value of the options and/or shares granted.

By March 1 of the year following the year in which an employee exercises their French tax-qualified stock option and/or vests in their tax-qualified RSUs, the French affiliate must provide the employee with an individual statement that includes prescribed details of the French affiliate, the employee, and the options/RSUs granted and exercised or vested, as applicable, including the acquisition gain on exercise/ vesting.

The French affiliate must also send a copy of this individual statement to the tax office where it files its corporate tax return before March 1 of the year following the year in which an employee exercises the stock option and/or vests in their tax-qualified RSUs.

In addition, French affiliates should also report details regarding the exercise of French tax-qualified stock options and the vesting of French-qualified RSUs in the annual employer year-end declaration ("DADS") by February 1 of the year following the year in which the exercise or vesting occurs. French employers must include in the DADS the same information as listed above for the individual statement.

Annual Report to Shareholders

If the French affiliate of the issuer company has annual

shareholder meetings, the French affiliate should distribute a

special report to its shareholders at their annual meeting listing

the French tax-qualified stock option and RSU grants that have been

made to the 10 employees of the French affiliate who have been

granted the most stock options and/or received the most shares upon

exercise/ vesting of the awards as well as the corporate executives

of the issuer company, its affiliates, and the affiliated companies

of the consolidated group. If the French affiliate does not hold

its own shareholder meetings, the French affiliate should still

compile this report, but retain it in its files.

INDIA

Tax Reporting for Stock Options/Restricted

Stock/Restricted Stock Units/Purchase Rights

Companies are required to issue a Tax Deducted at Source

("TDS") certificate to their employees by June 15, 2022,

after the end of the tax year (March 31, 2022) in connection with

amounts withheld on taxable gains from equity awards (on exercise

of stock options, the vesting of restricted stock and RSUs, and

purchases under employee stock purchase plans). Employees should

use this certificate to file their annual tax return, which is due

on or about July 31, 2022 (or such other date as notified or

extended by the tax authorities from time to time).

The Indian affiliate is also required to file TDS returns with the Indian tax authorities on a quarterly basis. These returns are due by the end of the month that immediately follows the relevant calendar quarter (except in the case of the quarter ending March 31, in which event the TDS return is due by May 31) and report details on all amounts withheld during the quarter, including those amounts withheld with respect to taxable gains.

Exchange Control Report

The Indian affiliate must also file an annual return with

the Reserve Bank of India through the AD Category—I Bank,

which provides details regarding the shares issued to or

repurchased from the employees / directors of the Indian affiliate

during the prior fiscal year ending March 31. This report should be

filed on Form ESOP Reporting (Annex IV of the Master

Direction—Reporting under Foreign Exchange Management Act,

1999 (dated September 19, 2016) (the "Master Direction").

The Master Direction does not prescribe the date by which the

report must be filed. Therefore, it is advisable to submit the

report as soon as possible (preferably by April 30, 2022).

IRELAND

Tax Reporting for Stock Options/Restricted Stock

Units/Purchase Rights

Prior to 2021, all employers were required to file a Form

RSS1 annually with Irish Revenue with respect to the following

events occurring in the prior tax year: (i) options and other

rights granted; (ii) shares issued following the exercise of

options; (iii) assets transferred—rights (other than share

options) exercised; and (iv) consideration given for options and

other rights assigned or released. In 2021, the reporting

requirement was extended to cover other forms of share-based

remuneration (including restricted stock, RSUs, and other awards

that are cash equivalents of shares), and Irish Revenue introduced

a new electronic return called the Employers Share Awards, or ESA,

return which must be uploaded through the Revenue Online Service,

or ROS, by March 31, 2022. Separate reporting requirements apply

for save-as-you-earn plans, approved profit-sharing plans, and

employee share ownership trusts.

JAPAN

Tax Reporting for Stock Options/Restricted Stock

Units/Purchase Rights

Japanese companies that are owned 50% or more by

non-Japanese companies and Japanese branch offices of non-Japanese

companies are required to file a statement with the district

director of the local tax office if: (i) a Japanese resident who is

or was an employee or officer of a Japanese branch or subsidiary of

a foreign parent exercised, or received benefits under, any of the

rights listed below; or (ii) a nonresident who is or was an

employee or officer of a Japanese branch or subsidiary of a foreign

parent has received Japanese source income generated from the

exercise of, or the receipt of benefits under, any of the rights

listed below. The rights are:

- The right to acquire, without payment or with payment of a discounted price, stock of the foreign parent, or any of its parent or subsidiaries (collectively, "Parent Stock").

- The right to receive payment of cash in the amount equivalent to the price of the Parent Stock or distributions related to the Parent Stock.

- The right to acquire the Parent Stock or receive payment of cash where the price of the Parent Stock, the business results of the foreign parent, or other index exceeds a predetermined threshold within a certain period.

Exercises of stock options, vesting of RSUs, payment of dividend equivalents, and employee stock purchase plans ("ESPP") are subject to these reporting requirements. These filings must be made with respect to any exercises or payments by March 31 (or by April 30 with respect to any exercise or payment made by nonresidents) of the calendar year following the year in which the exercise or payment occurred.

MALAYSIA

Tax Reporting for Equity Award Vesting

Companies that grant equity awards to employees in

Malaysia must report, on an annual basis, any stock option

exercises, RSU vesting, and/or purchases under an ESPP that took

place during the previous calendar year. The report must be

submitted to the Malaysian Inland Revenue Board in Appendix C of

the Form BT/MSSP/2012 (which is also known as Appendix A and

is the form used to report the grant of equity awards) and should

be prepared and filed at the same time as the preparation of the

statement of remuneration (i.e., EA Form) of the employees, which

must be provided to the employees by the last day of February of

each year. Please note that if the equity awards are granted to

employees of more than one Malaysian entity, a separate filing

should be made by each Malaysian entity as they are separate and

distinct employers.

PHILIPPINES

Securities Reporting for Exemption

Companies that grant equity awards to their employees in

the Philippines typically obtain an exemption from the Securities

and Exchange Commission in the Philippines ("SEC

Philippines") to avoid having to register their securities

with the SEC Philippines. Once an exemption has been received from

the SEC Philippines, the company is then required to file an annual

report with the SEC Philippines by January 10 of each year that

reflects the total number of shares that have been issued by the

company pursuant to stock option exercises, the vesting of RSUs,

and purchases under an ESPP during, and as of the end of, the prior

calendar year.

SINGAPORE

Delivery of Award Information for Tax Returns

Companies that grant stock options and share awards in

Singapore may have awards that are potentially eligible for the

Qualified Employee Equity-Based Remuneration Scheme ("QEEBR

Scheme") and/or the Equity Remuneration Incentive Scheme (All

Corporations) ("ERIS").

Under the QEEBR Scheme, qualifying employees may apply to defer payment of the income tax due at exercise of stock options and vesting of share awards, including RSUs, for a period of up to five years, subject to an interest payment. Under ERIS, qualifying employees are eligible for income tax exemptions for gains arising from qualifying stock option and share award plans, including RSUs, of up to SGD 1 million over a period of 10 years. Although ERIS was phased out in 2013 so that it does not apply to new equity awards granted after December 31, 2013, it still applies to gains accrued through December 31, 2023 on awards granted prior to such date.

Employees who qualify under the QEEBR Scheme must submit an application form to defer their tax gains to the Comptroller of Income Tax, and the employer must certify on the application form that the stock plan under which the stock option and / or share award is granted qualifies for the QEEBR Scheme by meeting the applicable vesting period requirements. The form must be submitted to the Comptroller of Income Tax by April 15, 2022.

In addition, the local affiliate in Singapore is required to provide employees with the details of all gains arising from stock plans, segregating the gains, where applicable, into those qualifying for tax exemptions under the various share incentive schemes (such as the QEEBR Scheme and ERIS), and those that do not qualify for any tax exemption under any schemes, no later than March 1, 2022, on an annual return. The annual return to employees is made on Form IR8A. If the company submits salary data electronically to the Comptroller of Income Tax, it may provide employees with such details of the remuneration as stated on the Form IR8A in any alternative format (e.g., via PDF or other electronic means).

THAILAND

Securities Reporting for Stock Options/Purchase

Rights

Companies that grant stock options to the employees of

their Thai affiliates must report any exercises of those options to

the Thai SEC within 15 days after the end of the calendar year in

which the options were exercised in accordance with the details

described in the guidance provided by the Thai SEC and also submit

a summary of the plan pursuant to which the options were granted.

Therefore, with respect to stock options exercised in 2021, the

issuer company must file the report by January 15, 2022. A similar

requirement exists for stock purchased under an ESPP—a report

has to be filed within 15 days after the end of each purchase

period under the plan. For example, if an ESPP's annual

purchase period ends on January 31 of each year, the reporting

deadline would be February 15 of that same year.

UNITED KINGDOM

Tax Reporting for Incentive Stock Options/Purchase

Rights

For each tax year, which runs from April 6 to April 5, UK

employers are required to file reports with Her Majesty's

Revenue & Customs ("HMRC") that relate to equity

awards made to their employees and the exercise or vesting of such

rights. These reports must be filed with HMRC through the online

pay-as-you-earn ("PAYE") system, which is the UK's

payroll tax deduction system.

Under real-time information ("RTI") reporting, employers are now generally required to report every payment made to an employee "on or before" the date the payment is made. But, by concession, all notional payments (i.e., amounts that are taxable even though no cash is involved) on exercise or vesting of stock awards must be reported as soon as possible after the notional payment is made and, in any event, within 14 days of the end of the relevant tax month. HMRC has confirmed that RTI reporting must be applied to internationally mobile employees that have UK tax and NIC (social security) liabilities, even if paid by an overseas employer.

By July 6, 2022, UK employers must also file through the online PAYE system an annual return with respect to stock options and other stock purchase rights that have been granted, exercised, or vested in the tax year ending April 5, 2022. Separate annual returns must be filed online for each separately registered stock plan, whether tax-qualified or non-tax-qualified. All tax-qualified stock plans must be separately registered online, but all non-tax-qualified stock plans may either be registered separately or together under a single scheme registration number.

UNITED STATES

Tax Reporting for Incentive Stock Options/Purchase

Rights

U.S. companies that grant incentive stock options

("ISOs") to their U.S. employees or sponsor an ESPP in

which their U.S. employees participate must deliver an information

statement (at least once per year) to those employees who have

exercised their ISOs during that year or who have purchased shares

of stock under an ESPP. For stock purchases that occurred in 2021,

information statements must be delivered to employees by January

31, 2022, and then filed with the Internal Revenue Service

("IRS") by either February 28, 2022, or March 31, 2022,

depending on the filing format. If paper returns are filed with the

IRS, the filing deadline is February 28, 2022, whereas

electronically filed returns, which are required for 250 or more

returns, are due by March 31, 2022. The information statement must

provide the number of shares purchased, the exercise or purchase

price, and the value of the shares transferred from the company to

the participant, among other items. The information statement for

exercised ISOs should be made on IRS Form 3921 and for shares

purchased under an ESPP on Form 3922.

VIETNAM

Exchange Control Reporting for Approved Issuers

Companies outside of Vietnam require exchange control

approval from the State Bank of Vietnam ("SBV") to offer

awards under an equity plan to employees in Vietnam. In 2016, the

SBV issued Circular 10/2016 that requires the local Vietnamese

subsidiaries of foreign issuers of equity awards to reapply for

approval and, once such approval is received, file quarterly

reports with the SBV on a prescribed form that summarizes, among

other things, the number of grants made during the prior quarter

and the number of shares issued pursuant to awards in the prior

quarter. The first quarterly report is due by the 20th

of the month following the quarter in which the approval is

received.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.