REMINDER: 2022 Nasdaq Board Diversity Disclosure and D&O Questionnaires

As issuers prepare for the end of the 2021 calendar year and the beginning of the 2022 proxy season, many will soon begin circulating director and officer questionnaires. Nasdaq-listed issuers should consider including new questions regarding the diversity of their directors now. To assist listed issuers, Nasdaq has provided sample questions for inclusion in director and officer questionnaires. Beginning in 2022, pursuant to recently adopted Nasdaq Listing Rule 5606, Nasdaq-listed companies will be required to publicly disclose on their websites, in their annual reports or proxy statements, board-level diversity statistics.

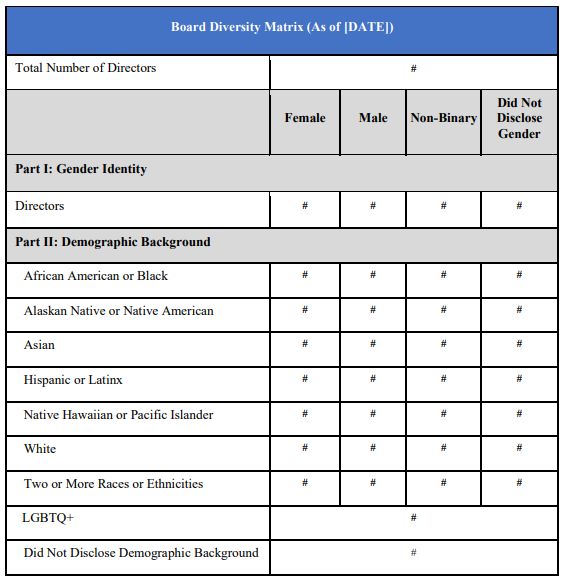

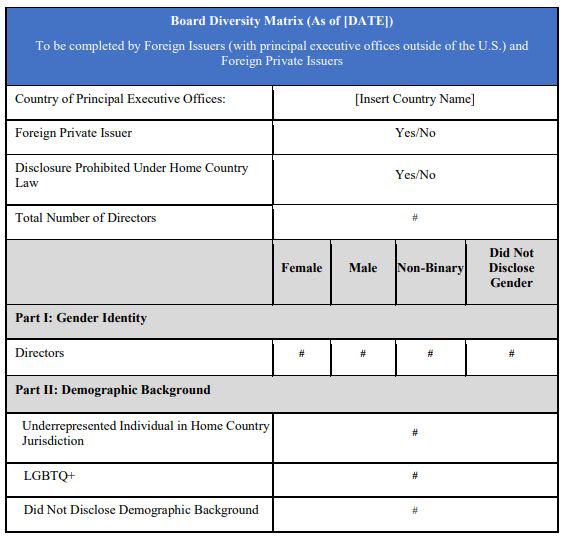

Nasdaq-listed companies should be proactive in communicating these disclosure requirements to their directors. Companies that were listed on Nasdaq prior to August 6, 2021 will be required to disclose their diversity statistics by the later of August 8, 2022 or the date on which the company files its 2022 proxy statement. Companies listed on or after August 6, 2021 will be required to disclose their diversity statistics within one year from the date of listing. In either case, companies are required to present their diversity statistics using the Board Diversity Matrix included in Rule 5606 or a substantially similar format. The Board Diversity Matrices set forth in Rule 5606 for domestic and foreign issuers are reproduced below for reference.

Domestic Issuers (with principal executive offices in the U.S.)

Foreign Issuers (with principal executive offices outside of the U.S.) and Foreign Private Issuers

Companies are not permitted to include additional categories within the Board Diversity Matrix, but are permitted to supplement their disclosure by providing additional information related to their directors below the matrix, in a narrative that accompanies the matrix or in a separate graphic. If a listed company provides the Board Diversity Matrix disclosure on its website, the Company must provide such disclosure concurrently with the filing of its proxy statement or annual report and submit a URL link to the disclosure through the Nasdaq Listing Center within one business day after such posting. Any publication of the information in the Board Diversity Matrix must be included in a searchable format. Following the first year of disclosure, all companies must include the current year and immediately prior year diversity statistics in their disclosures. More information regarding the Board Diversity Matrix can be found here and here.

In addition to the diversity disclosure requirements of Rule 5606, pursuant to Nasdaq Listing Rule 5065(f), listed companies will be required to have or explain why they do not have at least two (or one in the case of a company with five or fewer directors) diverse directors (as defined in Rule 5605(f)(1)). This requirement will phase-in in two steps, the timing of which will depend on the issuer's Nasdaq listing tier and the earliest initial deadline for which will be the later of August 7, 2023 or the date the Company files its proxy statement (or annual report on Form 10-K or 20-F for companies that do not file a proxy) for the company's 2023 annual meeting.

To view Foley Hoag's IPO, Then What? Blog please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.