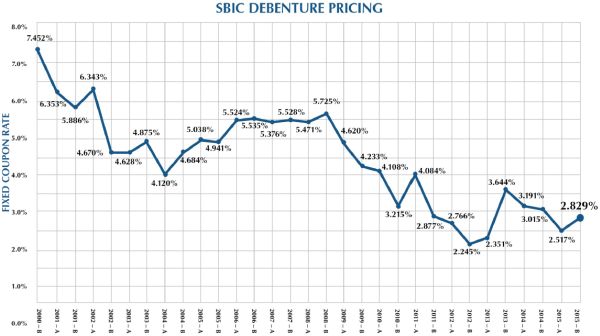

In September 2015, the SBIC Funding Corporation completed a pooling of SBA debentures in the amount of nearly $1.2 billion, the largest pooling in the program's 56-year history. The SBA debentures have a coupon rate of 2.829%. This most recent pricing reflects a slight increase from the March 2015 rate of 2.517% and continues the trend of historically low rates.

The pricing of the pool is a critical component to the cost of funding used by SBIC Funds. Once pooled, the interest rate on the SBA debentures becomes fixed for a 10-year period. The SBIC Fund is responsible only for a semiannual interest payment on the SBA debentures until the SBA debentures are repaid, which must occur within 10 years. In addition, there are no prepayment penalties.

The historical pooling is reflected in our chart.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.