The international tax landscape has undergone significant changes in recent years, driven by the rapid digitalisation of the global economy. In response to the challenges posed by highly mobile, intangible-heavy business models, the OECD has spearheaded the development of a comprehensive solution known as the Two-Pillar approach.1

While Pillar One focuses on the reallocation of taxing rights, Pillar Two introduces a global minimum corporate tax rate, aiming to ensure that the profits of large multinational enterprises (MNEs) are subject to a minimum level of taxation regardless of where they operate. As countries around the world grapple with the complexities of the digital economy, the adoption of Pillar Two has become a key priority for policymakers globally.

OECD Member Countries: Widespread Adoption with Varying Timelines

Among OECD member countries, there is widespread commitment to the implementation of Pillar Two, though the timelines and approaches vary across jurisdictions. We will now take a closer look at how some of these countries are adopting Pillar Two.

Australia: Early Adopter of Pillar Two

Australia has emerged as an early adopter of the OECD's Pillar Two framework. The Australian government has now released draft legislation to implement the Pillar Two rules 2, effective for income years commencing on or after 1 January 2024. This move aligns with Australia's commitment to the OECD's Two-Pillar solution and its desire to ensure a fair and coordinated approach to taxing the profits of large MNEs.

Singapore: Carefully Considering Pillar Two Implementation

Singapore, known for its business-friendly tax environment3, has taken a more cautious approach to the adoption of Pillar Two. The Singaporean government has indicated that it is carefully evaluating the implications of the global minimum tax rules and is engaging in discussions with the OECD and other stakeholders to understand the potential impact on the country's tax system and competitiveness. Singapore is expected to implement the Pillar Two rules for income years commencing on or after 1 January 2025.

United Arab Emirates (UAE): Potential Challenges with Pillar Two

The United Arab Emirates, a prominent global financial and business hub, faces unique challenges in the context of Pillar Two adoption. UAE has recently introduced a corporate income tax for certain taxpayers starting 1 June 2023 (but with grandfathering arrangements for free zone businesses) having regard to how to integrate the global minimum tax rules into its existing tax framework. Discussions are ongoing, and the UAE government is expected to provide more guidance on its approach to Pillar Two in the near future.

New Zealand: Pillar Two as a Backstop to Digital Services Tax

New Zealand had originally taken a unique approach, proposing a Digital Services Tax (DST) as a potential backstop if insufficient progress is made towards the implementation of Pillar One of the OECD's Two-Pillar solution. While the government has expressed a preference for a coordinated, multilateral solution, the reintroduction of the DST Bill suggests that New Zealand is prepared to act unilaterally if necessary to ensure that the digital economy contributes its fair share to tax revenues. New Zealand has since enacted the Pillar Two rules with effect from 1 January 2025.

European Union: Coordinated Approach to Pillar Two Implementation

At the European Union level, member states have been actively engaged in the development and implementation of Pillar Two. On 15 December 2022, the EU Council adopted a directive to ensure the coordinated implementation of the global minimum tax rules across the EU. Member states are now in the process of transposing the directive into their national laws.

BRICS Nations and the United States: Mixed Approaches and Ongoing Discussions

The BRICS countries (Brazil, Russia, India, China, and South Africa) and the United States have taken varying approaches to the adoption of Pillar Two, reflecting their unique economic and political circumstances.

Brazil has been actively engaged in the OECD discussions on the Two-Pillar solution but has not yet provided a clear timeline for the implementation of Pillar Two.

India has made amendments to its tax laws to address the taxation of the digital economy, though these measures are not directly tied to the Pillar Two framework.

China and Russia have not yet publicly indicated their specific plans for Pillar Two adoption. However, as major economies and members of the G20, their participation will be crucial for the successful global implementation of the minimum tax rules.

South Africa has implemented the OECD rules from 1 January 2024.

United States: Potential Adoption of Pillar Two

The United States, a key player in the international tax landscape, has been actively engaged in the OECD discussions on the Two-Pillar solution. While the Biden administration has expressed support for the global minimum tax concept4, the path to Pillar Two adoption in the US remains uncertain.

The implementation of Pillar Two in the United States would require legislative changes, which may face political challenges. However, the US has already implemented a similar minimum tax regime, known as the Global Intangible Low-Taxed Income (GILTI) rules, as part of the 2017 Tax Cuts and Jobs Act. This suggests that the US may be well-positioned to adapt its existing framework to align with the Pillar Two requirements.

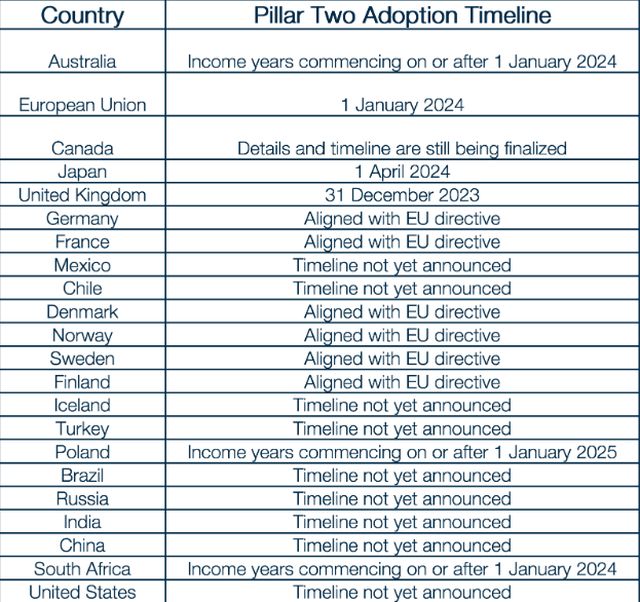

The table below summarises the Pillar Two adoption timelines for OECD member countries and other key nations:

The table illustrates the widespread commitment to the implementation of Pillar Two across OECD member countries, though the timelines and approaches vary. The BRICS nations and the United States have taken more mixed approaches, with ongoing discussions and evaluations of the potential impact of the global minimum tax rules.

Global Trends and Nuances

The adoption of Pillar Two is not without its challenges and nuances. Some countries, such as the United Arab Emirates, face unique obstacles in reconciling the global minimum tax with their existing territorial tax systems and lack of corporate income tax.

Moreover, the pace of Pillar Two implementation varies across jurisdictions. While early adopters like Australia and the EU have announced their plans, others, such as Singapore, are taking a more cautious and deliberative approach, weighing the potential impact on their local economies and competitiveness.

Despite these complexities, the global momentum towards the implementation of Pillar Two remains strong. As countries continue to grapple with the tax challenges posed by the digital economy, the OECD's Pillar Two framework is poised to play a pivotal role in shaping the international tax landscape in the years to come.

How Can A&M Tax Help?

We have the experience across key jurisdictions to help clients with assessment of their global positions on Pillar Two and also the on-going compliance requirements for Pillar Two returns.

Footnotes

1. Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy.

2. Australia releases draft legislation to implement Pillar Two of the international tax reforms.

3. Key Tax Changes from Singapore Budget 2024.

4. Pillar 2 Work Progressing Despite Lack of US Implementation, Treasury Official Says.

Originally published 12 June 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.