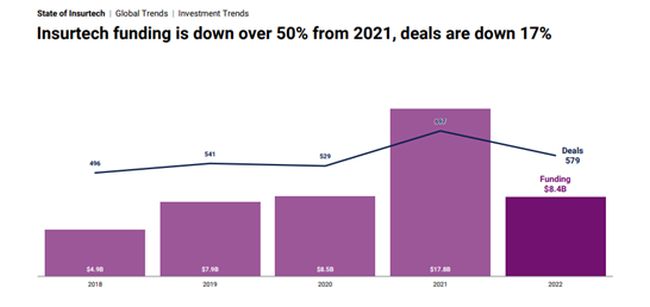

CB Insights' State of Insurtech 2022 provides a perspective on trends in the sector. In 2022, global insurtech funding fell over 50% to $8.4 billion, following 2021's record-breaking total funding of $17.8 billion. With about $1 billion in funding, the fourth quarter of 2022 marked the lowest amount raised since the second quarter 2018.

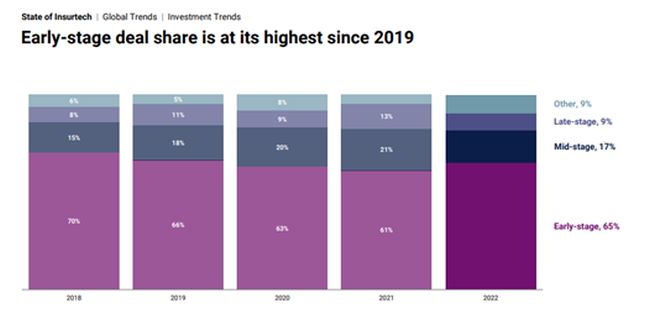

Down 17% from 2021, the number of deals in 2022 declined to 579 deals. The average and median deal sizes declined from their 2021 highs, returning to 2020 levels. The average deal size fell to $17.7 million in 2022, from $30.4 million in 2021. Overall, the United States led in funding and deals, followed by Europe and Asia. However, U.S. insurtech funding was down 60%. Early-stage deals accounted for the largest percentage of deals, both in the United States and globally. Early-stage deals accounted for 65% of insurtech deals globally in 2022, the highest share since 2019. The United States led in early-stage deal share, while Asia led in mid-stage deal share. In the fourth quarter 2022, Europe experienced its largest quarterly deal share since the second quarter 2019, and was the only region to see median deal size growth in 2022.

The number of M&A exits increased 40% year over year as companies capitalized on lower valuations to make acquisitions; there were a total of 81 M&A deals in 2022. Global mega round funding fell to its lowest level since 2018. Mega round funding dropped 90% in the fourth quarter 2022, with only one deal, which took place in the United States, raising $153 million. In the fourth quarter of 2022, there was only one unicorn birth, bringing the total of insurtech unicorns to 44. In the unicorn count, the United States leads the way with 25, followed by nine in Asia, eight in Europe, and one each in Australia and Latin America. In the fourth quarter 2022 there was a 67% decline in funding – marking the first quarter since the first quarter 2020 where P&C funding did not exceed $1 billion. Life and Health (L&H) insurtech fared better but still saw significant funding declines. Funding in this sector fell 58%, and deals fell 8% in 2022. Early-stage deal funding grew slightly and represented the largest L&H insurtech deal share.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.