Background

Our survey analyzed the terms of 229 venture financings closed in the fourth quarter of 2020 by companies headquartered in Silicon Valley.

Key Findings

Valuation results have rebounded sharply from pandemic troughs to historical highs

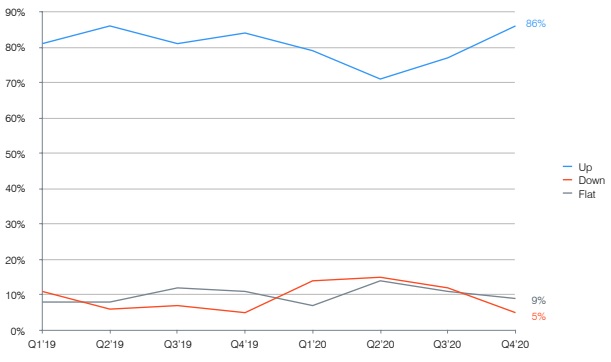

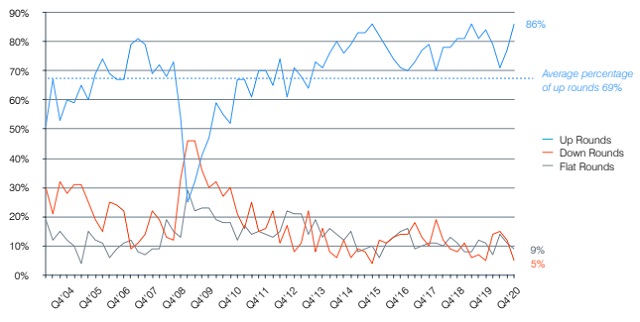

- Up rounds exceeded down rounds 86% to 5%, with 9% flat in Q4, an increase from the prior quarter when up rounds exceeded down rounds 77% to 12%, with 11% flat. This quarter had the highest percentage of up rounds since Q2 2019 and the lowest percentage of down rounds since Q3 2015.

- The Fenwick & West Venture Capital Barometer" showed an average price increase in Q4 of 125%, a significant increase from 76% in Q3 and the second highest average price increase recorded in a quarter since we began calculating valuation metrics in 2004.

- The median price increase of financings also rose sharply from 42% in Q3 to 83% in Q4, the highest median price increase recorded in a quarter in the history of this survey.

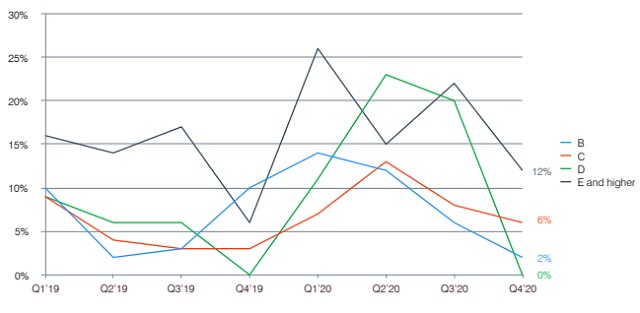

All series of financings, and Series D and E+ financings in particular, recorded stronger valuation results

- Valuation results across all series of financings improved in Q4 compared to the prior quarter. In particular, Series D and Series E+ financings recorded the greatest gains in average and median price increases compared to the prior quarter.

Valuations broadly strengthened across all industries

- Similarly, valuation results broadly strengthened across all industries in Q4 compared to the prior quarter. The software and internet/digital media industries again recorded the strongest valuation results in the quarter. The life science industry recorded valuation results that have surpassed pre-pandemic levels. Valuation results for the hardware industry have rebounded in the past two quarters from the lows recorded in Q2 2020, but remain down from pre-pandemic levels.

Use of senior liquidation preferences and participation rights declined

- The use of senior liquidation preferences and participation rights declined sharply in Q4 to the lowest percentages recorded in the history of this survey.

Fenwick & West Data on Valuation

PRICE CHANGE—The direction of price changes for companies receiving financing in a quarter, compared to their prior round of financing were as follows:

The percentage of DOWN ROUNDS by series were as follows:

EXPANDED PRICE CHANGE GRAPH—Below is the direction of price changes for each quarter since 2004.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.