- Only 1% of grocery shoppers remain loyal to a single store

- Acquiring a new shopper costs 5-25X of retaining existing ones

- The average shopper has 18 loyalty programs on their mobile phone

- Loyalty customers spend 1.5 times more per basket

- Loyalty customers make 2-3 more trips than regular shoppers

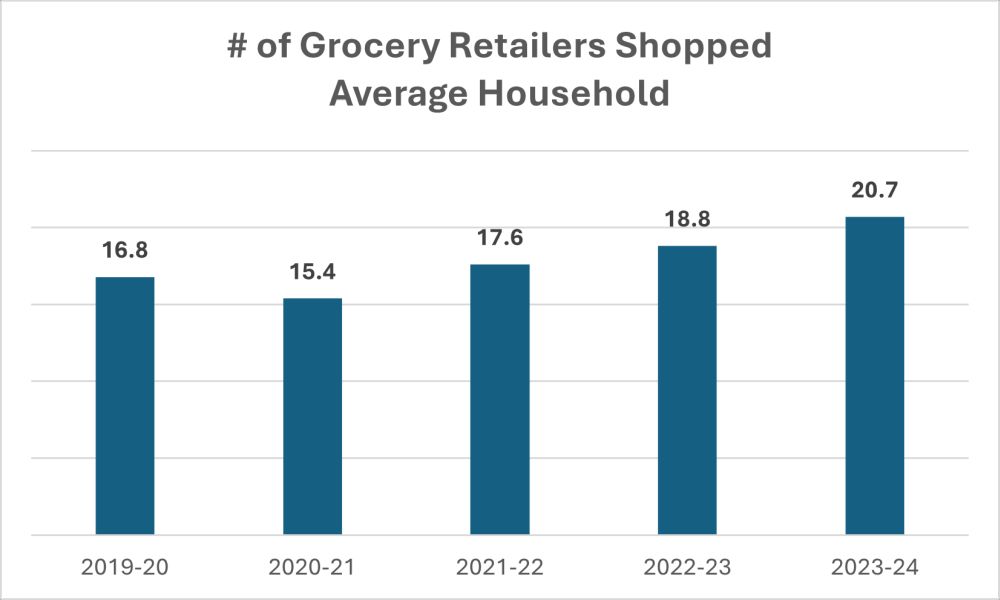

- Households shopped an average of 20.7 retailers in the 12 months between March 2023 and February 2024

Overview

Supermarket loyalty programs have existed since the 1980s and have changed drastically. Given the available technology, the growth in customer options, and the shift in preferences, there has never been a more critical time for a robust and effective loyalty offering than now.

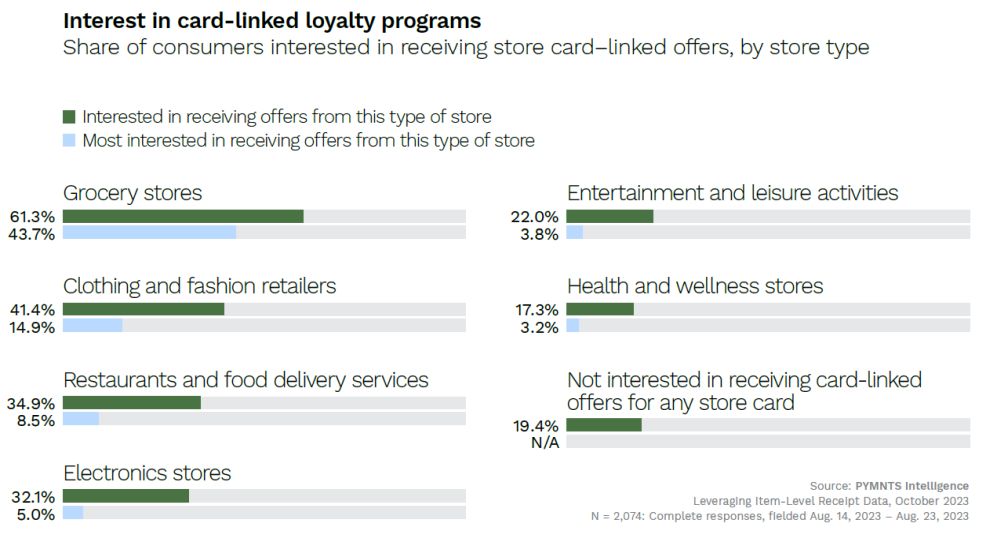

These programs have morphed into tools that can drive brand loyalty and margin and act as critical consumer touchpoints—touchpoints that shoppers are demanding at rates higher than other industries (see graphic below).

By analyzing your customers' shopping carts, retailers have found that this data is a powerful tool. It not only improves personalization and the shopping experience but also becomes a profitable way to monetize your customers' shopping behaviors, fund promotional activities, and better align product assortments with consumer preferences. This data-driven approach can give you a competitive edge in the market.

During the pandemic, supermarkets had shoppers' (almost) undivided attention. That is no longer true. Shoppers, on average, will visit between four and nine different grocery banners, and only 1% remain loyal to a single store. How do you plan to get their attention and keep it?

Market Impacts

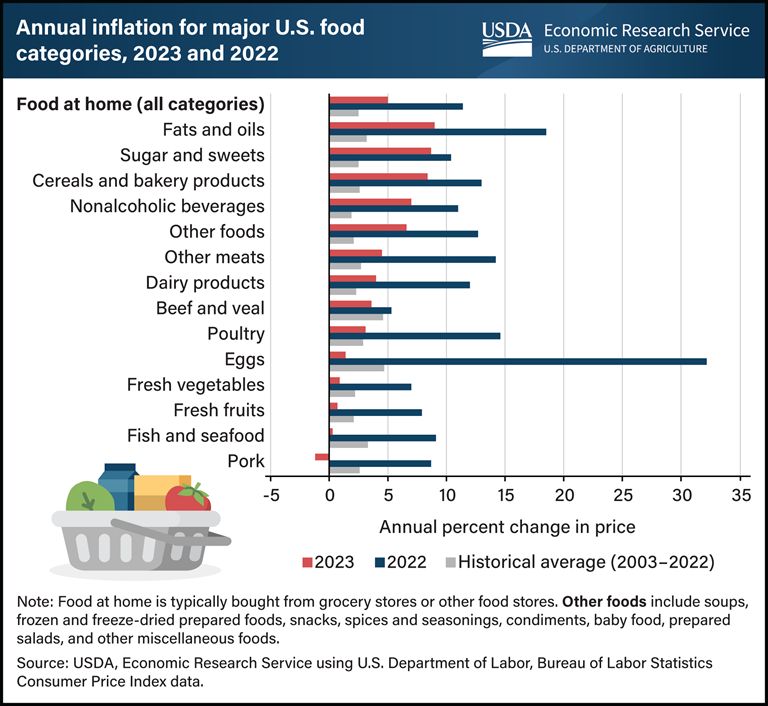

With inflation tracking well above historical averages across most supermarket categories, consumer loyalty may continue to fall behind price as shoppers become "hungry" for better deals.

Traditional high-low supermarkets are facing competitive headwinds from all directions. Big Box discount stores like Walmart and Target continue to expand their offerings, focusing on an Everyday Low-Price (EDLP) strategy. Smaller format players like Trader Joe's and Aldi showcase their value through private labels. Dollar General and Dollar Stores continue to evolve their grocery offerings, even expanding the availability of produce, an essential trip-driving category, now available in 5,400 or 27% of their locations.

With an abundance of options and ways to buy groceries (In-store, order online and pick up, and delivery), how do supermarkets convey value, drive traffic, and ultimately, loyalty, retention, and sales? Research shows that acquiring new customers costs between 5x and 25x that of retaining existing shoppers.1 Knowing this, we believe there is a better, more effective, and profitable way.

Makings of a Robust Loyalty Program

Shoppers are being squeezed, as evidenced by the number of places they shop for groceries. In the 12 months between March 2023 and February 2024, the average grocery consumer visited 20.7 locations, up 23% from the previous period.5

The average consumer has 18 loyalty programs on their phone, two to three of which are supermarket/grocery programs.2 Your program must accomplish three key things to keep shoppers coming back:

It needs to be interconnected.

- It should be a touchpoint for all your shoppers' needs, including the ability to schedule pick-ups and deliveries, view inventory, use a store aisle locator, create shopping lists and recipes, etc.

- Seamless linkage from emails and SMS with intuitive navigation that facilitates action

It needs to be relevant.

- Supermarkets must leverage their shopper data for more than just sales, units, and basket size analysis to create personalized offers and recommendations demonstrating deep knowledge of customers' shopping preferences. Loyalty program members spend 1.5X more per basket and make 2-3x more trips than the average shopper.3

- Deals/promotions/coupons should be easy to find, pertinent to how your members shop, and loaded onto their cards with minimal effort.

It needs to be easy.

- Use point systems or cash back, which they can accumulate to incentivize them to return. For example, Giant Eagle allows members to stack rewards for free fuel or 20% off groceries. Albertson's regularly provides dollar-off coupons ($5 off $25 or $10 off $50) to their loyal customers.

- Partner with other value-add services, i.e., fuel, to create even more value and reasons for shoppers to use your program

Summary

As supermarkets navigate the evolving landscape of ever-changing consumer demand, unparalleled access to data coupled with technological advancement will help supermarkets build profitable and enduring relationships with shoppers.

By adapting to market shifts, proactively addressing challenges, and prioritizing customer-centric strategies, supermarkets can maximize the impact of their loyalty programs and drive sustainable and profitable growth in an increasingly competitive market. Kroger, most notably credited with being one of the first to leverage personalization to create a competitive advantage, attributes much of its store comp growth to their shopper data efforts. Kroger shoppers redeemed 4 billion coupons in 2023, 1 billion more than the year prior. Most recently, through these personalized deals, their program grew the number of digitally engaged households by 18% in Q4 of 2023.4 Given the recent success and growing importance of loyalty and personalization programs, players like Target and Walmart continue to invest heavily in this space.

We know that loyal shoppers visit your stores more frequently, spend more money, have greater depth and breadth in their shopping baskets, and stay with you longer IF you deliver a program that speaks to them and fits their needs.

Does your loyalty program speak to your shoppers?

Ankura Performance Improvement Fundaments

We have a proven track record of executing strategic plans to achieve sustainable performance improvement and targeted operating results aimed at maximizing earnings before interest, taxes, depreciation, and amortization (EBITDA), cash flow, and ultimately shareholder value.

We work side-by-side with management and other stakeholders to guide companies through periods of uncertainty and subsequently accelerate growth and value creation.

Ankura's Performance Improvement professionals leverage their deep expertise across the firm to bring the appropriate specialized resources in shopper analytics, customer segmentation, promotion management, and optimization, and loyalty program set-up/execution, to deliver solutions to complex problems to create optimal outcomes.

Footnotes:

1. Harvard Business Review – "The Value of Keeping the Right Customers"

2. Upside.com – "How Grocery Loyalty Programs Stack Up Against the Big Five"

3. Internal Ankura Research of Grocery Loyalty and Shopper Spend

4. eMarketer – Kroger: Retail Media Hasn't Peaked

5. Wall Street Journal – The Era of One-Stop Grocery Shopping is Over

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.