This post continues our examination of the "10% buffer" for Hedging Derivatives, which refers to the amount by which the notional amounts of Hedging Derivatives can exceed the value, par or principal amount of the hedged equity and fixed-income investments. In this post we consider whether funds should apply the 10% buffer to Hedging Derivatives in the aggregate or on a "hedge-by-hedge" basis.

The Argument for a Unitary 10% Buffer

The provision of Rule 18f-4(c)(4)(B) establishing the 10% buffer is worded in the plural:

We applied this literally in our first derivatives exposure equation, measuring the sum of the notional amount of Hedging Derivatives (expressed in dollars) to 110% of the aggregate dollar value, par amount or principal amount of the corresponding hedged equity and fixed-income investments and borrowings. This approach should exclude the largest notional amount of Hedging Derivatives and thus minimize a Limited Derivatives User's derivatives exposure. As we noted in the post on the derivatives exposure equation, our formulas sought to resolve ambiguities in Rule 18f-4 so as to produce a smaller derivatives exposure. This approach would also reduce the frequency and costs of resizing Hedging Derivatives, which is one objective of allowing a 10% buffer.

A Currency-by-Currency Approach

While plausible in theory, we are not as confident about this approach in practice. It would permit, for example, a fund with Hedging Derivatives for investments denominated in euros, sterling and yen to use the 10% buffer for yen and sterling to exclude short-interest in euros well in excess of the value of the fund's euro denominated investments. This makes the size of the buffer for any one currency depend on how many other currencies a fund is hedging, which would be an odd policy.

Applying a 10% buffer on a currency-by-currency basis may be more consistent with Rule 18f-4's requirement that Hedging Derivatives hedge specific investments and our view that an excluded currency hedge must be for the same currency as those investments. It would also be consistent with the discussion of Hedging Derivatives in the adopting release, which uses the singular rather than the plural:

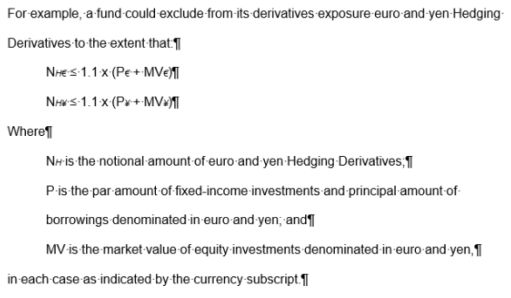

In any event, a fund should not be faulted for applying a separate 10% buffer to each currency, as this would reduce the notional amount of excluded Hedging Derivatives. For example, a fund holding equity investments with a value of ?10 million and ¥1.3 billion could exclude euro currency hedges with notional amounts up to ?11 million and yen currency hedges with notional amounts up to ¥1.43 billion. This approach would also allow a fund to calculate its excluded currency Hedging Derivatives without having to convert the notional amounts into dollar equivalents.

A Generalized Approach

This alternative approach could be extended to interest-rate Hedging Derivatives by using the par or principal amounts of the specific fixed-income investments or borrowings being hedged to calculate the 10% buffer for the corresponding Hedging Derivatives. The result would be a series of equations equal to the number of specific currency and interest-rate Hedging Derivatives the fund employs.

Note the investments and borrowings in the same currency are still aggregated, as they involved the same hedged risk: the exchange rate of the euro or yen as the case may be.

Conclusion

Absent further guidance, the literal terms of Rule 18f-4 would support applying the 10% buffer to a fund's Hedging Derivatives in the aggregate, rather than on a hedge-by-hedge basis. However, we suspect that a hedge-by-hedge approach would be more consistent with the SEC's intent in creating the 10% buffer. This approach would calculate the size of the 10% buffer based on the value, par amount or principal amount of all investments being hedge (e.g., all sterling denominated investments) by a given Hedging Derivative.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.