Bottom Line

President Biden signed the Merger Filing Fee Modernization Act of 2022, bringing notable changes to the merger filing process and state antitrust enforcement. The Act does the following: 1) Dramatically increases merger filing fees for the largest transactions while decreasing fees for middle-market deals; 2) Requires disclosure of certain foreign subsidies; and 3) Allows state attorneys general to avoid consolidation of state antitrust cases into multidistrict litigation.

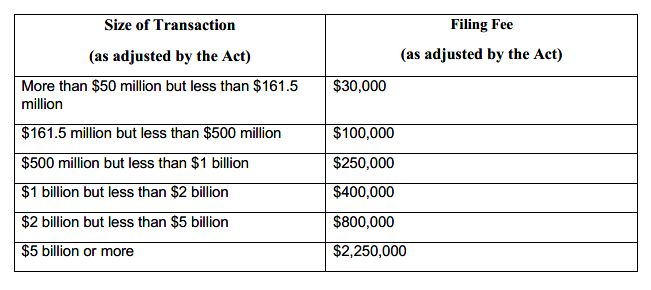

Large transactions will require higher filing fees

The Act updates premerger notification filing fees under the Hart-Scott-Rodino ("HSR") Act. Deals valued at less than $1 billion will have fees reduced to a range between $30,000 and $250,000. For transactions valued between $1 billion and $2 billion, the fee will be $400,000; deals between $2 billion and $5 billion will come with an $800,000 fee; and the fee for mergers above $5 billion will be $2.25 million.

The changes do not take immediate effect, so for now the fee structure that has been in place for the last twenty years will remain, with fees capped at $280,000 for transactions valued at $1,009.8 million or greater. Going forward, both the fee thresholds and fees themselves will be adjusted annually based on the Consumer Price Index.

The increase in fees will result in an estimated additional $1.4 billion in funding available to the FTC and DOJ over five years according to the Congressional Budget Office, increased resources that proponents of the higher fees say is necessary to fund agency enforcement priorities. Dealmakers can therefore expect continued aggressive enforcement from better funded agencies.

Companies will need to report subsidies received from certain foreign actors

The Act also requires parties making HSR pre-merger notification filings to disclose subsidies received from foreign entities "of concern," such as those controlled by governments like China, Russia, and Iran, or entities associated with specifically designated foreign nationals. In addition to the competitive effects such subsidies may have, the reporting requirement is intended to address concerns over the impacts of such subsidies on U.S. national security.

State attorneys general can now prevent MDL consolidation

Finally, the Act allows state attorneys general suing under federal antitrust law to avoid consolidation into multidistrict litigation. This will allow attorneys general to prevent antitrust cases from being consolidated and transferred to a venue outside the home state, which could have the effect of forcing parties to defend functionally identical litigation simultaneously in several locations, an inefficiency the MDL process was designed to avoid, and instead allowing each state's AG its own "home court advantage." This provision is not retroactive and will apply only to matters filed after the Act's enactment.

Main Takeaway

Significantly higher filing fees and increased disclosure requirements add several risks to the deal making process in an already aggressive antitrust landscape. Companies should seek experienced counsel to guide them through these issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.