For months now we have been talking about dark patterns and all the regulatory chatter associated with them. Many, including us, have been wondering whether it would end up being much ado about nothing, with dark patterns just being a new name for practices such as bait and switch that have long been considered unlawful. But, we warned, dark patterns had the potential to dramatically reshape how we look at marketing and blur if not obliterate the lines between clever marketing and unlawful marketing. For anyone who thought we were simply engaging in a theoretical law school exercise and likely crying wolf, developments over the past few months suggest that dark patterns are more likely to end up in the latter rather than the former category.

Why do we say that? Well for starters, attention to dark patterns has migrated from workshops, speeches and press releases to complaints and a consent order. In the recent $100 million FTC settlement with Vonage, the consent order specifically prohibited the use of dark patterns to frustrate cancellation efforts. Dark patterns were defined as:

[Any] user interface that has the effect of impeding consumers' expression of preference, manipulating consumers into taking certain action or otherwise subverting consumers' choice.

Well, that definition worries us more than a little bit because, as we've repeatedly said, isn't advertising in part intended to manipulate, even if in the nicest possible, non-misleading way? And we hear there may be more consent orders with dark pattern language in the proverbial pipeline.

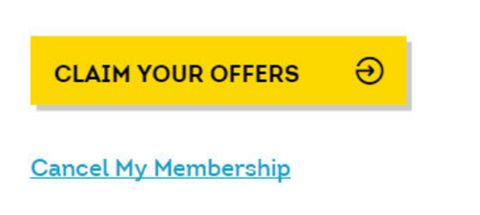

To further keep you up at night, two recent CFPB complaints call out as dark patterns practices that might just sound like clever marketing to some. One of the CFPB's allegations is that when a subscriber tries to cancel its credit monitoring plan with TransUnion, they are presented with a "choice between a prominent yellow button and smaller blue text, the latter of which is what the consumer needs to click on to cancel." Thus, the CFPB alleges, the cancellation process is difficult and confusing.

Now, many of you might be saying, sure, the yellow button is more prominent than the blue text, but the blue text is also prominent and hard to miss. And we might even agree with you. But the CFPB apparently believes being "clear but also less clear than the business preferred option" not only means more consumers might click on the yellow but that it is also misleading.

Another recent CFPB complaint reinforces this conclusion. In a case against the third-party event registration site ACTIVE, the CFPB alleged that after consumers provide their event registration and payment information, they are presented with an inserted offer for Active Advantage, a monthly subscription discount club. At the bottom of the inserted offer, consumers are presented with two buttons – a bright blue highlighted box titled "Accept" and a dark gray unhighlighted text box titled "No Thanks." By clicking one of these choices the consumer either enrolls in the discount club or rejects it; in either case, the consumer is then taken to a confirmation page for their event enrollment. In its complaint, the CFPB highlights testing done by the company that showed the word "Accept" on the call-to-action button yielded significantly higher rates of consumer enrollment than did words such as "Start Free Trial," "Enroll" and "Accept Membership." Now, we're not necessarily defending what was done in this instance, but it is interesting to see that an end result analysis (more consumers signing up) seems to be substituted for a careful traditional analysis of whether the webpage deceives consumers. So, is it time to push the panic button? Perhaps not yet, but it's certainly time to pay close attention to what is going on with dark patterns. And it may be time to pay closer attention to some of the things your marketing department is doing. Are consumers being presented with two choices that are both prominent but one is more prominent? If so, it may be time to at least flag that as a point of discussion. Similarly, are call-to-action buttons or other aspects of web design being chosen based on consumer research that indicates which of multiple "clear" yet different designs is more likely to get the desired outcome? If so, this may be another place in which to have a conversation about risk tolerance. This all may get very interesting, though we wonder what a federal court would say should a dark pattern case ultimately wind up there.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.