Although partnerships are the most used business structure within the agricultural community, they are frequently misunderstood and can result in dispute.

Partnerships provide great flexibility for decision making, profit sharing and land ownership which can also aid both capital and income tax planning. However, this flexibility can also lead to a lack of clarity whether that be in relation to decision making, profit sharing, business ownership or the legal vs beneficial ownership of land.

This article considers land ownership and how, if not clearly documented, income tax planning and profit-sharing adjustments can lead to disputes over the ownership of the business, and assets used in the business.

Land ownership

Just because someone's name is on the title deed (the legal ownership) does not necessarily mean they are the beneficial owner. If the land has been included on the balance sheet of the farming partnership, then someone could argue that this is an indicator (amongst others) of the property belonging to the partnership.

It maybe that there is a field that is shown as partnership property but that an individual partner considers it to be in their personal ownership. The property, the field in this example, could be partnership property but the capital profit sharing ratio may be 100% to the individual partner meaning that if the field were ever sold the individual partner would be entitled to 100% of the proceeds from the sale.

The actual ownership is crucial when considering Wills and where assets are passed on death. A partnership agreement trumps a Will. Unfortunately, this can lead to assets not making their way to the intended recipient following the death of a partner. Everything is possible but it is important that ownership is clear in the partnership accounts, ideally included in a well-drafted partnership agreement, and everyone understands the ownership so Wills, the accounts, and the partnership agreement can correctly reflect the intentions.

Share of the partnership

The lack of clarity within partnerships is often not helped by the absence of a formal written partnership agreement meaning there can be implied terms.

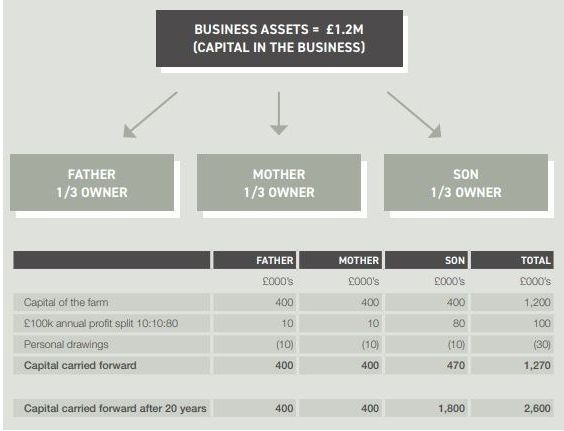

Although the Partnership Act 1890 governs partnerships that have no formal agreement and states that profits will be split equally, regardless of the time, effort and capital investment, this may not always be the case. Should you have repeatedly given 80% profit to 'son' and 10% to both mum and dad this could become implied normal going forward.

Partnership profit sharing can be flexed in line with the work of individuals or to assist with tax planning. Farming partnerships function by profits being retained, increasing individual partners' current accounts. Personal drawings are made from the current accounts by the partners to cover their living costs or spend as they wish.

All profit-sharing allocations together with personal drawings can be seen within the current accounts of the partnership and are often displayed towards the back of the financial accounts. Within farming partnership accounts there is often only one current and general capital account and by retaining profits the capital of the partnership can become impacted.

So, does son now own 70% of the farm as his capital, £1.8M of the £2.6M total? Or is the farm still owned 1/3 each?

This will depend on how the asset ownership and partnership agreement is documented.

Such situations are easily avoided through investing in a formal partnership agreement and ensuring this is supported in the financial accounts.

Clear ownership is of increasing importance due to the rising value of agricultural land and property. These values have meant that disputes are more common.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.