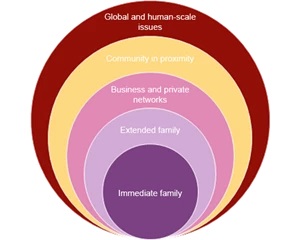

Wealth and responsibility do, in many ways, go hand in hand. Indeed, wealthy families are not so very different from any other family, with a 'biological' responsibility centred on health, safety and wellbeing towards family members and their interests. But there are often wider responsibilities too. For example, one may own or manage a business and be responsible for the livelihoods of employees and the returns for investors; or a HNWI may face particular risks given their status and hold a commensurate responsibility towards the security of the family.

Throughout history, there has been a prevailing notion that wealth brings with it a sense of responsibility which reaches out beyond the family's immediate circle of personal and business interests and relationships. Philanthropy, in particular, has been synonymous with wealthy families for generations.

This idea of the responsibility which wealth brings with it was one of the unifying and recurring themes which came up time and again in the interviews we conducted with leading advisers in the HNWI industry for our report "The Generation Game: The Great Wealth Transfer and the Outlook for Families in 2021 and Beyond". The report considered the key trends that will shape discussions around wealth stewardship as families and their advisers prepare for the next transfer of assets and ensure the sustainable management of familial wealth for the future.

Those interviews were conducted during the strictures of the Covid-19 lockdown and so we had little opportunity to cross-examine our contributors and identify points of consensus and indeed difference. We were pleased then to be able to host the interviewees at a follow up round table discussion last month where, not least given the impending commencement of COP26, wealth and responsibility was again the main talking point.

At a time when the world is facing existential challenges on many fronts - from the climate emergency to the Covid-19 pandemic - and when there is heightened public scrutiny of wealth (its origins, use and management) as well as an expectation that it can, and should, be leveraged to make substantive impact on some of the critical issues facing society and the planet, responsibility is now writ large.

No longer is making decisions solely in the interests of one's immediate family or business the primary focus, with a portion of financial gains then being used for altruistic purposes. Increasingly, families are considering how they can operate in a way that aligns financial returns with real, sustainable benefits and impact, using all of their wealth responsibly. There's a growing recognition that the two can - and should - work together in tandem. Indeed, the notion of 'taking care of one's family' is now often seen within a broader planetary context, with real concern for the world which the next and future generations will inherit.

The sheer scale of commitments made at the COP26 climate summit in Glasgow underscores the strength of feeling towards the use of wealth for vital causes. Among the philanthropic initiatives announced, some of the world's leading foundations including the Rockefeller Foundation and the Bezos Earth Fund joined together to launch a new body, the Global Energy Alliance for People and Planet. This pledged $10bn of funding to support the renewable energy transition in emerging economies.

This might be good old philanthropy in action but a focus on ESG investing is also on the rise, as recognition grows that delivering financial rewards and achieving positive environmental or social impact need not be mutually exclusive. According to one recent report, impact investing accounted for around a third of high net worth individuals' (HNWIs) and family offices' portfolios last year, but investors now forecast that this will increase to over half by 2027. This trend is being driven not just by a desire to support good causes, but also by growing evidence that this does not have to come at the expense of returns - and indeed that ESG investments can even outperform the market.

The flipside to all this is, somewhat counterintuitively perhaps, responsibility again. Yes, there is a significant and growing shift in how families perceive and wish to deploy their wealth. But that brings with it new responsibilities - how to adjust investment strategies sustainably, for example; or how to carefully manage decision-making processes so as not to alienate family members; or even how to review one's tax position in light of new transparency and compliance requirements.

These issues, and more, were expanded on in our Generation Game report and are now more important than ever for families and their advisers to consider.

With this in mind, and following our round table discussion, we will be publishing a series of short blogs covering topics ranging from investing in intangible and digital assets such as non-fungible tokens (NFTs) and cryptocurrencies, as well as ESG, to what happens when wealth owners choose to go down a different route to the traditional inheritance model, or how to manage conflict when family disputes impact philanthropic aims.

The Generation Game: The Great Wealth Transfer and the Outlook for Families in 2021 and Beyond" is available to read here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.