Adoption of both the Unitary Patent and the Unified Patent Court has been strong. But what lies behind the numbers?

In this article, Caroline Day looks at the first year of the Unitary Patent, the Unified Patent Court and their successful adoption and impact, focusing on insights behind the figures and analysing the top ten technology categories.

The Unitary Patent and the Unified Patent Court recently celebrated their joint first birthday, and it was an occasion worth celebrating. Adoption of both systems has been strong and, pending at least some desirable IT improvements to the UPC case management system, generally successful.

The first year saw over 28,000 requests for unitary patents, 64.2% of which were from EPO member states, and with US applicants leading the global uptake at 16.1% followed by China (6.0%), Japan (3.8%) and the Republic of Korea (3.3%)1.

The Unified Patent Court has been busy too: as of 1 June 2024, a total of 373 actions had been filed, including 134 infringement actions, 63 of which gave rise to at least one counterclaim for revocation. The Court of First Instance received 32 applications for provisional measures, preserving evidence and orders for inspection, and 39 revocation actions. A total of 16 appeals have been filed at the Court of Appeal, along with 2 requests for discretionary review, 5 applications for suspensive effect and 15 applications for an order for expedition of an appeal2.

But how about some colour behind those numbers?

Subject matter of Unitary Patents

Every year, the EPO publishes statistics concerning the number of patent applications filed in each technology area3. The EPO has also made similar statistics available in relation to Unitary Patents4.

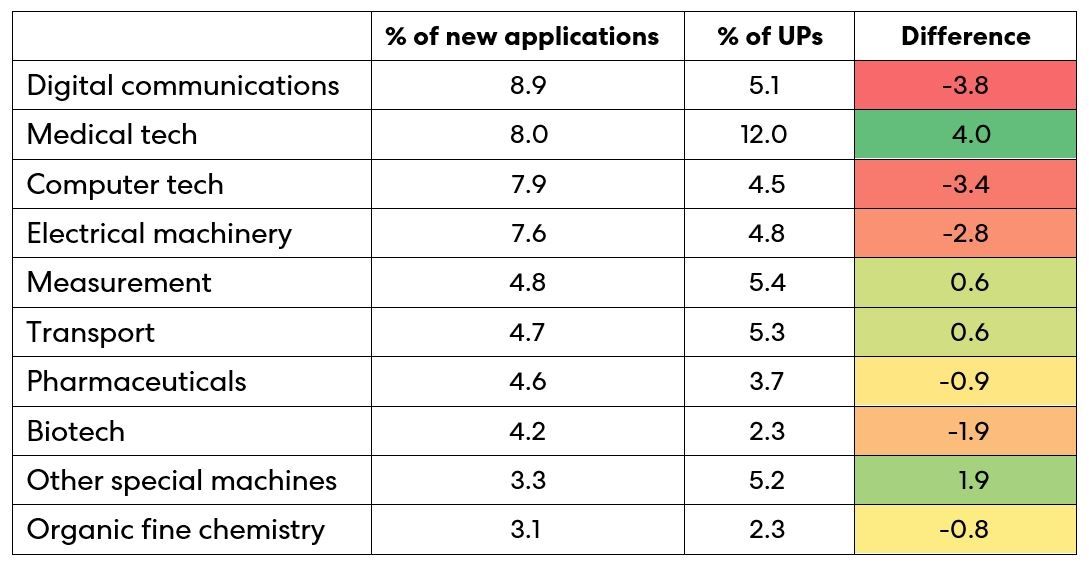

I've looked into the top ten subject matter areas for new applications in 2023, along with the proportion of applications in each category, given all the applications filed. This is represented in the table below, in which a similar value is given for Unitary Patents requested in each category.

Of course, unitary effect is requested at the end of the patent process, and thus to some extent the pool of applications which could become UPs reflects applicants' filing strategies over the last several years, with the EPO generally taking between two and five years to allow applications. Nevertheless, a comparison between the proportional representation of each technology classification makes interesting viewing.

The figures in red indicate categories that are underrepresented amongst Unitary Patents (UPs) compared to new filings, while those in green are overrepresented. You can see the biggest discrepancies are in the first few categories.

What could account for these variations?

I note that Qualcomm is a top filer in the Digital communications category, and has been a keen adopter of the UP system, but is closely followed by Huawei, which has been somewhat more circumspect in its filing of UPs, possibly explaining the relatively small proportion of UPs in this field.

In contrast, UPs seem popular amongst Medtech patentees. This could be disproportionately skewed by Johnson and Johnson, the top holder of UPs and within the top three applicants in this category.

It is somewhat harder to guess the reason for the underrepresentation of Computer tech in UPs. The top filers in this category include Huawei, Samsung, Siemens and Qualcomm, all of which feature relatively high up in the charts of UP holders. Could these companies be focusing on other technology areas when selecting which applications become UPs?

Unified Patent Court: An experience worth repeating?

While it remains a little early to draw clear conclusions as to trends, as time goes on, some companies are rapidly racking up experience of the Unified Patent Court.

Panasonic, for example, used the UPC to open up a new front in its Standard Essential Patent battle with OPPO and Xiaomi.

Abbott Laboratories, in various forms, appears to have been the most frequent flier in terms of court hearings, with cases concerning continuous glucose monitoring against SiBio and DexCom, perhaps reflecting the Medtech industry's investment in the UP/UPC system, as backed up by the UP figures above.

While the hearings so far have been held in first instance Divisions in Germany, France and at the Court of Appeal in Luxembourg, use is being made of much of the full geographical of the courts, and it seems the Europe-wide system is just warming up.

My colleagues and I are keeping a close eye on how the courts are being used and will report any trends as they emerge.

Footnotes

1 A successful start for the Unitary Patent | Epo.org

2 Case load of the Court end May 2024_final.pdf (unified-patent-court.org)

3 Statistics & Trends Centre | Epo.org

4 Statistics & Trends Centre | Epo.org

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.