There are a variety of benefits to moving offshore, yet few would argue the assertion that tax neutrality is paramount among them. As anyone familiar with the phrase "tax haven" would surely recognize, many countries offer strongly favorable tax terms as an incentive to draw new business.

While these incentives can generate greater profits, the host nation typically benefits as well. By creating a hospitable corporate environment, smaller nations can lure significant international wealth across their borders.

Additionally, moving into an international market often provides companies with access to a wide variety of non-traditional investments — opportunities that may not be accessible via a domestic bank or brokerage firm.

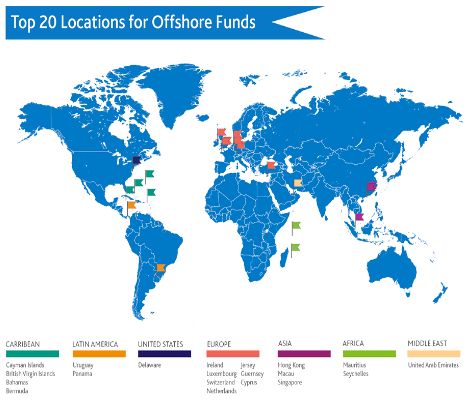

Listed below, and grouped by region, are some of the world's premier locations for offshore funds.

The Caribbean

Cayman Islands

The Cayman Islands have a history of serving as a preferred destination for funds being advised by investment banks. The country ranks first globally among offshore hedge fund domiciles, and is the fifth largest financial services center in the world.

The Cayman Islands' popularity is explained by many factors, including a stable government, pro-business policies, and advanced legal system—as well as numerous tax-free incentives with minimal financial regulation and oversight.

The British Virgin Islands

The British Virgin Islands offer one of the best, most respected financial sectors not only in the Caribbean, but on a global scale. Along with its modern, efficient banking system, the government has placed considerable focus on developing strict money laundering and tax evasion standards. Since the adoption of the BVI Business Companies Act in 2004, more than half a million firms have been incorporated on the island.

This emphasis on transparency has earned the British Virgin Islands a stellar reputation in the financial community and a spot on the OECD's "white list".

The Bahamas

Thanks in part to its progressive government policies; this small island nation is attractive to those seeking a favorable offshore location. The Bahamas has earned the distinction of being the first independent nation in the Caribbean with IOSCO A Status. This came after the Bahamas reached Signatory A status under the Multinational Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information (the MMoU) of the International Organization of Securities Commissions.

There are many advantages of incorporating in the Bahamas, including complete anonymity and confidentiality to investors; exemption from local taxes and stamp duties; ease of company incorporation; and minimum requirement of one shareholder and one director.

Bermuda

This wealthy fund domicile possesses two major distinctions. First, it serves as the world's third largest reinsurance center, trailing only the comparably massive New York City and London. Second, the island nation is also very popular in terms of insurance-linked securities.

Ideally situated between the U.S. and Europe, Bermuda melds attractive tax policies with world class financial services. Investors can rely on a solid network of experienced and knowledgeable service professionals to provide assistance in legal services, fund administration, audit and tax advisory, director services, and other areas concerning fund management.

Latin America

Uruguay

The establishment of multiple free trade zones, located at strategic points, has made Uruguay a popular offshore destination. These free trade zones host a variety of key services, including call centers, financial institutions, warehouses and logistics operations.

Uruguay is known for its strong protection of banking secrecy. Like Switzerland, Uruguay offers investors an enticing combination of low taxes and banking privacy. While a company's finances may be inspected by anyone, the names of directors and shareholders are kept off of public records. This commitment to privacy and a robust economy are the main reasons behind the country's reputation as a safe tax haven.

Panama

Panama's status as the Western Hemisphere's largest free trade zone is attributable to several important factors. The country has a strong economy, a stable government, favorable tax laws, and a nearly ideal geographical location, thanks to both Panama Canal and its close proximity to the U.S.

Panama is well known for being a major international banking hub, with more than 80 international and domestic banks operating within its borders.

United States

Delaware

When it comes to private equity, this small East Coast state is a titan. It ranks first in importance (by a wide margin) for this asset class. It also serves as one of the favored domiciles for real estate funds.

Delaware Delaware's advanced business statues make it an attractive place for global investors. Reviewed and updated on a regular basis, these statutes provide ease, clarity, and flexibility in business entity formations and transactions, including mergers, transfers, and conversions.

Europe

Ireland

Aside from those working in the financial services sector, Ireland's top status as an offshore destination may come as a surprise to many potential investors. However, Ireland offers myriad compelling arguments to support its status as a major offshore jurisdiction.

First, Ireland offers highly favorable tax rates, along with easy and efficient access to the massive European consumer market. Second, Dublin serves as a key hub for fund servicing operations within the global asset management industry. Finally, the country is a world leader in aircraft leasing. Its combination of European Union membership, strategic location and business-friendly laws make Ireland one of the most popular offshore options.

Luxembourg

While it may be one of Europe's smallest nations, Luxembourg is the largest European Union fund domicile. That's due in part to the country's top S&P rating. Luxembourg revels in the highest ratings from leading agencies such as Moody's and Fitch, and remains the clear financial sector leader in the Eurozone.

Investors appreciate the country's extreme stability in regards to its politics, economy, and tax policies. Luxembourg is also gaining attention for its creation of low-tax, high-security storage facilities for the housing of assets such as fine art, precious metals, classic cars, and even wine.

Switzerland

The words "Swiss" and "banking" go together like "peanut butter" and "jelly." That's because this central European financial services giant has a long history of neutrality, offering investors strict confidentiality of clients and transactions, secure banking, and a strong currency. These attributes make it a near perfect environment for investment.

Switzerland is also at the forefront of modern banking technology, not only working on ensuring the security of online transactions, but also on improving user experience via digital means. This may involve the use of innovative ways of logging on to accounts—such as through voice or facial recognition—or the development of applications that allow investors to better visualize their portfolios.

The Netherlands

Long hailed as a global hotspot for international business operations, The Netherlands's strategic location provides ideal access to major markets in Europe, Africa, and the Middle East. The country is well-known for its stable political and economic climate, skilled workforce, and efficient, orderly government processes.

The Netherlands offers a wide range of tax advantages. Although the marginal corporate tax rate is 25%, there are opportunities of lowering the effective rate, such as taking advantage of the country's extensive network of double taxation treaties.

The Channel Islands – Jersey and Guernsey

Known as the Channel Islands, the UK Crown dependencies of Jersey and Guernsey may not have much global name recognition. Yet, they are extremely prominent in the financial services realm. The Channel Islands are associate members of the EU, and are among the best-regulated and most well established offshore financial centers on the planet, proving particularly popular in the areas of private equity and real estate.

Jersey is long established as a strong financial center. It is the larger of the two islands in terms of services, specializing in a variety of fund categories. Jersey also offers a number of low-tax business formats.

Guernsey has a well-developed financial infrastructure, offering strong banking, investment advice and management, and fund management services. It is a leading domicile for captive insurance and private equity funds in Europe. The Channel Island's Stock Exchange is based in Guernsey.

In 2015, the European Securities and Markets Authority (ESMA) recommended that Jersey and Guernsey receive EU AIFMD passport rights, thereby extending the market access of the Channel Islands to EU countries.

Cyprus

Cyprus' status as an offshore area of note was given a boost by its admittance into the European Union in 2004. The country benefits from the EU's single market directives and its own emerging body of jurisprudence.

Advantages of incorporating in Cyprus include a low corporation tax, no capital gains or dividend tax for non-residents of Cyprus, a strong business infrastructure, and a legal system based primarily on English law.

Asia

Hong Kong

Few jurisdictions are more strategically situated than Hong Kong, which serves as a dual gateway into both Western and Eastern markets, including the rapidly growing Chinese market. Hong Kong boasts extremely business friendly tax laws, with no capital gains, withholding, or dividend taxes. Hong Kong also gets points for the easy, streamlined nature of its tax system.

The reasons behind the growing popularity of Hong Kong as a fund domicile include its close proximity and relationship with China, the ability to hold funds in a range of currencies, attractive interest rates, and favorable tax laws for foreign investors.

Macau

For companies looking to do business in China and other parts of South East Asia (and not operating domestically), Macau is as an increasingly attractive market because of its distribution of UCITS funds. This is important, as the number of UCITS funds for sale across Asia has increased significantly.

Singapore

Singapore possesses one of the fastest growing wealth management industries. It is a worldwide leader in financial services with an extremely favorable tax system. Like Hong Kong, Singapore provides a strategic point of entry to the Asian market, but without being burdened by the perception of being too heavily influenced by China. The tax rates of this island nation are among the lowest in Asia. Singapore is working towards greater tax transparency, although the banking industry still has tremendous influence over government policy.

Africa

Mauritius

Drawing attention as an international financial center on the rise, Mauritius is an attractive domicile for investment funds in emerging markets, particularly in India. It offers excellent access to Asia, South Africa, the Middle East and Europe.

With a reputation for being well established, this small island has both a regulated—and pragmatic—environment, and an extensive double-tax treaty network.

Seychelles

Seychelles has emerged as an increasingly popular offshore choice. That's particularly true with regard to mutual and hedge funds, which can be constituted as a company, an international trust or limited partnership.

One factor contributing to the rise of Seychelles as a top fund location is the republic's commitment to bank secrecy. The names of beneficial owners, directors and shareholders are not part of public record. Additionally, a Seychelles IBC benefits from low set-up costs; an exemption from all local taxes and stamp duty; and no disclosure of minimum capital requirements. Critics have accused Seychelles of not doing enough to combat harmful activities such as money laundering. However, Seychelles has expressed a firm commitment to change by working to improve its legal framework and practices in regards to tax matters.

Middle East

UAE

Lacking the deep oil reserves of surrounding nations, the key UAE city of Dubai has transformed into a world class financial center in order to overcome this shortcoming by dedicated its efforts to managing the money of its oil rich neighbors. The strategy proved remarkably successful. With low taxes and Swiss-level privacy, the politically and financially stable UAE is an increasingly popular offshore destination.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.