The Insolvency Rules 2016 (the 2016 Rules) have effect from 6 April 2016. A key change introduced by the 2016 Rules is a new approach to decision making, including a deemed consent procedure. The new approach is designed to ease the administrative and cost burden in insolvency proceedings, and is summarised below.

Deemed consent

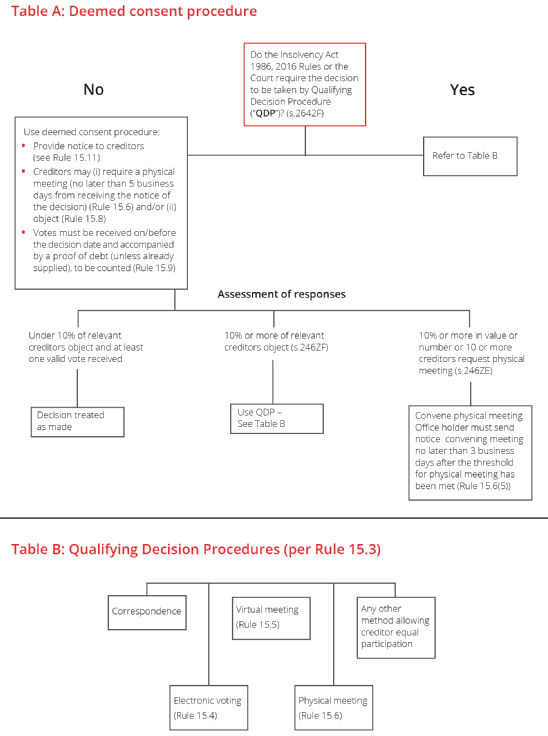

The deemed consent procedure is available unless the decision relates to remuneration, or is otherwise required by the Insolvency Act 1986, the 2016 Rules or the court. The deemed consent approach allows an office holder to give notice of a decision to relevant creditors (i.e., those entitled to vote on the matter).1 The periods of notice required are set out in Rule 15.11 of the 2016 Rules.

In order to object, a creditor must send a notice of objection to the office holder and this must be received on or before the decision date in order to be counted. This notice must be accompanied by a proof of debt, unless this has already been provided. Unless 10 per cent or more in value of creditors object and provided at least one valid vote is received on or before the decision date, the decision will be deemed passed.2

If 10 per cent or more in value object to the proposed deemed decision, one of the qualifying decision procedures under the 2016 Rules must be used and the deemed consent procedure cannot be used for further decisions on the same matter.

If 10 per cent or more in value or in number, or more than 10 individual creditors request a physical meeting within five business days of receipt of notice of the proposed deemed decision, deemed consent will be unavailable and a physical meeting must be convened.3

Qualifying decision procedures

Typically, deemed consent will be the default decision making procedure under the 2016 Rules. However, where this is not available, or has been objected to by the requisite number of creditors, one of the qualifying decision precedures listed below will be used. The qualifying decision procedures under the 2016 Rules include:

- Correspondence

- Electronic voting

- Virtual meetings

- Physical meetings

- Any other method of decision-making which affords creditors an equal right to participate

Note that, if 10 percent or more in value or in number, or more than 10 individual creditors request, a physical meeting must be convened.

The diagram below also sets out the decision making process.

For a printable version of the chart, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.