Are you a member of chambers that operates as a limited company? If so, has chambers got HMRC approval for its members to receive full tax relief for their contributions to the chambers? HMRC are challenging barristers' tax deductions.

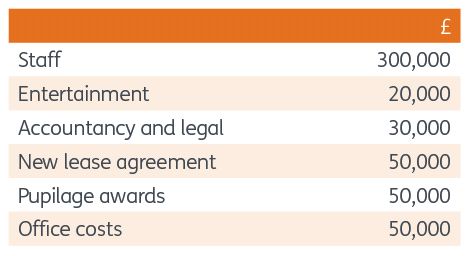

In this case, only £430,000 of the above costs is eligible for tax relief as the new lease agreement is capital and the entertainment costs are specifi cally not allowed for tax purposes. The member is therefore only able to claim tax relief for 430/500 x £25,000, which is £21,500, unless chambers has an agreement in place with HMRC for a different treatment.

HMRC is reviewing claims by members of such chambers with a view to recovering additional tax, and so it is important to have an agreement in place with HMRC. In the example above the total tax at stake for one year could be £32,900.

If you are operating chambers via a limited company or are a member of chambers operated as a limited company, and you would like help getting an agreement from HMRC to save your members the tax that can arise without the agreement, we can help.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.