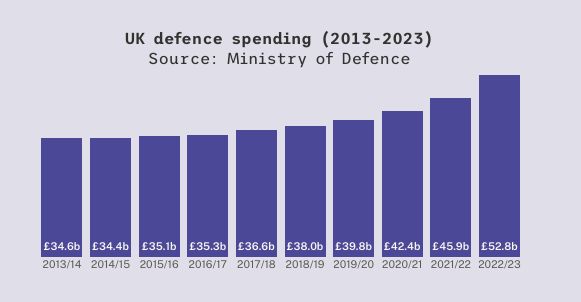

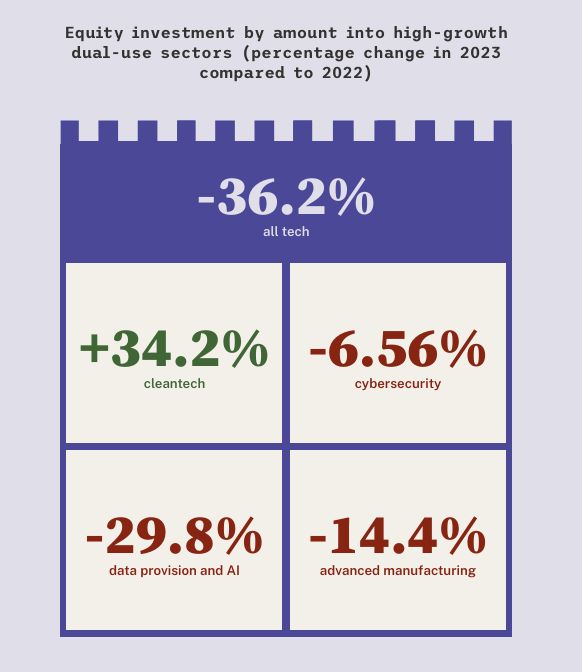

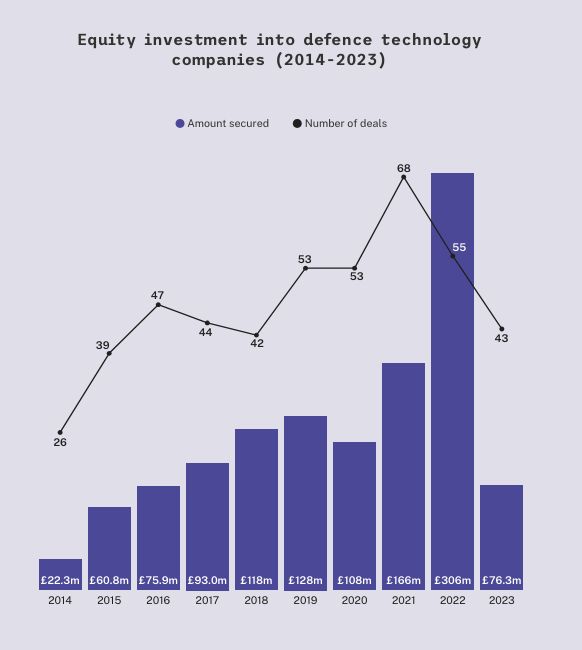

With the upcoming election in the UK we can expect to hear much discussion of spending plans for the next term of parliament, one of which will be defence spending. This report – UK Defence Tech 2024 – from Beauhurst gives a neat pictorial summary of recent defence spending up to the end of 2023 by the UK government (Fig. 1 below), as well as equity investment into certain defence subsectors termed "dual-use" which are defined as high-growth tech areas with a dual defence and civilian use case (Fig. 2 below). We can also see at a glance (in Fig. 3 below) how equity investment into pure 'defence technology' companies has changed over recent years.

Fig. 1

Fig. 2

Fig. 3

Fig. 1 shows there has clearly been a steady increase in overall defence spending over the last few years, maintaining the UK above its 2%-of-GDP commitment to NATO, and spending looks set to rise further if the Conservative government's pledge to increase spending to 2.5% of GDP is maintained by whoever is in government next.

As the report acknowledges, however, government defence spending pledges do not directly translate into investment in early stage businesses (and it is often in those businesses that the most radical innovation happens). Therefore, it is important to look at the numbers for equity investments and grant funding into the sector as well.

In contrast to the trend for overall government defence spending, the numbers for investments into dual-use areas in Fig. 2 paint a different picture, with falls in 3 of the 4 dual-use areas (Cybersecurity, Data Provision & AI, and Advanced Manufacturing), with only Cleantech growing (up 34% compared to last year). The falls in those 3 areas follow the overall downward trend (of around 36%) for investment into the tech sector as a whole.

The falls in investment into dual-use areas are not as large, though, as those in the pure defence technology companies (Fig. 3) which, even discounting the very large investment in 2022 as an outlier, show a large fall in 2023 compared to previous years. Grant funding into the pure defence companies, however, has remained relatively steady.

The numbers seem to show that dual-use technologies are at present considered more "investable" than pure defence technology companies, perhaps because their ability to serve both markets offers more diversification to the investor. Nevertheless, the falls in investment funding for both dual-use and pure defence technology companies are disappointing considering the increasing threats to security that have materialised over the last few years. In that time we have seen new conflicts in the Ukraine and the Middle East and rising tensions in Taiwan, and it is clear that threats to stability are growing. What we need is increased investment in those areas, so that companies can develop and implement the technologies that will counter those increased threats. Whilst increased investment across the defence sector would be desirable in the coming years, we can also hope that the benefits of both civilian and defence use cases continue to prove attractive to investors in the dual-use area.

Between the fiscal years 2021/22 and 2022/23, defence spending in the UK increased by 15.0%. While defence spending has increased steadily since 2016/17, 2022/23 saw the largest increase in spending observed across the period.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.