Reducing consumer harm has been a key regulatory focus for the FCA over 2021, and the final hallows of the year provide a good opportunity to reflect on the plans, proposals and policies seen from the FCA during this period. Consumer harm is not a novel concept, nor are efforts to mitigate harm; but nonetheless with the lasting bite of COVID and rising digital sophistication of scams, the FCA has decided that 2021 was the year for laying the regulatory foundations. Readers may be aware that the FCA is currently undergoing a transformation which, it is hoped, will enable a more digital and data driven approach for the regulator.

Read the policy statement here.

A. The Consumer Duty – How will it impact sales and marketing to individual investors?

On December 7th 2021, the FCA published a follow-up consultation paper (CP21/36) to its first issue on the new Consumer Duty. The first consultation was released in the summer and aims to provide retail customers with greater protection, with the rules expected to come into effect in July 2022.

Although the new Consumer Duty is controversial for some, the FCA seems committed to achieving good consumer outcomes and to move this proposal one step forward.

The Consumer Duty extends to all firms involved in manufacturing and supplying products and services to retail clients: even without a direct relationship with the end consumer.

Retail customers is a wide term and includes high-net worth investors, sophisticated investors and any other person who is not a per-se professional or elective professional client. The FCA is also proposing to extend the duty to include small and medium sized enterprises (SMEs), which would widen the applicable scope. The scope of the Consumer Duty is therefore limited to the scopes within the sectorial sourcebooks.

The underlying core tenet is for firms to "step into the shoes" of consumers, with a greater focus on their financial welfare. This is not a strict legal duty of care, as those familiar with tortious concepts will recognise, but rather a suite of measures designed to specifically tackle harm.

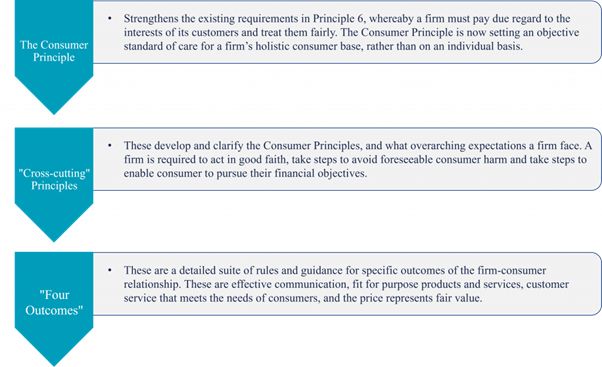

There are three elements of the Consumer Duty:

It is worth focusing further on the four outcomes that the FCA want to achieve:

- Communications – Firms' communications should consistently support consumers by enabling them to make informed decisions about financial products and services. Consumers should to be given the information they need, at the right time, and presented in a way they can understand.

- Products and Services – All products and services that are sold to consumers should be fit for purpose. They should be designed to meet consumers' needs and targeted at the consumers whose needs they are designed to meet. This is an essential requirement for products and services to be able to represent fair value for consumers.

- Customer Service – Firms should provide a level of customer service that meets consumers' needs throughout their relationship with the firm. Customer service should enable consumers to realise the benefits of the products and services they buy, and ensure that they are not hindered from acting in their own interests.

- Price and Value – Firms should ensure that products and services are fit for purpose and represent fair value, not just because they meet consumers' needs and objectives as set out in our Products and Services outcome, but also because their price represents fair value.

In practice, we think that this means that significant additional thought will need to be given to the design, manufacture and sale strategy for all new products.

Read more about it here.

Read the FCA policy statement: Consumer Duty here.

B. Public advertising

The FCA is partnering with Google to tackle consumer harm. Google now requires firms advertising financial services to have adverts approved by an authorised entity. These adverts will display the relevant FCA register information and will provide greater transparency for consumers. By integrating these verification stages into the process, it is hoped firms are held to greater accountability through increasing transparency as to the author of adverts. The verification process will match firms against the data held within the FCA register; Google hopes to run a verification process out to all adverts eventually but has only rolled out to a number of higher-risk sectors thus far.

Google is helping the FCA for the 'ScamSmart' campaign, with the former donating advertising credits to help raise awareness of digital scams. These credits will be spent by the FCA to target individuals at risk of online scams by increasing knowledge of online financial risks.

Read more about it here.

Read the policy statement here.

C. Looking ahead

The FCA has signalled a proactive approach to reducing harm in the years ahead, through laying proposals and plans in 2022 to respond to consumer harms. Firms are required to place a greater focus on protecting consumers and the FCA is exploring proposals and consultations for ensuring this happens. The largest change (in the Consumer Duty) is expected to result in a cultural shift for firms and require them to consider the holistic impact on consumers. Next year should see these proposals take effect, and we expect further scrutiny and refinement on the anticipated changes in the interim.

Read more about this here.

Read the policy statement here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.