As many farms and estates have multiple enterprises or have diversified into non-farming activities within their current business one feature of Xero may be helpful when it comes to understanding the profit/ loss position of these various ventures. Tracking Categories will allow you to analyse income and expenditure without the need to have lots of additional codes (e.g. having a repairs code for each enterprise or for each rental property). By using Tracking Categories this allows costs to be shown as a consolidated figure in your annual accounts whilst also being able to break these figures downs between different enterprises or properties.

- Tracking Categories can be found under "Accounting" and "Advanced Accounting". You can have 2 Tracking Categories however you can have up to 100 Tracking Options, as sub-categories within each of these.

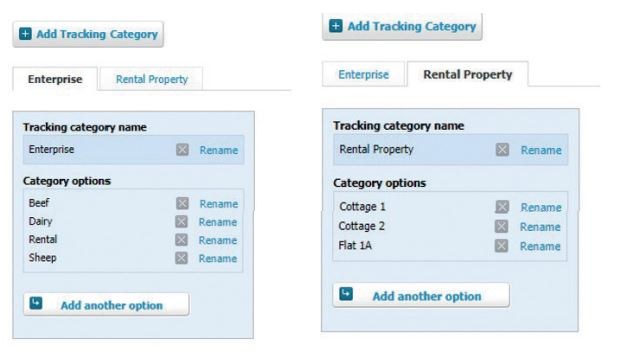

- By clicking "Add Tracking Category" you can add in

the overall Tracking Category name. In the case below I have used

'Enterprise'. Then add in the different options you

require. In the example here I have included Dairy, Beef, Sheep,

and some Rental properties. As the business in this example has

multiple rental properties the second Tracking Category,

'Rental Property' has Cottages 1, 2 and Flat 1A as the

options.

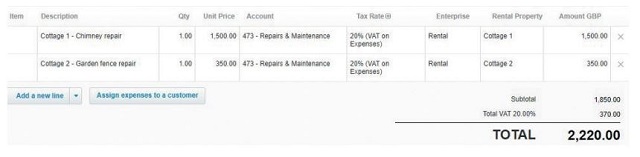

- If I, therefore, have a repair bill for Cottage 1 and Cottage 2

I can raise a Bill as follows which, as you can see, goes to the

same repairs code, but I now also have Enterprise and Rental

Property as options. These options will also appear on the

Reconcile screen next to the VAT rate option.

- This means whenever I code a transaction from the Reconcile screen or generate a bill or invoice, I will have these options available to me and so if you choose to use Tracking Categories you will need to be be consistent in selecting them. (Please note that there is the ability to use Find and Re-Code to add your tracking categories to transactions that have previously been reconciled).

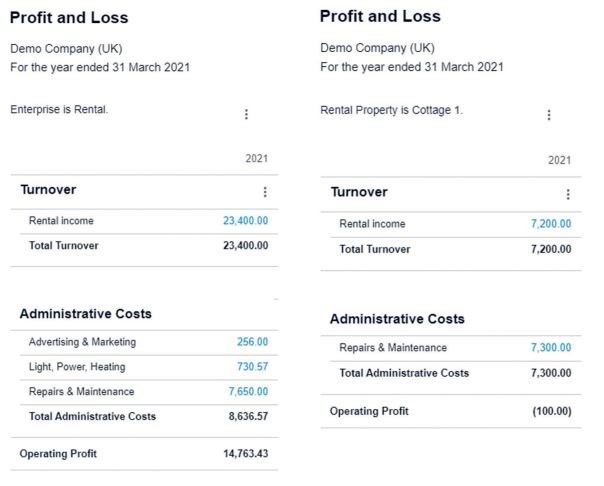

- By using Tracking Categories, you can now select

"Rental" as the Enterprise when running a Profit and Loss

report to isolate this aspect of the business. The image below

shows all tracked transactions for all 3 properties in the year so

I have then selected just Cottage 1 in the second image that shows

that this property is loss-making in the

year. You can then clearly see that this was due to extensive repairs in the year. By using Tracking categories this allows for the bigger picture of overall rental profits to be easy to understand and view and then allows the ability to drill down into greater levels of detail for the individual properties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.