Introduction

This article gives a comprehensive description of the export customs regime in Turkey. Above all, Turkey offers a business-friendly environment, a deep talent pool and low production expenses at the nexus of Asia and Europe. Besides, the Turkish business environment is very close to the properly functioning markets from the east and west.With low production utilities situated in Turkey, many companies are able to access the global logistics network far more easily and use the advantages for export opportunities. Therefore, Turkey is one of the most preferred countries for export across the world.

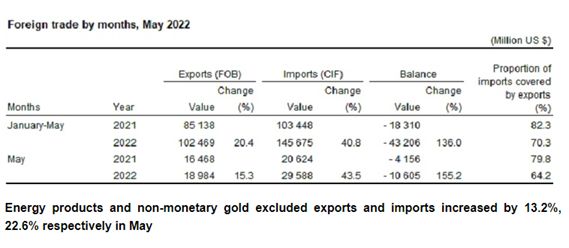

Foreign trade data appears as the most concrete indicators of the increasing interest of exporters and also importers regarding Turkey. To clarify, you can take a look at recent official foreign trade data issued by the Ministry of Trade. Also foreign trade statistics of the Turkish Statistical Institute confirms this, as seen below:

Regarding the main benefits of investing in Turkey, see our article on 'Is Turkey Safe for Investment?: Six Advantages to Grow Your Business in Turkey'.

What are the main elements of the Turkish Legal Framework on Customs Export Procedures?

The Turkish Export Regime is carried out by keeping in mind Turkey's rights and commitments within the umbrella of the World Trade Organization and Customs Union between EU and Turkey. Also the Turkish Customs Code (No: 4458) stipulates main rules of exporting goods.

Full text of the Turkish Customs Code No: 4458 is available online here.

What is the meaning of Export Procedure?

Export regime is applicaple when the goods in free circulation are taken out of the Customs Territory of Turkey for export purposes. It is significant to stress here that the exportation regime may require the implementation of exit formalities including commercial policy measures and export duties.

Goods to be exported from the Customs Territory of Turkey are declared to "the authorized customs administration" by the "customs declaration". In exceptional situations, oral declaration form, special invoice, and a victual list may be equal to "customs declaration".

What about export duties?

Export duties may contain

- "customs duties" payable on the exportation of goods and other duties and charges having an equivalent effect,

- "duties and other charges" payable on exportation that are introduced under the agricultural policy or under specific arrangements applicable to some products obtained by the processing of agricultural products.

Customs debtors should undertake taxation, commercial policy measures and other export duties on time. Otherwise they may encounter heavy fines and penalties imposed by competent national authority . The Ministry of Trade also has a comprehensive power to pose restrictions or prohibitions.

Who is the exporter?

Every legal or natural person might be an exporter. More specifically, the term exporter implies a person or a company that sends goods or services to another country for sale.

What does "returned goods" mean?

Returned goods pose a serious problem for customs debtors. If the goods in free circulation which, having been exported from the Customs Territory of Turkey or from another point of the customs territories of the customs union to which Turkey is a party by agreements, are returned to that territory and released for free circulation within a period of three years, they are regarded as "returned goods". There are no import duties for returned goods for three years.

What are the main steps for exportation of goods from Turkey?

To sum up, there are five steps to accomplish exportation procedures:

- Taking a legal help from a reliable law firm,

- Inform the authorized customs administration regarding the export goods,

- Use export customs declaration for such declaration (or summary declaration where customs declaration is not necessary),

- Carry out necessary commercial policy measures,

- Undertake certain export duties including the payment of export taxes.

Conclusion

Overall, it is significant to address that customs export regimes cause several legal concerns facing customs debtors in Turkey. Firstly the problem stems from the complexities of Turkish customs legislative framework. Secondly, finding the competent national customs authority for each customs procedure and fulfilling the necessary customs duties are far from straightforward. In the absence of full-fledged legal consultation, customs procedures are getting harder and time-killer regime. Customs administration has a full of authority to impose serious fines and penalties upon customs debtors. Accordingly providing comprehensive legal assistance should be the first step for any customs export procedure in Turkey.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.