Turkish Crowdfunding Communiqué.

Communiqué No. III – 35/A.2 ("the Crowdfunding Communiqué") published by Turkey's Capital Markets Board ("CMB") makes it possible for an entrepreneur or venture capital company to be funded by raising money from the public through platforms allowed by the CMB. The Crowdfunding Communiqué includes the general principles of crowdfunding and also determines the criteria that platforms and venture capital companies should meet.

According to the Crowdfunding Communiqué, crowdfunding can be conducted in two ways: equity-based crowdfunding and debt-based crowdfunding. Companies that are prevented from raising funds through crowdfunding are also included in the communiqué.

Below we highlight the prominent regulations of Communiqué No. III – 35/A.2.

01 The role of platforms in the funding process and the 01 elements they should have

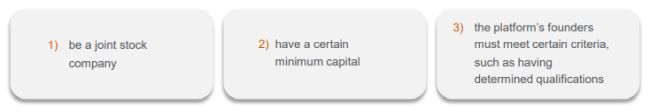

In order to allow the establishment of platforms by the CMB in accordance with the Crowdfunding Communiqué, the platforms must:

It is foreseen that changes in the partnership structure of a platform will be subject to CMB approval or a written notification, depending on the rate and nature of the change.

Platforms place funds collected from investors during a crowdfunding process in a bank account opened in the name of the funded company with escrow authority. Subsequently, it ensures that that the collected funds are transferred to the relevant company or returned to the investors under the principles determined within the framework of the communiqué.

02 General framework of fundraising through equity and debt02 based crowdfunding

In equity-based crowdfunding, a new joint-stock company must be established before the funds are transferred to the entrepreneur. If the venture capital company is a limited liability company, the conversion of the company to a joint-stock company must be completed and registered within the periods specified in the communiqué. In this case, the funds will only be transferred to the company in exchange for newly issued shares through a capital increase. If the fundraising company is already a joint-stock company, a capital increase is made in the amount of the collected funds.

In debt-based crowdfunding, funding activities cannot be carried out against any capital market instrument other than debt instruments. The investment committee determined by the board of directors of the platform shall prepare an evaluation report on whether the company funded by the debt instrument can make repayments on a regular basis.

In both types of crowdfunding, the Crowdfunding Communiqué includes some common regulations:

- The campaign period for fundraising cannot exceed 60 days;

- The right of withdrawal can be exercised within 48 hours from the moment the payment order is given by the investors; and

- The same entrepreneur or venture capital company cannot start a new campaign process based on another share or debt before any on-going campaign process is completed. However, while a share-based campaign process continues for a project, it is possible to initiate a debt-based process for the same project and vice versa, within the scope of the communiqué.

03 Investment limits determined

In accordance with the Crowdfunding Communiqué, real persons who are not qualified investors can invest a maximum of TRY 68,100 (approximately EUR 3,500) in a calendar year. This limit can also be applied as 10% of the annual income of the investor, provided that the investment amount does not exceed TRY 272,400. In addition to these amounts, in debt-based crowdfunding, real persons who are not qualified investors are able to invest a maximum of TRY 27,240 in a single project.

Qualified investors are exempt from the above limitations for crowdfunding investments.

04 Funds collected through share-based crowdfunding are controlled and audited with a report to be prepared within the scope of AAS 3000

As per the CMB's amendment to the Crowdfunding Communiqué on 7 April 2022, as of the date of the amendment, the control and audit of the use of funds collected through share-based crowdfunding in accordance with the purpose declared in the information form will be audited by preparing a reasonable or limited assurance audit report within the scope of the Assurance Audits Standard Other than Independent Audit of Historical Financial Information or Limited Independent Audit (AAS 3000). Prior to the amendment, such controls and audits were made by preparing a special-purpose independent audit report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.