My first real job was working at a delicatessen in suburban Pennsylvania when I was 13 years old. Through this introduction into the real world of business, I learned that the way the business earned money was by investing in inventory, premises, equipment and salaries. Through hard work and patience, these investments could allow the store owner to sell items and to profit.

Years later, I found myself in the intellectual property (IP) field. As opposed to the tangible investments required in the delicatessen, I have spent the last 20 years helping companies obtain intangible assets such as utility patents and trademarks. My clients spend part of their budgets obtaining intangible assets with the hopes that these assets will help them profit. If a company enforces their IP against an infringer in court, it is relatively simple to calculate whether the investment in IP paid off, but many IP owners never need to enforce their IP. On an individual basis, it is sometimes difficult to determine whether investment in IP pays off.

It is relatively straightforward to recognize that tangible assets help a business generate revenue and profit. For example, a car manufacturer invests in a factory and in metal to make cars, so that it can sell cars. But how does one determine if IP assets have the same effect? Are IP assets having a positive impact on the economy today? Or are industries without IP performing just as well as industries which invest heavily in IP?

To answer these questions, the United States Patent and Trademark Office recently released a report entitled "Intellectual property and the U.S. economy: Third edition." The report looks at U.S. industries which are considered "IP-Intensive" and compares various aspects of such industries to other industries which are not IP-Intensive. The data in the report is based on statistics from 2019.

In order for an industry to be classified as IP-intensive in the report, the industry must, as a whole, have been granted IP rights such as utility patents, design patents, or trademarks at a level above the average of all US industries. Each industry is classified by a ratio of either patents or trademarks per 1,000 employees in the industry. With regards to copyright, on the other hand, a number of industries were determined to be copyright-intensive by being affiliated with industries previously classified as copyright-based industries by the World Intellectual Property Organization.

Some examples of utility patent-intensive industries included communications equipment manufacturing and pharmaceutical and medicine manufacturing. Trademark-intensive industries included management/ technical consulting services and clothing/ accessories stores.

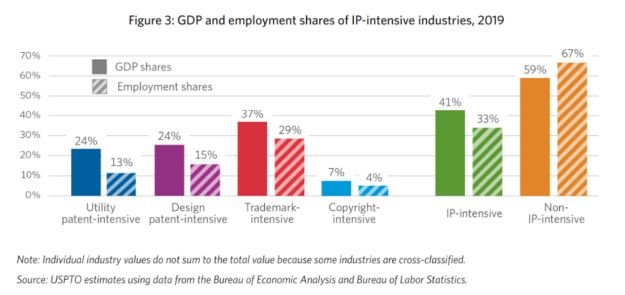

The study found that there were a number of parameters in which IP-intensive industries performed better than parts of industry which are not IP-intensive. For example, IP-intensive industries accounted for larger shares of national output than shares of national employment, which indicates high productivity in these industries.

(Source: USPTO report, page 5)

In addition, average weekly earnings were found to be higher in IP-intensive industries when compared to non-IP-intensive industries. Another difference is that IP-intensive sectors have higher percentages of employees with four-year degrees.

The USPTO report indicates that when looking at IP-intensive industries on a large scale, it appears that there is a correlation between IP-intensive industry and economic growth. While a correlation has been shown, owning IP or being in an IP-intensive industry is not a guarantee that a company will reap the aforementioned benefits.

Back to the Future

The world of the late 1980s, when I was a kid at my first job, was a very different one than today's world. For example, the 13-year-old Avraham would only read about a hand-held mobile phone, able to connect via live video to all corners of the earth within seconds, in a science fiction book (in print, not on an electronic device). Today's teenager couldn't imagine a day without being connected to such a device, and you may be reading this article on such a device. Although intangible assets were important then, they seem to be even more important in today's economy, in which many more jobs exist in the intangible space.

Will the next 40 years show an even higher dependence upon intangible assets? Only time will tell.

Originally published March 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.